The Populist Case for the Gold Standard

ABSTRACT: There have been many calls for reforming the gold standard since the end of the classical gold standard and especially since the end of Bretton Woods. While these calls have somewhat abated in recent years, this article will attempt to show that the gold standard is still a superior monetary system, and that the reform of the monetary system is still a desirable policy.

Key Words: gold standard, monetary policy, austrian economics, populism

Kristoffer Mousten Hansen (kristoffi@gmail.com) is a research assistant at the Institute for Economic Policy at Leipzig University and a PhD candidate at the University of Angers. He is also a Mises Institute research fellow.

The author thanks Dr. Joseph Salerno for comments as well as an anonymous referee.

We will proceed by first analyzing the shortcomings of the present fiat-money order, indicating how it distorts the market and society through inflation, redistribution, by artificially increasing the importance of financial markets, and by hampering US industrial production in international trade. Then we will show that these problems would cease to exist under the gold standard, and we will indicate a possible reform for returning to gold in the US. Finally, we will argue that such a reform in order to be successful must become a popular crusade—i.e., it must become a populist issue.

INTRODUCTION

Politics have become increasingly populist throughout the Western world since the Great Recession. Both left-wing and right-wing parties thunder against political and other elites, suggesting that their specific programs and ideologies will put an end to what they see as unfair exploitation of the people by an unaccountable and increasingly out-of-touch elite. In the United States recent populist movements are the Tea Party movement and Occupy Wall Street, and both Donald Trump and Bernie Sanders used populist rhetoric in their presidential campaigns.

The rise of populism is, in hindsight, perfectly understandable. The war in Iraq would be a “cakewalk”; “if you like your health insurance, you can keep it”; my opponent’s voters are a “basket of deplorables”—mainstream politicians have again and again shown themselves to be out of touch with reality and increasingly, it seems, also with more and more of their voters. Most important for our purposes, the Federal Reserve, charged with managing the money supply and securing low inflation and low unemployment, was oblivious to all dangers on the eve of the Great Recession, and seemed to do what it could to help big banks and investors weather the storm, no matter what the price would be for the rest of the country.

Indeed, the Federal Reserve has proven unable to achieve the goals set for it since its establishment and especially since the final end of the gold standard and the introduction of the fiat dollar in 1971, when its control over the money supply was vastly expanded. The Fed did manage to break the inflationary expectations that had led to double-digit inflation in the 1970s, but this slight improvement has not canceled out the many evil effects of fiat money. The harmonious development of society and the economy depends on sound money, which is itself a spontaneous social institution (Mises 1981, 421), while monetary policy leads to accumulating economic distortions. These distortions favor political and financial elites (Sennholz 1985, 1979): they have greatly expanded the scope of the financial sector and its importance to the economy, and politicians now have greatly increased resources at their disposal to pursue their dreams of remaking society. With our present fiat money system it is much easier for politicians to engage in deficit spending, as this spending artificially enlarges the market for government bonds as well as other financial titles. The public at large, on the other hand, is more and more dependent on financial markets if not outright on the state, while political elites are less beholden to the taxpayers for the resources they need.

More than any other institution, it is our contention that the Federal Reserve has caused economic distortions and increased popular resentment toward elites in general. This is why the gold standard should be the eminently populist cause: against unaccountable elites and for the general welfare of the public at large. Not only that, it is only by making the gold standard a populist crusade that there is any hope of restoring gold to its monetary role (Mises 1981; Sennholz 1985; Paul 1985). Fiat money has greatly distorted the economy and harmed the common man, and returning to the gold standard would resolve these distortions. This does not mean that the restoration of the gold standard would mean the fulfillment of every policy currently advocated by populists, nor that the advocates of gold should stoop to demagogy. The case for gold must be presented honestly. All we mean by making the gold standard a populist cause is to make the appeal directly to the public at large, and especially to that part of the public who are the most victimized by the present system, and who have the most to gain by returning to sound money. The gold standard cannot be just an academic exercise: we must show how a return to gold would improve the economic situation and prospects of the common man.

We will proceed as follows: first, we will present some of the main problems of fiat money. In particular, we will focus on how these problems affect the broad classes of producers in the private sector. Then, we will show how these problems would disappear, or at least be more manageable, under a gold standard. We then sketch how the gold standard would look in the present day and how we could move from fiat dollars to gold and, eventually, to complete monetary freedom. Finally, we will briefly discuss the ways monetary reform might become a populist movement.

We do not pretend to any great originality with this proposal, rather it should be seen as an updated and slightly modified version of Mises’s proposed reform from the 1950s.

THE CASE AGAINST FIAT MONEY

What follows is a brief survey of the main problems of fiat money. They are all variations of the effects that additions to the money supply have as new money enter and spread through the economy, the Cantillon effects (named after the Irish economist Richard Cantillon, who first analyzed them in 1755. Cantillon 2010), and are as such all connected. They can be broadly categorized as inflation, redistribution, financialization, and deindustrialization.

Inflation

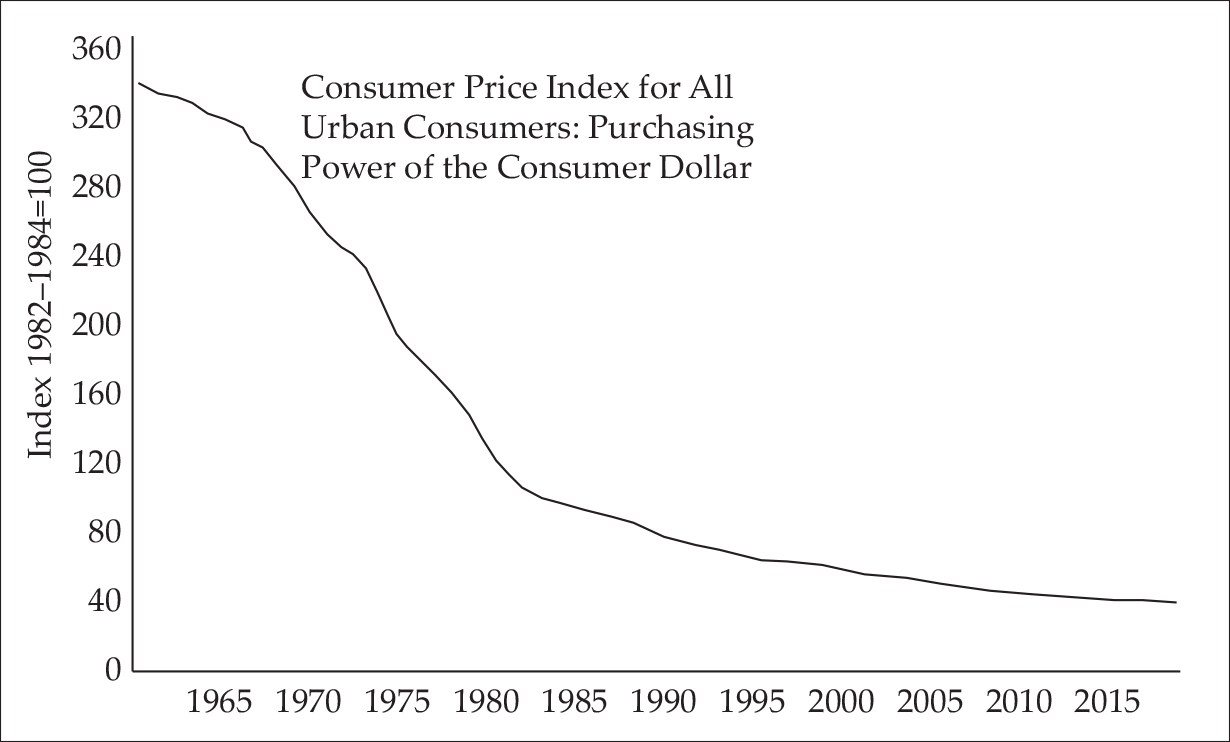

Price inflation is a constant presence in the age of fiat money. It is true that the high inflation of the 1970s gave way to more moderate inflation in the following decades, but the purchasing power of the dollar has continued to fall steadily (see figures 1 and 2). This moderation might partly have been due to greater restraint on behalf of the Federal Reserve, but it should be pointed out that the money supply continued to grow throughout the period. A more likely explanation is that the advent of moderate price inflation was due to exogenous factors beyond the control of US monetary authorities. The last forty years or so of globalization have seen the integration of first the East Asian tiger economies, then the formerly Communist countries, and especially China, into the world economy, massively increasing global production and trade. Former Fed chairman Alan Greenspan frankly admitted that the period of low inflation was not due to activist central bank policy (Greenspan 2007, 12–15; cf. Stockman 2013, 63–64); indeed, more recently he admitted in an interview with the Gold Investor that during his tenure as chair of the Federal Reserve “US monetary policy tried to follow signals that a gold standard would have created. That is, sound monetary policy even with a fiat currency” (Greenspan 2017, 14). We may question just how effective merely playing at the gold standard is compared to the real deal,1 but this policy may have led monetary authorities along a less inflationary path for a time.

