Explaining Malinvestment and Overinvestment

Mainstream macroeconomists may—and do—disagree with such an assessment, but Austrian macroeconomists rightly consider the Misesian/Hayekian1 theory of the business cycle to be one of the signal achievements of the entire Austrian School of thought. This Austrian business cycle theory (ABCT) offers a unique perspective on the destructive array of private sector incentives created by central bank manipulations of the supplies of money and credit

ABCT is essentially a theory of unsustainable economic expansions, that is, macroeconomic expansions that must unavoidably be followed at some point by macroeconomic contractions. At the center of this scenario is the phenomenon of malinvestment. Thus, in order to explain ABCT one must be able to convey in what malinvestment consists. In the past, Austrians have usually done this either entirely by means of verbal explication or with the assistance of certain unconventional constructions such as Hayekian triangles.2 These figures relate the stages of production to the magnitude of ultimate output and thus can reveal the effects of a change in market interest rates on the structure of production. However, to grasp the significance of such triangles one must also comprehend certain distinctively Austrian ideas such as“roundabout production” and the average production period. Students of economics who are not already familiar with the Austrian School are thus not likely to find Hayekian triangles to be very enlightening. Something more familiar to such students might prove more helpful.

Pursuing that line of thought, the present paper will offer an interpretation of malinvestment in more conventional terms, using such frameworks as the familiar capital asset pricing model (CAPM) seen so often in finance classes. In addition, the everyday observation about the disproportionate effects of interest rate changes on the present values of assets with different maturities will be shown to be congruent with Hayekian triangles, thus removing the latter from the realm of the exotic. Finally, the important role of the “subsistence fund” in understanding malinvestment will be illustrated. First of all, however, the basics of ABCT will be briefly reviewed

ABCT in a Nutshell

The distinctive Austrian approach to business cycles is bundled within the two “universals” of macroeconomics, time and money3 (Garrison 2001, pp. 47–52). Production in a modern economy is a roundabout process. It takes time and is measured in monetary units. The intertemporal dimension of the structure of production is, and I believe quite rightly, untiringly emphasized by Austrians. They always distinguish higher-order capital goods, which function at or near the beginning of the temporal string, from lower-order consumer goods, which are the culmination of the process. The complicated and somewhat fragile production structure requires that complementary inputs be available not only in the right magnitudes but also at the right moments in time. If they are not, then projects that appeared profitable are soon revealed to be unprofitable. In other words, what appeared to be capital creation is seen in fact to be capital consumption. ABCT focuses on the “medium run,” because that is where problems arise. In the short run, the capital structure cannot be changed significantly, and in the long run all errors have been rectified. It is in the medium run that there is time enough for capital projects to be initiated and the direction of production to change, but insufficient time for any possible malinvestments to be corrected—at least not without serious repercussions. This inability to smoothly liquidate or redirect projects stems largely from the heterogeneity of most capital goods.

What is the source of the widespread “cluster of entrepreneurial errors” (Rothbard 1970, p. 746; 1975, pp. 18–21) that typifies the boom-bust sequence? It is that market rates of interest are driven below the “natural rate” as result of credit expansion by the central bank. Market rates are the result of the supply of and demand for credit (or loanable funds), while the natural rate is an expression of individuals’ time preferences, that is, their preferred rate of substitution between present goods and future goods. Such declines in market rates make it appear as if consumers have chosen to save (delay consumption) at a higher rate than before, when in fact they have not done so. Furthermore, the increased credit available at relatively low interest rates must appear as an increase in funding for businesses. Otherwise, no cycle will appear (Rothbard 1978, pp. 152–53).

