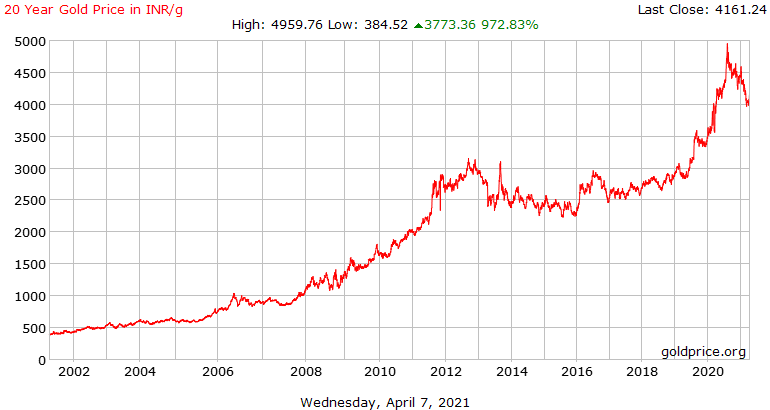

THE GRAPH OF GOLD IN INDIA

Gold has always been a much-discussed topic in India and has now become a thing to talk about the falling-rise of the prices every time there are family gatherings. One of the oldest precious metals to be known to humankind, gold for thousands of years has been valued as an investment. But what is so special about this metal, it has high chances for investments, liquidity, recycle ability and so many uses! As a monetary asset, gold for years has maintained its value and purchasing power even during inflationary periods. The gold in India is traded at the Multi Commodity Exchange market.

India saw the highest rise in the prices for the first time in April 2021 when gold was of Rs 46, 536 and the lowest in 2001. This was the highest price of 21 years and it has shaken the market. After the beginning of the vaccination drive against the coronavirus disease and a spurt in economic activity, people are now turning to more risky investment options for stronger profits. These include options such as equity and cryptocurrency, gold etc

Here are the few reasons that have led to the fluctuation in gold prices:

- High Liquidity: The RBI allowed borrowers to avail of a moratorium on loan repayments till August 31, 2020. The Government also declared a lot of economic stimulus packages to pump liquidity into the markets.

- Reduced gold mining: Owing to the lockdown, the mining in many countries has been affected which shakes the demands- supply chain. Hence increasing the prices of gold.

- Exchange Rate: The Indian Rupee has fallen sharply since the lockdown. Currently, it is around 75 against the US dollar. Since India is the second-largest importer of gold, such exchange rate fluctuations impact gold prices.

- Weakening-dollar:

Under normal circumstances, gold and dollar share an inverse relationship. Since international gold is dollar-denominated, any weakness in the dollar pushes up gold prices and vice versa. The inverse relationship is because firstly, a falling dollar increases the value of currencies of other countries. This increases the demand for commodities including gold. It also increases the prices. And secondly, when the US dollar starts to lose its value, investors lose its value, investors look for alternative investment sources to store value and gold is an alternative for those investors.

The open interest in gold contracts traded on the Comex, Dubai, ICE, India, Istanbul, Moscow, SFE, TOCOM and LME is captured by the World Gold Council. It is, therefore, obvious that the derivative prices of gold have moved higher in anticipation of an increase in investment demand for gold following deteriorating global conditions. Given the logjam that global central bankers are currently in, unable to increase rates or do monetary tightening due to nebulous growth, the case for investing in gold is likely to remain strong over the next couple of years at least.

But if the investment demand for gold does not increase, mirroring the optimistic derivative prices, there could be sharp swings in prices in both directions. Investors in gold, therefore,e need to stay alert for sudden bouts of volatility. Gold is used in India as a form of tackling inflation, and holding an item with an intrinsic value because of its rarity is a good way to counter the fluctuations in fiat currency. As a traditional form of savings in India, gold instils a feeling of comfort and security in a person’s wealth. This has been termed the “exposure effect” by psychologists.

While holding financial gold and gold in the form of ETFs and E-gold is a prudent investment, holding physical gold in the form of a real asset is preferred for the simple reason that it can be held, felt and kept safe in a box. This experience of physically owning gold is important to Indians, and is another reason why we like gold so much – it’s safer in terms of real value than the Rupee, and appreciates over time. The middle class of the country, the ones who plan and live life statistically calculating money were the ones who were affected more. They believe in buying and keeping the gold in lockers as an investment for their daughters and family. A lot of them plan to buy during a certain time and were not able to do so due to fluctuations leading to mismanagement in planning. As aware as they are about the gold prices, they know how the global demand affects the prices and investment opportunity for millions of people.

The government is making efforts to help its citizens as well. In August 2013, the finance ministry had banned banks from selling gold coins to contain the country’s burgeoning CAD. Gold imports have fallen sharply to $650 million in August 2013 on account of a slew of steps taken by the government to curb inbound shipments of the precious metal. Gold imports are estimated to have declined by 41 per cent to 500 tons in the 2012-13 financial year on account of curbs imposed by the government. On the quantitative front, RBI introduced the 80:20 formula under which 80 per cent of imports would be for domestic demand while 20 per cent of total imports would have to be re-exported through value additions in the form of jewellery. The greater the gap between the sustainable CAD level and the actual figure, the more vulnerable the economy is to adverse global developments which could suck out foreign investment. Gold is a hedge against all kinds of uncertainties. Gold comes to the rescue even in the prevailing global and financial uncertainty. However, the government needs to take strict measures to control the increasing prices of gold and help investors overcome the losses due to uncertainties in other markets. India’s passion for gold is not new. However, what has happened over the last few years is that rising gold imports have coincided with a rise in its prices and a weakening of the rupee against the dollar. This has shaken all classes of the society and further affecting the economy of the country as well.

By: Jinal S Mehta

Sources:

Financial Express

Times of India

Hindustan Times

Bank Bazaar

The post THE GRAPH OF GOLD IN INDIA appeared first on The Economic Transcript.