Figure 1: Purchasing Power of the US Dollar, 1960–2019.

Figure 2: Purchasing Power of the US Dollar, 1960–2019, YOY Change.

Nevertheless, the effect of these positive developments across the globe would, in the absence of government manipulation of the money supply, have been a steep fall in the prices of consumer goods. The 1990s and the first decade of the 2000s should have been marked by deflation, as the amount of goods offered to consumers increased while the supply of money remained steady. This would have spread the benefits of globalization and increased production to all holders of US dollars. But the Fed’s inflationary policy neutralized this beneficial effect, as it pumped more money into the economy in pursuit of its goal of low but stable price inflation. The hollowing out of the purchasing power of the dollar therefore continued at a time when we should have expected a general appreciation in the value of money.

The inflation engineered by the Fed did not cause uniform price increases across the board. The effects of additions to the money supply depend on where the new money enters the economy and how it spreads through the economy. So some consumer goods did fall in price—e.g., consumer electronics—while others rose drastically, such as housing. Figure 3 shows this clearly by comparing changes in the Case-Shiller housing index to the general Consumer Price Index. Housing became drastically more expensive relative to other consumer goods over the last thirty years.

Figure 3: Case-Shiller Housing Index Compared to CPI (1987 = 100).

Figure 4: United States Trade Balance, 1992–November 2018.

Inflation and the erosion of purchasing power do not affect only the consumers; they are also important factors for producers. In an inflationary environment, the entrepreneur cannot simply allow for yearly depreciation based on the purchase price of his assets. He has to also estimate how monetary factors will distort future prices in order to calculate his replacement costs and make adequate allowance for depreciation. At the very least, this increases the costs of doing business, as more time and resources must be spent on accounting; more seriously, it can lead to capital consumption and reduced productivity, as the entrepreneur fails to foresee replacement costs adequately (Rothbard 2009, 993–94; Baxter 1955; cf. Reisman 2002).

Monetary inflation, furthermore, is not simply a hydraulic process, with prices being raised gradually as new money percolates through the economy. Rather, inflation may also affect the quality of products offered for sale by entrepreneurs (Sieroń 2017). Increases in the money supply often affect the prices of producer goods before those of consumer goods, especially when the new money enters the economy in the form of credit expansion. It is not possible to simply pass on the higher costs to the consumers if the demand for goods is elastic, as higher prices would then simply mean lower total revenues. Rather, the entrepreneur must somehow reduce his costs in order to stay profitable, which usually means substituting lower-quality for higher-quality inputs (ibid., 153, 155).

This process of product degradation also takes place over the long term: given that the broad mass of consumers will only receive increased monetary incomes late in the Cantillon process, the entrepreneurs will have to cut costs long before they can raise prices for consumers in order to stay in business. As inflationary credit expansions are perennially reoccurring, entrepreneurs will have to shift their innovative activities toward cost-cutting technologies and finding ever-cheaper substitutes for inputs, at the expense of research into higher-quality products. In the long run, we should therefore expect the inflationary environment of the fiat dollar system to yield progressively worse consumer products over time compared to what would have been produced under a sounder monetary regime.

While it is difficult to isolate this effect in the real world of complex phenomena, there are some clear indications that such product degradation has in fact been taking place. When we look at the consumption of foodstuffs in the United States during the twentieth century, there are some clear trends of changing consumption patterns that follow very closely the change to inflationary fiat money. This is not to say that every change in the diet for the worse is caused by monetary phenomena. For instance, the fall in butter consumption (figure 6) occurred mainly before the end of Bretton Woods and was probably due to the crusade of Dr. Ansel Keys against it (Teicholz 2014), but other changes have a clearer connection to the increasingly inflationary monetary systems of the postwar period and especially after 1971.

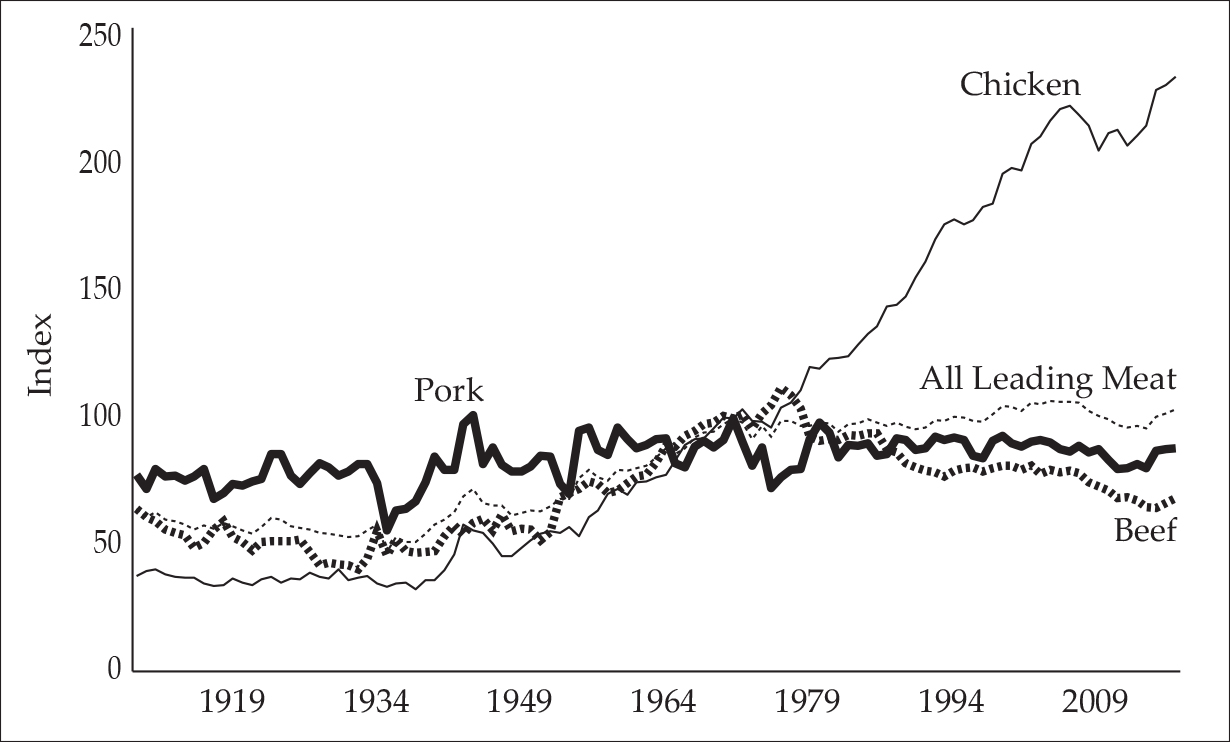

The changing trends in the consumption of meats have a clear connection with monetary phenomena. We will make two assumptions for the purposes of our presentation: that people, at least in Europe and America, eat more meat the more prosperous they are and that most people in the western world consider beef a higher-quality meat than pork or chicken. There was a rising trend in per capita consumption of the main kinds of meat—beef, pork, and chicken—until 1971. After this date, however, overall consumption of meat virtually stagnated: it only returned to the 1971 level for an extended period in the 2000s and was in 2017 only 3.5 percent above the 1971 level. What is more, the kinds of meats consumed have changed dramatically: pork consumption has declined and beef consumption has collapsed by more than 30 percent, while the amount of chicken consumed per capita has more than doubled since 1971, and has increased sixfold since 1909 (see figure 5). While changing consumer tastes may account for part of this change, it is hard not to suspect that most people can simply no longer afford the same amount and quality of tasty beef that they could in the 1960s and 1970s.2 There are, at the very least, some interesting indications here of the way that fiat money has led to the production and consumption of lower-quality products.

Figure 5: Per Capita Availability of Leading Meats, Indexed 1971 = 100.

Figure 6: Proportion of Per Capita Availability of Fats.