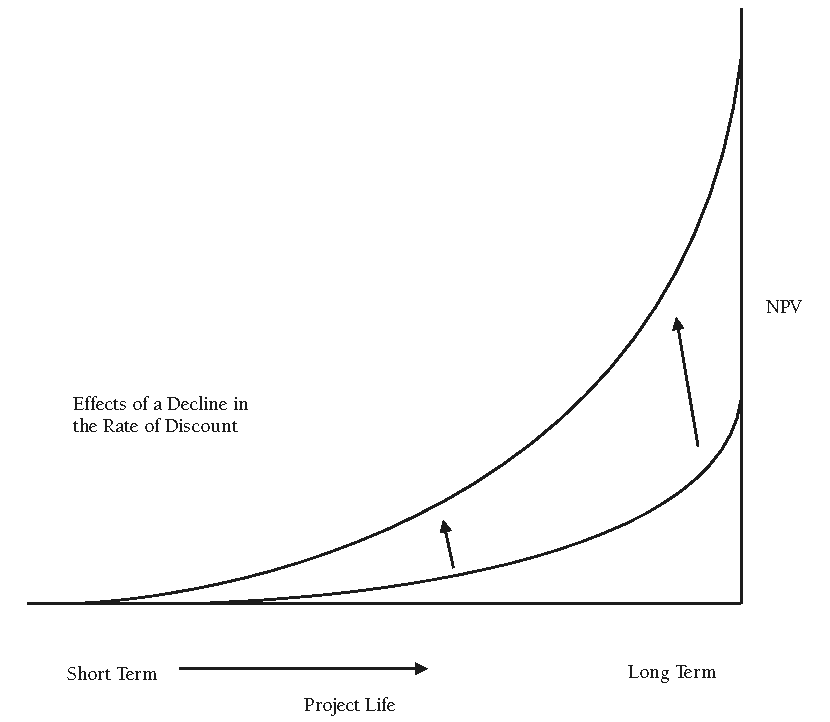

The low rate of interest and abundant credit induce businesspeople to lengthen the production process.4 This occurs because the net present value of longer-term projects rises relative to that of shorter-term projects (see figure 1). Entrepreneurial demand for capital goods thus increases, and producer goods’ prices rise relative to consumer goods’ prices. The result is a production structure that is unsustainable. Consumers will eventually reassert their unchanged time preferences via strong demand for consumer goods, and the prices of consumer goods begin to rise relative to those for capital goods. The resources needed to complete the projects will not be forthcoming, so many such projects cannot be completed at all, or can be completed but at a loss. The economy is being pulled in two directions. Entrepreneurs want more capital goods (and the complements to those capital goods), at the same time that consumers want more consumer goods. The needed correction comes in the form of a recession, during which many projects are liquidated and unemployment rises. Macroeconomic equilibrium can only be re-established when and if the central bank ceases to expand the supply of credit, thus allowing market rates of interest to once again be consistent with time preferences.

Figure 1

The Subsistence Fund

Regardless of which aspect of the credit expansion one highlights, whether it is the pattern of market interest rates that first encourages, then discourages, greater roundaboutness, the zero-sum struggle for available resources between lower-order goods and higher-order goods, the overinvestment which prolongs the contractionary, corrective phase of the cycle, the scarcity of resources that serve as complements to the lengthened capital structure, or the “forced savings” imposed on consumers by entrepreneurial malinvestment, one theme (implicitly) runs through the entire exposition of the Austrian theory of unsustainable business cycles: the subsistence fund. It is, in fact, a concept that links all aspects of the theory. Moreover, since it focuses on the actions of the capitalist/entrepreneur as the key appraising agent, it pinpoints a crucial element of ABCT, i.e., the proposition that unsustainable expansions only occur if and when it is businesspeople to whom the artificial increase in credit is made available.

[T]he Austrian theory of the trade cycle reveals that only the inflationary bank credit expansion that enters the market through new business loans (or through purchase of business bonds) generates the overinvestment in higher-order capital goods that leads to the boom-bust cycle. Inflationary bank credit that enters the market through financing government deficits does not generate the business cycle; for, instead of causing overinvestment in higher-order capital goods, it simply reallocates resources from the private to the public sector, and also tends to drive up prices. Thus, Mises distinguished between “simple inflation,” in which the banks create more deposits through purchase of government bonds, and genuine “credit expansion,” which enters the business loan market and generates the business cycle. . . . Mises did not deal with the relatively new post-World War II phenomenon of large-scale bank loans to consumers, but these too cannot be said to generate a business cycle . . . because they will not result in “over” investment, which must be liquidated in a recession. Not enough investments will be made, but at least there will be no flood of investments which will later have to be liquidated. Hence, the effects of diverting consumption [/] investment proportions away from consumer time preferences will be asymmetrical, with the overinvestment-business cycle effects only resulting from inflationary bank loans to business. (Rothbard 1978, pp. 152–53)