Redistribution

It is a fact of nature that economic resources are distributed unevenly. Even if everybody had the same resources initially, different choices would quickly lead to differences in wealth and income. In a market economy, such differences are due to differences in productivity and in entrepreneurial skill. Workers will tend to be paid according to the value of their contribution to production; savers will earn a return on their investment based on the social rate of time preference; successful entrepreneurs will earn higher profits than unsuccessful entrepreneurs; all will earn an income and accumulate wealth based on their contribution to satisfying consumer demand. This inequality is not wrong or evil, but simply a fact of life that results from the free actions of economic agents.

Inflationary monetary policy distorts this picture of market-determined natural inequalities, as Cantillon effects redistribute income and wealth to the early receivers of new money and away from those who receive the new money last or who are on fixed incomes. This process was restricted under the gold standard, since gold cannot be created at will and gold mining does not lead to Cantillon effects, as we shall see below. Increases in the issue of fiduciary media did mean some redistribution, but these increases were severely limited by the danger of an outflow of gold. Since the final destruction of the gold standard in 1971, however, this is no longer an issue: the monetary authorities can keep inflating the money supply and banks can continue to create fiduciary media to the benefit of some at the expense of others.

The result has been stagnating incomes for workers and for the middle class generally, while the politically well connected and the financial operatives who are closest to the source of new money benefit. Recent studies (Bachman 2017; Brill et al. 2017; Bivens et al. 2014) suggest that for the median US worker, earnings (in real terms) have not only been stagnant, but have fallen slightly since 1973. This is not due to falling productivity: rather, the growth in productivity has far outstripped growth in compensation to workers since 1970 (Brill et al. 2017, 8). Up to that point, increasing productivity was reflected in higher wages, as we should expect according to economic theory. While the economy has continued to become more productive, then, the average worker sees less and less of this increased productivity.

Who are the beneficiaries of this hidden redistribution? The main clients of the central bank: the government and the commercial banks (Hülsmann 2013). These have generally been the first to receive the new money, as the banks have been able to expand their issue of fiduciary media and the government has always had a ready market for new debt issues. Since the 1970s, finance has become an increasingly important part of the economy, and even in nonfinancial firms, financial income constitutes an increasing proportion of total revenue (Lin and Tomaskovic-Devey 2013). The reason for this should be clear: as money is pumped into the economy through financial markets, firms that position themselves to take advantage of monetary infusions and easy financial conditions will win out over their less savvy competitors (although this is an advantage that depends on the conditions of easy money and credit expansion). The company officers guiding this process and the workers skilled in financial dealings will naturally earn higher compensations than their colleagues engaged in more mundane activities.3

This does not invalidate the conclusion of economic reasoning that wages are set in accordance with the discounted marginal revenue product (DMRP) of the worker (Rothbard 2009, chap. 7). However, this is the long-run tendency of the market and will only ever be reached in final equilibrium. In the meantime, inflation, especially in the form of credit expansion, temporarily increases the revenue to be gained from financial transactions and makes indebtedness more attractive. It is therefore clear that so long as the inflation lasts, financial incomes will be higher than they otherwise would be. In our inflationary environment, the DMRP of financial wizardry is simply higher than it would otherwise be, and that of workers correspondingly lower.

While real wealth has increased as a result of globalization and increased productivity, the distribution of wealth and incomes has been increasingly skewed since 1970 due to continuous inflation. Private sector workers see their wages stagnate while government employees, government contractors, and the financial sector benefit.4

Financialization

Fiat money, as we have seen, tends to lose its purchasing power over time. This means that plain saving—hoarding of money and accumulation of durable goods—and direct investment of accumulated funds in capital goods are discouraged. Instead, both the supply and the demand for financial assets increase as savers look for some way to protect their accumulated wealth (Hülsmann 2013, 6). The quality of fiat money is such that it is not a good store of wealth, since price inflation and a falling purchasing power are inherent to fiat money (cf. Bagus 2015b on the importance of the quality of money). Furthermore, as a consequence of central bank policy, the prices of financial assets tend to increase relative to those of nonfinancial assets (Žukauskas and Hülsmann 2019), so saving in forms other than financial titles is discouraged. In order to protect themselves from the wealth-destroying effects of inflation, savers have to engage in financial speculation: they take on debt to invest in financial assets, just to stay ahead of inflation and the redistributive effects of central bank policy.

This all leads to increased dependence on the financial sector, not only for consumers who want to acquire durable consumer goods such as houses and cars, but also for savers who want to accumulate wealth for later consumption and for businesses that want to expand operations (Hülsmann 2008b, 180–85). There is nothing wrong with financial institutions or financial markets in themselves. They provide a valuable service for the individual saver or borrower, and they provide a valuable service for society as a whole by helping to allocate funds to the most valued uses. The problem is that the destruction of sound money has led to a situation where everybody has to make use of financial services simply to preserve their wealth, while the financial markets increasingly depend on central bank interventions, not on the objective facts concerning the real assets underlying the various financial claims (Hülsmann 2014, 11–12). A paper issued by the Bank of England (Bush, Farrant, and Wright 2011) makes a similar point: severe imbalances have been allowed to build up in the international monetary and financial system, and capital movements do not seem be guided by considerations of productivity.

There is also evidence that overreliance on financial markets has had spillover effects on the real economy, as it has distorted the process of valuation and calculation guiding economic action (Ehret 2014). This leads us to the next problem generated by fiat money and privileged financial markets: the perennially reoccurring business cycle.

It should come as no surprise that banks and other financial institutions’ knowledge that they can depend on the central bank to bail them out leads to moral hazard. They can now engage in risky speculation in the hope of huge profits, and when the financial system periodically experiences a crisis or collapse, the taxpayers and hapless depositors are left with the bill. This speculation generally takes the form of increased lending to businesses in the form of fiduciary media, that is, uncovered money substitutes. As this increase in lending is not matched by an increase in saving, the result is that the market rate of interest is driven below its natural level and the business cycle is set in motion (Mises 1981, 357–64).

Austrian economists have thoroughly explained the business cycle resulting from credit expansion (e.g., Hayek 1935; Mises 1998, 535–83; Rothbard 2009, 989–1041; Skousen 1990; Hülsmann 2002; Huerta de Soto 2009; Salerno 2012). Cheap credit initially fuels a boom, as entrepreneurs invest in a longer structure of production. But the real savings needed to complete all investment projects are not available, and this becomes apparent when the infusion of cheap credit has passed through the system and the interest rate again rises to a level determined by the time preference of the economic agents. The boom inevitably turns to bust as nonviable investments are liquidated, workers laid off, and inconvertible capital goods in unprofitable production processes abandoned.

As part of the adjustment process during the bust, there is often so-called secondary or credit deflation (Rothbard 1963, 14–19; Salerno 2012, 37–41). Faced with bankruptcies and financial difficulties among borrowers, banks contract credit, or refuse to roll over short-term loans. At the same time, there is often an increased demand for money, as, faced with greater uncertainty, entrepreneurs and consumer hold off on spending until they are more sure of the economic environment. However, monetary authorities often intervene to prevent this deflation. To do this, they recapitalize overextended banks with new money, and the financial system that initiated the business cycle is largely saved from the ensuing recession. At the same time, workers and entrepreneurs have to scramble to reconstitute the structure of production along sustainable lines, while living through periods of unemployment and reduced incomes.

Deindustrialization

It is difficult to know how much of the decline in manufacturing and deindustrialization in the United States we can ascribe to the natural development of the economic system. The integration of vast areas of the globe into the world economy over the last several decades means that some industries are simply no longer competitive in the United States. Workers and investment will have to shift to other employment where the US still has a comparative advantage. There is no way around this adjustment, but there is some reason to believe that industry in the United States has been disadvantaged by the monetary policy of the Federal Reserve.

The first indication that something is amiss is the permanent deficit in the US balance of payments. Except for periods of recession, the deficit in the trade balance has only grown since the early 1990s (see figure 4). This would not normally be a problem, since the trade deficit would be offset by investments in the US economy. Increasingly, however, the trade deficit is paid for by a continuous outflow of newly created fiat dollars. Under the gold standard, this would be impossible (cf. below), and in this world of fluctuating fiat currencies, inflation should have led to a depreciation of the dollar in terms of foreign currencies, as its supply increased and its purchasing power fell. Yet this has manifestly not happened; the dollar’s exchange rate is by and large stable.

The reason for this is that the fiat dollar deliberately continues to be overvalued against foreign currency. David Stockman (2013) has repeatedly spoken of the “China price,” the downward pressure on prices caused by the flow of goods from China. Yet it is not just increased productivity and market integration that cause this. Lewis Lehrman (2013, 191–95) has argued that China is in effect a financial colony of the United States: by pegging the yuan to the dollar at an undervalued rate, Chinese exports to the US are boosted, and the People’s Bank of China can then inflate its own currency against its artificially overvalued dollar holdings. Indeed, the current international monetary system is best seen as a continuation of the gold-exchange standard introduced in 1922 and reintroduced at Bretton Woods, where the dollar became the world’s reserve currency and the only link to gold. This allowed the US to build up a balance of payments deficit, especially from the late 1950s on. Instead of an outflow of gold from Fort Knox, dollar balances simply accumulated abroad, especially in Western Europe, stoking inflation there, and in effect meant (and means) that the citizens of any country with a positive balance of payments vis-à-vis the United States were financing Americans’ acquisition of tangible assets in their own countries as well as the foreign spending of the US government. Jacques Rueff called this “an unprecedented system of spoliation” (Rueff 1972, 191) and it has continued since the end of Bretton Woods in 1971.5

The best description of this system is as a policy of American financial imperialism in which the Chinese government and other creditor nations are the junior partners.6 Not only are the incomes of Chinese workers artificially diluted, but the permanent overvaluation of the dollar has made it impossible for American industries to compete with those of other nations, and the result has been widespread deindustrialization in America (ibid., 195). It has been persuasively argued that increased trade contributed significantly to the collapse of manufacturing employment in the 2000s (Houseman 2018), which would corroborate the theory advanced here: monetary policy distorted the benefits from globalization and hobbled American industry. Had the dollar been allowed to depreciate as a consequence of inflationary Fed policy, it is plausible that the dislocations from the emergence of the Chinese economy and its integration into the world economy would not have been as severe. In that scenario Chinese and American industry would both have adapted and evolved according to the law of comparative advantage, to the benefit of both countries. Instead, American workers have had to suffer far more than necessary from the inevitable dislocations of globalization, while the benefits of globalization have been redirected to the people in control of the fiat dollar system: politicians, career bureaucrats, and crony capitalists well connected to the Fed’s money-creating operations.

The fiat dollar, then, has bred serious ills for American economy and society. Yet can the reintroduction of the gold standard—or, rather, the introduction of a pure gold standard—overcome these problems? And how can we go about reestablishing gold as money? We turn now to these questions.

THE SOLUTION: RETURN TO GOLD

The goal of this section is to establish that a return to the gold standard would overcome the severe problems that the fiat dollar has caused and that such a return is not only desirable but also eminently feasible. We will also briefly explain why the gold standard is preferable to some other commodity standard, such as a silver standard or a bitcoin standard.

Previous Reform Proposals

There have been very many proposals for a return to or a reform of the gold standard ever since the gradual deformation of the classical gold standard began. The following is not a complete list of these proposed reforms. We are only interested in recent reforms along the lines of a “true” or “pure” gold standard, where gold truly is money and money is seen as a market institution (Salerno 2010a). Money originated in the market as the outcome of the free actions of human beings (Menger 2007, 257–85; 2009), and the ultimate goal of any reform should be to reestablish money as a market institution and banish all government interventions from the monetary sphere. In a way, returning to the gold standard is just a means to this end—once the reform is accomplished, it is up to the actors in the market to either validate the experience of millennia by freely using gold as money or to discard the gold standard in exchange for their preferred medium of exchange.

The “gold standard” of such reforms is Mises’s from 1953 (Mises 1981, 413–57), and this is the one we will use as a blueprint for our own proposal. Rothbard wrote several works calling for a return to gold at a legal par that would lead to 100 percent reserves, and while we agree with his views on fractional reserve banking, we do not agree with this proposed method of achieving 100 percent reserves (Rothbard 2005, 1985; more on this below). Jesús Huerta de Soto has also proposed a reform of money and banking along Rothbardian lines (Huerta de Soto 2009, 715–812). Hayek in his writings on monetary reform in the 1970s does not endorse a gold standard, but his call for full freedom in monetary matters is definitely consonant with the gold standard as envisioned by its champions (Hayek 1976, 1990, 2008). Hans Sennholz (1969, 1979, 1985) and Ron Paul (Paul 1985; Paul and Lehrman 1982) both emphasize the need for complete freedom in monetary matters as part of their reform proposals. The Misesian reform we will outline below is superior to both the Rothbardian approach and a reform that calls for full freedom in monetary affairs but stops short of abolishing the paper dollar.

The way of returning to gold that Rothbard proposes is that the definition of the dollar be changed so that the total stock of gold becomes 100 percent equal to the supply of dollars in circulation (Rothbard 2005, 181–83; Huerta de Soto 2009, 800). When Rothbard wrote this in 1962, it would have required a ten- or twenty-fold rise in the price of gold , and it would require an even greater increase today, but this would simply be the equivalent of a massive inflation and would itself cause grave dislocations. It would also amount to a massive intervention in the monetary sphere, which is not the best strategy when the goal of the reform is the elimination of all such interventions. Rothbard sees a massive deflation of the dollar supply as the only alternative, but if this is so, that is probably the better alternative. In the end, Mises’s plan is preferable, as it depends on the free action of men in the marketplace, not government fiat, to set the new legal par between dollars and gold. If the goal is monetary freedom, then the price of gold should be set by free markets, not by politicians (cf. Salsman 1995, 120). Once the market has established the price, paper money is to be made freely convertible into gold and vice versa. This plan is not a guarantee against a deflationary destruction of fiduciary media, but is the reform least likely to entail such radical economic dislocation. And should such a deflation happen anyway, it will be due to the choices of freely acting men, not a government policy.

The problem with reforms along the lines suggested by Sennholz and Hayek that look only to freedom in establishing a new monetary system is that they overlook the great advantage fiat dollars have in competition with alternative potential moneys. Since it is already established as money, the fiat dollar will generally be preferred to other media of exchange, as it simply fulfills the primary purpose of money better than the alternatives (White 2002, 2004). Since prices are expressed in dollars, it is much easier to continue to use the incumbent money rather than speculate on some other commodity that might in time become widely used as a medium of exchange. This advantage of incumbency could be countered if the issuer of the fiat money, addicted to highly inflationary policies, in the end completely destroyed the monetary system. If we rely only on freedom, only on economic actions and not on political reforms in the establishment of sound money, all we can do is to wait for and even cheer on the complete destruction of the monetary system, while we stock up on the commodities that we think will emerge as media of exchange after the economic apocalypse. This is, however, an immoral and destructive course of action (Hülsmann 2008b, 241), as it amounts to resignation and surrender in the face of a great evil. There is, furthermore, no reason to think that the advocates of sound money will be in a position to prevent the perversion of the monetary regime that would emerge after the end of the fiat dollar.

The goal of all these reforms and of the reform we will present below is not simply anchoring the dollar to gold; rather, the goal is to completely replace fiat money with commodity money. Only in this way can the evils of fiat money be permanently banished.

How the Gold Standard Would Solve the Problems of Fiat Money

Inflation

Unlike with fiat money, there are definite limits to the possible increases in the supply of gold. Gold is an economic good and its production is subject to the same economic laws as all other goods (Hülsmann 2003, 39). In particular, the production of gold is limited by the law of costs (Sennholz 1975, 47–48): over time, the costs of production will tend to equal the selling price, as entrepreneurs bid up the prices of factors of production until the return to capital (the interest rate) is the same in all industries. Should a producer of gold go beyond this limit, he will lose money, just as would be the case in the production of other goods: he would spend more on inputs and wages than he would receive in revenue, so attempts to become rich simply by producing money would be self-defeating.

Furthermore, gold is indestructible; virtually the whole stock ever mined is still in existence, so current annual production is just a fraction of the total aboveground stock, usually 1–2 percent (Skousen 1996, 83–85). The possibilities for monetary inflation, then, are clearly limited under a gold standard.

This does not mean that the supply of gold is completely fixed; the production of gold will respond to an increase in the demand for money. As the demand for money increases, the purchasing power of money increases, meaning that it is now relatively more profitable to produce money. Gold miners will therefore expand their operations and less gold will be used for industrial purposes, as the gold is more highly valued in monetary uses, and manufacturers will search for substitutes to replace the more costly gold. Current production of gold and supply for monetary uses will also respond to a decrease in the demand for money: if the demand for gold for monetary purposes falls, its price will fall and gold miners will curtail their activities, reducing the additions to the present stock of gold. It may also prove possible to use more gold for industrial purposes or for consumer goods at the lower price, and more gold will therefore be switched to these uses, away from the monetary use (Salerno 2010b, 345; White 1999, 31–39).