By what standard is a credit expansion deemed to be cycle-generating? First of all, it must be an “artificial” expansion, that is, not the result of a decline in the rate of time preference. This is the necessary but not sufficient condition. A further stipulation is needed: the gap between credit and saving must be experienced by businesses, not consumers. Entrepreneurs must have access to credit in excess of the saving that is available to them. That is the fundamental message which Rothbard conveys quite emphatically in the citation above. Some Austrians may speak and write about a contrast between generic “saving” and the supply of fiduciary credit, but that is insufficiently precise. As Rothbard recognized so clearly, the only discrepancy that really matters insofar as business cycles are concerned is that between the magnitude of saving at the disposal of entrepreneurs and the magnitude of credit at the disposal of entrepreneurs. The former sets the limit on a sustainable lengthening of the capital structure, and the latter identifies the maximum initial investment in capital projects (see figure 2).

Figure 2

It is not saving per se that is the benchmark, but the magnitude of the subsistence fund. What, exactly, is this subsistence fund?

Saving and Productive Expenditure

The labor expended by employees of business firms is not, contrary to widespread assumption, the primary or original source of income. One of the serious flaws of classical economics was just that erroneous assumption.5 Reflect on a pre-capitalist, primitive world in which there are no businesses, but of course there does exist both labor and land. When goods are produced, what should the income receipts be called? They cannot be wages, because there are no employers to pay wages. They are, unavoidably, profits. In such a world, laborers sell goods but not their own labor. “Smith and Marx are wrong. Wages are not the primary form of income in production. Profits are” (Reisman 1996, p. 479). What occurs as capitalists appear? The proportion of total income that is profit (100 percent in the primitive state) declines as those capitalists provide funds to their employees (wages) in advance of the sale of the finished goods.6 This transfers most of the risk from the workers to the capitalists, but it also allows the capitalists to benefit from the increased productivity of the more roundabout production processes.

What then is the source of wages? It is capitalists and their decision to save a portion of their earned income. Placed in the hands of businesspeople, this saving becomes productive expenditure which is used to acquire the factors of production. The greater the amount saved, the more that is available to be spent for labor and other inputs. The wages fund, or subsistence fund,7 is that part of the monetary income of capitalists which is saved and invested in productive projects. Equivalently, it is that portion of the funds which capitalists make available to entrepreneurs that is then used to purchase inputs.8 It overlaps, but is not identical to, the concept of saving.

Some economists will reject the concept of the subsistence fund on the grounds that firm revenues depend on sales to consumers and therefore, in effect, consumers provide the funds that businesses need to hire labor and other inputs. Such a train of thought may seem reasonable, but it flies in the face of another classical insight. John Stuart Mill realized that there was a “fundamental theorem” regarding capital which was often misunderstood even in his day. It appears to be almost wholly forgotten today.

What supports and employs productive labour, is the capital expended in setting it to work, and not the demand of purchasers for the produce of the labour when completed. Demand for commodities is not demand for labour. The demand for commodities determines in what particular branch of production the labour and capital shall be employed; it determines the direction of the labour; but not the more or less of the labour itself, or of the maintenance or payment of the labour. These depend on the amount of the capital, or other funds directly devoted to the sustenance and remuneration of labour. (Mill 1987, p. 79; emphasis in original)

One might think of the above in the following terms. From a macroeconomic perspective, the level of saving determines the level of potential total demand for, and thus the potential total employment of, inputs. It sets an upper limit on sustainable production. From a microeconomic perspective, consumer demand for final goods determines the relative demand for inputs, and thus the pattern of employment of those inputs in the production of particular goods and services. At one level, capitalists and entrepreneurs steer the economy. At a different level, consumers (indirectly) steer the economy. Classical economists emphasized the first; while Austrians emphasize the second. One should note carefully that it is not saving per se that is crucial, but the productive expenditures of entrepreneurs, which are made out of the totality of funding available to those entrepreneurs. In a properly functioning, free-market economy, that pool of funds will consist only of real saving, and no unsustainable macroeconomic expansions will result.9