It is theoretically possible for there to be short-term, localized inflation in gold-producing countries during a gold rush (Skousen 1996, 88), but these are unlikely now that the whole earth has been explored. Should they happen, however, they will only be temporary: the new gold will spread across the globe in such a way that its purchasing power will tend toward equality throughout the world (Mises 1981, 170–78), as it indeed did during the period of the classical gold standard (McCloskey and Zecher 1985). Speculation will speed up this process, further limiting the local inflationary effects of sudden increases in gold production.

Deflation of the money supply will be very limited, since gold is indestructible. Two kinds of changes on the demand side may cause the money supply to fall: a fall in the demand for money will lead to a lower purchasing power of money and higher prices, which would mean a relative increase in the profitability of gold for industrial purposes, leading to increased industrial demand. Similarly, an increase in industrial demand for gold will lower the supply of money, causing a general fall in prices and an increase in the purchasing power of money. In both cases, gold does not disappear completely: it will still be a potential part of the money supply, ready to reenter people’s cash balances should their demand for money increase or the possibility for profitable industrial uses disappear. There will very probably be price deflation during periods of economic growth, but this is on the whole beneficial (cf. Saul 1969; Bordo, Landon-Lane, and Redish 2010), as it just means that the value of everybody’s money holdings will increase slightly, which will not hamper economic growth (Selgin 1997; Thornton 2003; Hülsmann 2008a; Bagus 2015a). A falling price level will tend to stimulate gold production, and increased gold production will then tend to stabilize the price level. This is indeed what happened historically: in the period of 1890–1910, for instance, there was a tremendous economic expansion, but the overall level of prices was much the same in 1910 as it had been in 1890. The reason was that falling prices had stimulated gold production to such an extent that the monetary gold stock increased threefold (Rueff 1972, 45).

The problem of inflation leading to lower-quality products will also disappear under the gold standard. Recall that the substitution of lower-quality for higher-quality inputs was a response to the cost squeeze experienced by entrepreneurs as a result of fiat money inflation affecting input prices before affecting the prices of the final products. These problems will disappear on the gold standard, as money will be produced by entrepreneurs in response to consumer demand, not created arbitrarily.

Redistribution

Unlike the production of fiat money, money production on the free market does not imply redistribution away from producers. Just as in other industries, the incomes to gold miners are due to their productive efforts and entrepreneurial foresight, to how well they satisfy consumer demand.

It might be argued that gold, after all, is money, and that Cantillon effects mean that the production of gold leads to redistribution. But the similarity between the two cases is only on the surface. The “redistribution” to the entrepreneurs operating gold mines is no different from the “redistribution” to entrepreneurs engaged in producing consumer goods and capital goods. The new money produced will be paid out to the entrepreneurs, capitalists, and workers engaged in gold mining, and should increased demand for money or reduced costs increase the profitability of mining, more workers and capitalists will be attracted to the business. Conversely, should the profitability of gold mining decrease for some reason, workers will be laid off and have their wages reduced, capitalists will shift their investments from gold mining to more profitable areas, and entrepreneurs will suffer losses until all the adjustments have been made. All these changes are no different from what happens in other industries, and they do not lead to the kind of redistribution described by the Cantillon effect.

It is true that during a gold rush the workers and capitalists will be able to enjoy their increased incomes before the price effects of the increased money supply have taken effect, but a comparison to the production of a nonmonetary commodity will show that this is no different from increased profits in other sectors. Let us imagine that there is a sudden increase in demand for steel. Steel mills will make larger profits, as their selling prices increase before their buying prices, and these profits will be distributed among the entrepreneurs and workers and capitalists engaged in steel production. Entrepreneurs will bid up factor prices for their inputs in order to expand their production to satisfy the increased demand until production has been expanded and the profits have been distributed to workers and factor owners. The permanent effect of the change in demand has been increased incomes to all the workers and factor owners engaged in steel production, and they can enjoy these incomes before the prices of consumer goods have adjusted fully to the change in consumer demand brought about by the change in income distribution.

When we have commodity money, then, a boom in the production of money does not have effects, when it comes to the distribution of incomes, that are different from those of a boom in any other industry. It will lead to a rise in money incomes, but everybody is free to try their luck in the gold mines, and so the increased monetary incomes here will quickly bid up money wages in other industries. The distribution of incomes will change accordingly as productivity and consumer demand change.

Financialization

Financial markets offer an important service to the economy—what we may call the financial division of labor7—as they transfer savings to where they are most valued. Savers benefit, as they gain a return on their savings and borrowers benefit, as they can now raise the funds they need for their planned investments instead of having to fund them out of their own savings. Financial intermediaries simply facilitate the process of investment by searching out and evaluating possible investment opportunities, pooling savings, and organizing markets (cf., e.g., Mishkin and Eakins 2016 for more on the true benefits of financial institutions).

However, as detailed above, the role of financial markets has been much exaggerated under the rule of fiat money, as virtually all saving has had to be in the form of financial assets to guard against inflation and as the costs of borrowing have been artificially lowered. Under a gold standard, we can expect money with a stable, probably even increasing, purchasing power. The artificially elevated demand for financial assets will therefore disappear, as it will no longer be necessary to guard against the erosion of one’s savings by investing in financial markets as fast as possible. We can imagine that people would instead accumulate funds and make long-term investments—perhaps in bonds, perhaps in various market funds, and probably to a larger extent in non-financial assets. There will still be an important role for financial markets, and it might even be, as Salerno (2010a, 364–65) speculates, that some financial assets (specifically, money market mutual funds) will supplement gold in its monetary role. But the artificial impetus forcing every small-time saver into the financial market and inducing everybody to take on debt will be gone, as it will no longer be necessary for everybody to dabble in financial markets to protect their savings.

The business cycles and periodic financial collapses will also disappear with the return of the gold standard. There will still be entrepreneurial errors and bad business decisions, and these may lead to the collapse and bankruptcy of companies from time to time. But we will not see the systematic boom of the economy as a whole followed by crisis and recession as the bad investments are liquidated. This phenomenon is dependent on infusions of money into the credit market that drive down the market rate of interest from its natural level—and this simply will not be possible under the pure gold standard. All lending will have to be backed by savings; there will be no fiduciary media. Credit will only be what Machlup (1940, 224n; cf. Mises 1981, 265) called transfer credit and Mises called commodity credit, that is, credit provided out of real savings, not simply granted ex nihilo by banks.

Even the case of a gold-induced business cycle that Mises (1998, 571) thought at least theoretically possible—increases in the supply of commodity money that reach the credit markets first—will not, in our opinion, trigger the business cycle, for what has happened here is not an artificial lowering of the rate of interest; rather, some entrepreneurs with a lower time preference have increased their incomes by better satisfying consumer demand. They have chosen, at the market rate of interest, to increase their investments relative to consumption. There is no difference between this scenario and the case where an entrepreneur in some other sector is successful, amasses a fortune, and invests most of it rather than consuming it. In Machlup’s terms, it is still an (perhaps temporary) increase in transfer credit, not created credit, and such fluctuations are simply part of the dynamic market process (Rothbard 1963, 34–36).

Deindustrialization

We live in a changing world and industries that were once competitive may suddenly find that new competitors in the global economy are undercutting them. This is simply part of reality, and to the extent that worldwide economic integration has made manufacturing in the United States noncompetitive, being on the gold standard would not have changed this. Some short-term pain for some producers is inevitable when the whole world economy has to adjust to the integration of large nations like China into the international division of labor.

The problem of the permanent balance-of-payments deficit and the artificially overvalued dollar would, however, be solved by returning to gold. Increased imports would mean an outflow of gold, and this would lead to a higher purchasing power for gold in the country. Foreigners taking advantage of this would increase their purchases of goods from the United States and the outflow of gold would be reversed to an inflow as speculators exploited the profit opportunity created (Salsman 1995, 34). Gold would tend to be distributed in such a way that its purchasing power is the same in all countries (Mises 1981, 170–72, 178). There are very definite limits to the supply of commodity money and a balance-of-payments deficit could not go on for long. Eventually, it would be reversed and money would start pouring back into the country (Heilperin 1939, 145, 152–53). These adjustments would happen automatically—that is, without the need for intervention by the monetary authorities—and would result in imports, in the long run, being paid for with exports or with foreign investments. Only the gold-producing countries would have a sustained outflow of money.

How would the gold standard affect trade between industrializing nations and the United States and would it limit the tendency for manufacturing to decline in the US? To the extent that imports into the US have been artificially stimulated and production in the United States has been disadvantaged by the fiat dollar system, to that extent the gold standard would restore competitiveness to industry in the United States. This does not mean that the gold standard would hamper international trade; quite to the contrary, it would promote sustainable trade and integration between all trade partners. We can imagine that under the gold standard, the United States would specialize in producing and exporting higher order goods such as specialized machinery, advanced electronics and the like to China, while China exported lower order goods and consumer goods to the United States. Yet all this is speculation; all we can say with any degree of certainty is that the balance of payments would tend to balance in the long term, and that capital flows would finance expansion of production in the most profitable locations and not simply support government and private consumption in the United States.8

The Outline of a Gold Standard for the Twenty-First Century

The gold standard would be a vast improvement over fiat money, as it would solve most of the problems identified above. Furthermore, it is clear that it is the broad strata of the public who would gain from the reform, while only the narrow elites controlling the production of fiat dollars would lose out. The goal of our reform should not, however, be to simply return to the gold standard as it existed before 1933 or 1914, as this system still left the government and the central bank with some influence over monetary policy. Rather, we should aim at complete monetary freedom, at getting the government completely out of the business of producing and managing money.

Mises’s reform plan is, as indicated above, the main inspiration for the present proposal. His reform consists of two simple steps: 1) cease all inflationary activity; this also means 100 percent reserves for all future bank deposits; and 2) once the market price of gold stabilizes, this market price of gold is decreed the new legal parity for the dollar and the dollar is to be convertible unconditionally at this parity (Mises 1981, 448–49). A conversion agency independent of the Federal Reserve should be set up to accomplish this. The goal of this reform is not simply to stabilize the value of the dollar, but to make sure gold coins again circulate as money, that gold is again in everybody’s cash holdings, in order that the common man understands the importance of commodity money and is alerted in time should inflationary schemes be tried (ibid., 450–52). It is therefore important that all five-, ten-, and twenty-dollar bills are withdrawn against new gold coins within a year of the reform.

The first step in any reform, then, must be to stop inflating the money supply. The market can only be expected to find the correct price if disturbing factors are eliminated and the goal of reform is openly announced. It is therefore also necessary that all legal tender laws and all laws and taxes discriminating against the use of gold for monetary purposes be repealed (Paul and Lehrman 1982, 179–81). Naturally, all measures prohibiting or limiting private coinage of gold and silver coins must also be repealed. This will greatly facilitate the production and spread of such coins and prepare the way for the complete privatization of the monetary system.

Once these measures have been implemented and the commitment to restore the gold standard been openly and forcefully communicated, markets will in a short time establish a new dollar-gold ratio that will then be elevated to the new legal parity. It is impossible to say beforehand what this new price will be. Mises thought that the price of gold would settle around $36–$38, but this is obviously nowhere near the present-day market price. The legal price of $42.22 per troy ounce that the Treasury still insists on using in its accounts is equally outdated (Bureau of the Fiscal Service 2019). We can imagine that the imminent reintroduction of gold for monetary uses will create additional demand for gold, although it must be realized that a lot of the present demand for gold is for monetary and investment purposes: out of a total production of 4,490 tons in 2018, 1,810.6 tons were bought by investors and central banks (World Gold Council 2019).9 Most likely, a great proportion of the 2,200 tons used for jewelry was also really investment demand, but how much we can only speculate.

For present purposes, imagine that the announcement of the reform and the initial actions suggested above lead the gold price to settle around $1,500—a slight increase from its present level.10 This price is then decreed the new legal parity—that is, the dollar is now defined as 1/1,500 troy ounce of fine gold. The conversion agency envisioned by Mises then proceeds to exchange all paper dollars presented to it at the legal parity into newly minted gold coins.

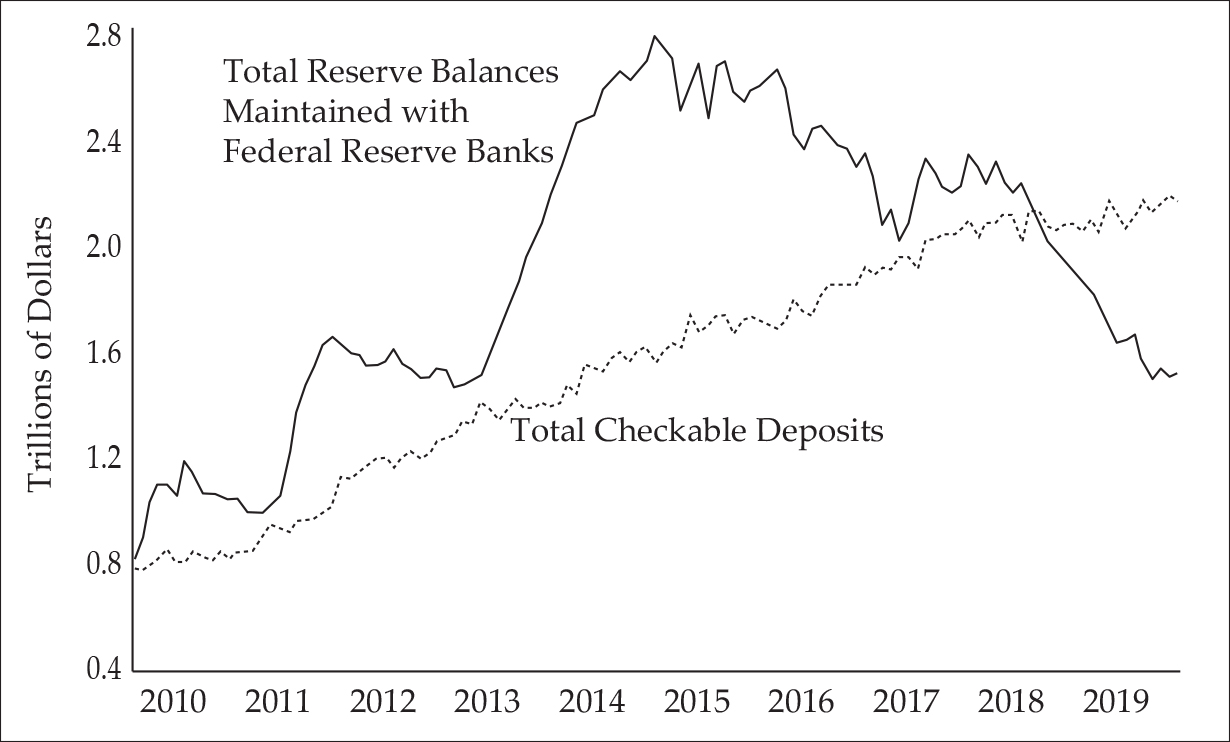

Several problems immediately present themselves when we contemplate this plan. For one thing, what kind of dollars, that is, what range of money substitutes should be accepted for redemption? Whether we choose M1 or M2, or just the currency component of M1, it is clear that the Treasury does not have enough gold to fully redeem all fiat dollars now in existence. At our suggested price of $1,500, the gold reserves of about 8,140 metric tons would be valued at about 400 billion dollars (precision is not important for our purposes here). This would be enough to redeem about one-quarter of the currency component of M1, or one-tenth of M1 or one-thirty-sixth of M2 (see figure 7).

Figure 7: US Money Stock, 2019.

Clearly, despite the large gold reserves, immediate redemption of every dollar in existence is not possible at gold prices below $15,000 at a minimum. However, there is no reason to think that the whole dollar stock will be presented for redemption at once. The dollar will, after all, improve considerably in quality once all inflation stops and redemption in gold is resumed. Hopefully, this means that an orderly withdrawal of paper money and its substitution with gold will be possible, and the Treasury will be able to gradually buy up gold in the market as necessary to redeem all dollars with gold as they are presented to the conversion agency. How the Treasury is to find the resources to buy gold as needed is a different question: it might fund the purchases out of tax receipts, which would mean an increase in taxation or a reduction in government expenditures and would therefore be unpopular, as well as keeping paper dollars in circulation, or it might fund its gold purchases by selling off government assets. The government held assets worth $3.48 trillion at the end of fiscal year 2017, to which should be added stewardship land not on the books (Department of the Treasury 2018, 55, 155). Selling off these assets to fund the necessary gold purchases would have the double benefit of not burdening the taxpayer and liberating substantial resources for use by the private sector, increasing real wealth and the production of desirable goods and services. This is clearly preferable to diverting taxes to gold purchases, since taxation not only is unpopular, but it is also destructive of real wealth.

Another serious problem is how to most easily get rid of the paper money in daily use. The use of cash is still widespread, and especially so for small purchases (Kumar, Maktabi, and O’Brien 2018). We agree wholly with Mises that it is desirable to replace banknotes with hard currency, but that is more easily said than done. The smallest gold coin produced by the US Mint is the one-tenth- ounce gold eagle, which at the suggested price of $1,500 per ounce would have a purchasing power equal to $150. Even were it technically possible to produce a one-twentieth-ounce coin, this too would be unusable for smaller purchases. Clearly, some other solution is necessary.

One possibility would be to allow for the existence of the old Federal Reserve notes, which could then assume the function of a token money for small purchases (Paul 1985, 137). This, however, leaves open the possibility of government interference in monetary matters, as only a legal monopoly on the issue of such notes can ensure their monetary character, and the point of the reform is precisely to finally achieve the complete separation of money and the state. Another possibility is to let banks take care of the problem by issuing money certificates and token coinage in small denominations. We can easily imagine that banks and other intermediaries will already be helping the citizens redeem their dollars for gold, so it is not too farfetched to think that the process will to a large degree consist in the transfer of gold bullion from the government to banks rather than of coins to citizens. This will save the cost of coinage for the government and economize on the costs of redemption for the citizens, and the citizens, if they so chose, could then continue to keep their gold in the bank and use money certificates.

There is a risk that the old paper currency will continue in use, simply because its value will be stabilized by the reform. As already said, this is undesirable, as it leaves the government a role in monetary affairs—and thus leaves the door open for the government to start meddling again. The solution to this problem is simple: allow the market to set a premium for gold above paper. Only at the conversion agency should the legal parity be enforced (Paul 1985, 135–36; Sennholz 1985, 82), market actors should be free to prefer gold in exchange and even to refuse to accept paper dollars. It is natural that sound money and trusted money certificates should be preferred to and command a slight premium over paper, since it is a more honest and secure form of money. By allowing this premium to emerge on the market – i.e., by abstaining from government intervention in the market process—while still enforcing the legal parity at the conversion agency, we should see a steady stream of gold out of the US Treasury and into private holdings. The premium may not amount to more than 1 percent, and will perhaps even be less, but that should be enough. This trend can be strengthened by forcing the US government as a whole, not just the conversion agency, to accept paper dollars in payment of fines and taxes at the legal parity. Since paper currency is also not very durable, we should expect it to disappear relatively quickly as old notes are turned in before they disintegrate.

Returning to the gold standard would usher in an era of increased productivity and prosperity for all. This has been the historical experience: the monetary reform in Germany in 1948, for instance, did not lead to a crisis, but rather straight out of a depression (Rueff 1964, 103–21; Lutz 1949) and was an important cause of the German Economic Miracle.11 It is true that returning to the gold standard would mean that the government would have to balance it budget in short order, and this may evidently be problematic for companies whose main business is in government contracts of various kinds, but these difficulties would be minor compared to the great prosperity unleashed in the rest of the economy. The financial system too should be able to adapt to sound money quickly, as most banks have ample reserves compared to their demand deposits (see figure 8). These reserves will be a more than adequate cushion for any short-term turbulence in financial markets that might result, especially since the quality of the banks’ reserves will improve as they are gradually swapped for gold through the process of redemption.

Figure 8: Total Reserves and Total Checkable Deposits, 2009–19.

Mises suggested that a monetary reform should be accompanied by the elimination of further issues of fiduciary media (Mises 1981, 438). His idea was to institute a 100 percent reserve requirement on new issues of money substitutes, whether in the form of demand deposits or banknotes.12 There is a lively debate over the issues of banking and money among supporters of the gold standard, but here we will limit ourselves to suggesting a reform targeting base money, or money in the narrower sense. A banking reform liberalizing financial institutions and removing undue protections and privileges would be of great benefit in itself and has previously been suggested as an integral part of monetary reform by, for instance, Judy Shelton (1994, 305–6), but we will not here enter into a discussion of the problems or benefits of fractional reserve banking and fiduciary media.13

Once the reform has been accomplished and all fiat dollars have been exchanged for gold, it will be a small matter to move on to complete monetary freedom. No special privileges should be afforded the use of gold for monetary purposes. Merchants, banks, and other financial institutions are free to favor one medium of exchange over another, should they so desire, but the same freedom of choice cannot be allowed to the government. While it may continue to keep its accounts in terms of the defunct dollar or in terms of gold, it should be forced to accept any commodity in current use as money in payment of taxes and other dues. This will ensure that, going forward, the market will be free to confirm gold as money, or to replace it with its preferred commodity.

Why Not Silver or Cryptocurrencies?

We have throughout emphasized that the goal of the reform is not simply the gold standard, but full monetary freedom. So why not choose another commodity, such as silver, or something more modern such as bitcoin?

It is entirely possible that the market may, in time, come to prefer these media of exchange to gold. We have proposed a gold standard that would put the minimum of artificial obstacles in the way of such a substitution. Yet there are still good reasons to think that gold is the better choice for a commodity money.

There is, first of all, a long tradition across the globe of gold as a medium of exchange and store of value. This means that there is widespread ownership of gold throughout society and that it would not take much mental effort for the citizenry at large to again come to think of money as gold and gold as money. This is probably as true of silver as it is of gold. Bitcoin, on the other hand, is a recent invention (cf. Barta and Murphy 2017; Ammous 2018 for an introduction to bitcoin). While it could theoretically serve as money, it is not used or owned widely in society yet. Unlike gold and silver, bitcoin requires at least some familiarity with modern digital technologies. This will, in our view, slow down its widespread adoption for some time, even if it should prove to be a higher-quality medium of exchange than gold. The payment of transaction fees is also inherent in the use of bitcoin, while it is free to use gold and silver, although banks might very well charge a fee for the use of their services and credit card companies already charge such fees.

Our preference for gold over silver is purely pragmatic: both metals could conceivably perform the functions of money equally well and have done so historically. However, the US government is in a better position to replace the paper dollar with gold than with silver. The Treasury possesses 8,140 metric tons of gold, or about 261 million troy ounces—enough to redeem a sizable portion of the outstanding paper dollars, as outlined above. Its stock of silver is slight by comparison: only 498 metric tons, or about 16 million troy ounces (US Geological Survey 2018). The conversion agency is bound to buy more gold than the US government already possesses anyway, but the US government is in a much better position to return to gold than to institute a silver standard.

Nevertheless, should the public prefer silver to gold, we can conceive of the conversion agency supplying silver currency as well, although this can only be done if the government buys up large quantities of silver. Having silver circulate as money as well as gold might be one way to solve the problem of small change outlined above, but it should be made clear that a fixed exchange between the two metals is not what we advocate. That would run into the problems described by Gresham’s law, and would at best result in silver becoming a rather expensive token coinage. Instead, it might simply be possible for the citizens to buy silver coins from the conversion agency instead of redeeming their dollars for gold. But this would be a purchase transaction, not an act of redemption, and silver would continue to fluctuate in value in terms of gold. Expanding the possibilities for purchasing silver coins even before the reform is completed would also be in keeping with the ultimate goal of monetary freedom.14

WHY THE CASE FOR MONETARY REFORM MUST BE POPULIST

“[We] must show how the money system impoverishes most people and benefits politicians, government officials, and entitlement cronies.” – Hans Sennholz (1985, 78)

Such a reform as we have presented above is ambitious, and it might well be asked how it can be a popular cause. However, any social institution depends on popular support for its continued existence, and this is true also of money. In order to promote sound money, the public at large must be convinced of the justice and utility of that reform (Mises 1981, 456).

The reason for making the cause of the gold standard a populist cause is not simply that all branches of government have proved impotent or unwilling to defend sound money (Mises 1981, 452); unfortunately, there does not seem to be any clear political gain to be made from championing sound money, while there is a clear financial and bureaucratic interest in maintaining the status quo. There also seems to be very little understanding of the importance of the gold standard, which to this day is still too often confused with the gold-exchange standard in official circles and academia and therefore dismissed as a barbarous relic.

It is, however, clearly in the interest of the public at large to see a return to sound money, and it is especially in the interest of that portion of the public employed in the private sector or who live off their own funds. We tried to outline in the last two sections how such people are hurt by the fiat dollar and how a return to gold might benefit them especially. Only by making such appeals to the tangible benefit that the public can expect from sound money can we expect them to join a movement for gold (Paul 1985, 131), and only if we can make the cause of the gold standard a popular movement on a par with the free trade movement of the nineteenth century (Hayek 1990, 133) can unwilling politicians and bureaucrats be forced to accept it. It is, in other words, necessary to make sound money a popular crusade in order for a return to the gold standard to become at all possible.

Making the cause for the gold standard a populist one does not mean that just any argument in its favor can be used. The arguments used must always be true and in accord with reality. A popular movement for sound money and gold should not create unrealistic expectations in the public; the gold standard can solve some problems but it is not an economic panacea. The agitation for the gold standard should never go beyond what can reasonably be expected, but we should not be afraid to show the relevance of sound money to whatever question holds the public’s attention at the moment. Some arguments are clearly not compatible with the gold standard: the gold standard imposes golden shackles on the state, and it would be dishonest to pretend otherwise, nor can or should it be hidden that advocacy for sound money was and is intimately connected with the main goals of classical liberalism and libertarianism: laissez-faire, personal freedom, and peace. This does not mean that the public has to be converted to the whole liberal/libertarian program, but it does mean that it would be dishonest and counterproductive to hide the fact that sound money would mean severe limits to the possibilities for expanding state power.

The case for gold probably cannot sustain continued support on its own. A sound money movement would want to ally with other popular movements to advance its cause (Sennholz 1985, 79). Sennholz suggested the tax revolt movement in the 1980s, but there is no reason to be picky. Gun owners, advocates of First Amendment rights, of privacy rights, of religious freedom—wherever there is a movement whose objectives are consonant with the objectives of the sound money movement, there the possibilities for cooperation should be explored. Some causes, no matter how popular, cannot be allies of a movement for restoring the gold standard. Specifically, any movement that seeks to expand the scope of government significantly in pursuit of its goals cannot be an ally of a movement for sound money, as the objectives of such a movement are incompatible with the institution of sound money.

How can the populist appeal, then, be made? This, as already indicated, depends on the specific circumstances of time and place and the problems exercising the public. In general, in the American context, appeals might be made to the injustice of Roosevelt’s confiscation of gold in 1933 and how it would be just to restore the gold to the current owners of dollars; the long tradition of adherence to gold and sound money might also be invoked, from the Jeffersonians and Jacksonians to the late nineteenth century. Fundamentally, any policy rests on the popular acceptance of the doctrines on which it is grounded, which is why any long-term reform must be based on popular support for true principles:

The first condition of any real monetary reform is still to rout completely all populist doctrines advocating Chartalism,15 the creation of money, the dethronement of gold and free money. Any imperfection and lack of clarity here is prejudicial. Inflationists of every variety must be completely demolished. We should not be satisfied to settle for compromises with them. The slogan, “Down with gold,” must be ousted. The solution rests on substituting in its place: “No governmental interference with the value of the monetary unit!” (Mises 2011, 21)

CONCLUSION

The gold standard, and sound money generally, is still the only solution to the problems generated by fiat money. We have argued in this paper that the economy and society of the United States is still plagued by the evils of fiat money, even though the high inflation of the 1970s gave way to the “Great Moderation”. We have also tried to show how returning to gold would solve the specific problems caused by fiat money, and how a feasible reform returning the dollar to gold would look now, after close to 50 years of fiat money.

The crucial point is that any restoration of the gold standard must originate as a popular movement, and the advocates of the gold standard must therefore make their appeal to the public, not to politicians and central bankers. The benefits of sound money are very real, and so are the abuses of fiat money. There is therefore no reason that sound money cannot become a popular idea at the center of a political program as it once was (Mises 1981, 414).

- 1. One reason to be skeptical of the extent to which Greenspan really imitated the gold standard, or at least to question his success in doing so, is that under the gold standard, the US balance-of-payments deficit would have been eliminated by the outflow of gold. As the deficit grew at an almost constant rate (see figure 4) throughout the 1990s and first decade of the 2000s, the great moderation was clearly not a good imitation of the gold standard. Jacques Rueff (1972) in his The Monetary Sin of the West gives a good explanation of how and why the US balance-of-payments deficit persisted under the gold-exchange standard. The same causes he identified back then are still at work today.

- 2. Changing consumer attitudes are not necessarily independent of changes in the relative prices of foodstuffs: if beef is not only more expensive but also rising in price relative to chicken, as it has been, it may be much easier for housewives to accept government propaganda and corporate marketing extolling the supposed superior nutritional qualities of the lower-quality foodstuff.

- 3. Note that Lin and Tomaskovic-Devey attribute the rise of financialization to deregulation.

- 4. Hülsmann (2013) also stresses the redistribution of wealth from “have-nots” to “haves” in general.

- 5. Robert Lucas (1990) in an important paper has asked why doesn’t capital flow from rich countries to poor? He suggests several possible answers, but does not consider monetary problems. Yet it is here that the solution lies, as we have indicated in the text. See also the comments to this effect in the paper from the Bank of England already cited (Bush, Farrant, and Wright 2011, 9), as well as the analyses of the gold-exchange standard and Bretton Woods—they are really the same thing—by Jacques Rueff (1964; 1972) and Robert Triffin (1960; 1964). Their diagnosis is, mutatis mutandis, still applicable today: the US is still able to run a “deficit without tears” (Rueff 1972, 23) and benefit from what the French finance minister Valéry Giscard d’Estaing called the “exorbitant privilege” of issuing the world’s only reserve currency (Eichengreen 2011, 4).

- 6. See Hoppe (2006) for an account of how the modern international monetary system in general functions along similar lines. It should be clear that it is at most the governments of the creditor nations that can be considered junior partners, since they can increase their money supply and government spending on the basis of accumulated dollar reserves. The populations of foreign countries lose, as their purchasing power is diminished: in a free system, either their currencies would be revaluated, or should the gold standard be adopted, gold would flow into the creditor nations.

- 7. This is Jörg Guido Hülsmann’s term—it has not, to my knowledge, been used in published writings.

- 8. Much more could be said on the international aspects of a restored gold standard. The reader is invited to consult the works referred to in The section on “Previous Reform Proposals” and in footnotes 5 and 6.

- 9. See also the additional charts and resources at Goldhub’s research library, https://www.gold.org/goldhub/research.

- 10. Since first writing this essay, gold has appreciated somewhat and is now fluctuating in a range between $1,700 and $1,750. I have retained the suggested price of $1,500, since it merely serves an illustrative purpose and is not too far removed from what the price can be expected to settle at should the reform be put in motion today. The basic principles of the suggested reform remain the same no matter what the price of gold rises to. The figures for the money supply used in this paper are also outdated, as the latest data used is from 2019.

- 11. See also Concise Encyclopedia of Economics, s.v. “German Economic Miracle,” by David R. Henderson, accessed April 4, 2020, https://www.econlib.org/library/Enc/GermanEconomicMiracle.html.

- 12. It should be clear that in this Mises was inspired by Peel’s Act. The main difference is that Mises recognized the correct character of demand deposits as money substitutes, and that Mises insisted on complete freedom in banking, subject to the normal commercial code.

- 13. I would, however, suggest that there is a clear parallel between the problems of the gold-exchange standard, which Rueff (1972, 28) identified as “a dual pyramidal credit structure based on the world’s gold stock” and a “duplication of the credit structure,” and fractional reserve banking, and that if one accepts Rueff’s criticisms of the former, it is very hard to explain how they do not apply to the latter.

- 14. Strictly speaking, the US Mint need not be involved in coining silver at all. It is enough to repeal all legal tender laws early on and decree that all commonly accepted media of exchange are also acceptable in payment of taxes. The government would still have to use gold as the money of account, but it could then accept silver in payments according to the prevailing market rate at the time. Naturally, such acceptance should be forced on the government, but private parties should be free to accept or refuse payment in whatever money they chose.

- 15. The text reads “Chartism,” but this must be an error by the translator: chartalism was the state theory of money made famous be Georg Friedrich Knapp in 1908, whose modern epigones are the promoters of so-called modern monetary theory (MMT). Chartism, on the other hand, was a movement for the extension of suffrage in nineteenth-century Britain.