Austrians are accustomed to thinking in terms of the relative prices of all things including those of inputs, the imputation of values for higher-order, capital goods from the demand for lower-order, consumer goods, and the allocation of inputs based on their discounted marginal value products.10 Do Austrians need to abandon that approach? Not at all. Allocations of inputs between industries and firms are driven by the discounted marginal productivity of those inputs; while relative prices drive specific output choices. However, consideration of the subsistence fund yields some insights that may be more difficult to achieve if one avoids the use of the concept. First of all, in a central banking system with fiat currency, the link between real saving and the supply of loanable funds is very loose. Therefore, the link between real saving (by both consumers and businesspeople) and the pool of funds available for business investment is equally loose. In such a system, businesses that invest in new projects may not, in fact, be engaging in truly productive expenditures. This will not be evident ex ante, but it will become painfully clear ex post when the investments have to be liquidated. What appeared to be capital creation reveals itself to be capital consumption.

Also, one might recall the two dimensions of erroneous investment that characterize a typical, credit-driven business cycle: malinvestment and overinvestment. Austrians have explained the former very well.11 Malinvestment occurs due to misleading relative price signals, and it necessitates a corrective contraction. But what of the overinvestment? That is, why must the contraction persist for a substantial time and, thus, bring about considerable suffering? The answer to that question may become less opaque if one applies the concept of the subsistence fund. Briefly stated, the overinvestment occurs because entrepreneurs are led to believe that the subsistence fund is larger than it actually is.

The pivotal role played by the concept of the subsistence fund is addressed directly, although from a slightly different angle, by George Reisman, a Misesian who sees much in classical economics that he thinks should be of interest to Austrians:

The wages-fund doctrine held that at any given time there is a determinate total expenditure of funds for the payment of wages in the economic system, and that the wages of the employees of business firms are paid by businessmen and capitalists, out of capital, which is the result of saving; not by consumers in the purchase of consumers’ goods. . . . [T]he abandonment of the wages-fund doctrine and with it, classical economics’ perspective on saving and capital, made possible the acceptance of Keynesianism and the policy of inflation, deficits, and ever expanding government spending. (Reisman 1996, p. 474)

The usefulness of the subsistence fund concept also extends to the issue of complementarity. In ABCT the credit expansion that initiates the cyclical sequence leads to a capital structure that cannot be maintained, because

[I]t is relative scarcity of complementary factors which here causes excess capacity and upsets plans. . . . [C]omplementarity is of the essence of all plans, and withdrawal of a factor, or its failure to turn up at the appointed time, will equally endanger the success of the production plans. (Lachmann 1978, p. 107)

Imagine that the absent factor is labor of a particular kind. If it is unavailable, why is it unavailable? Does it not exist? Surely it does exist, for otherwise no one would plan a project that required its participation. Then why is it not forthcoming in the context of a roundabout production process that entrepreneurs have made lengthier?

A lengthier production structure means that the labor must be applied in an earlier stage of the process, farther removed from the final goods. In other words, the time interval between application of the labor and sale of the final product has expanded. This requires, in real terms, that the workers have available a greater stock of consumer goods by means of which they can sustain themselves over this longer time period. Without such goods, no labor will be made available for these lengthier projects, or the labor may be available but only for a period shorter than the duration of the project. In a crucial sense, consumer goods are used to “purchase” the needed factors of production (Strigl 2000, p. 11). And, ceteris paribus, such an enlarged stock of consumer goods can only exist if time preferences have fallen, proportionately

less is consumed by capitalists, and those capitalists have thus provided businesspeople with a larger subsistence fund. Furthermore, multi-period projects are viable only if the required conditions are replicated intertemporally. “Production can only be maintained if each attained subsistence fund is used to support another roundabout method of production” (Strigl 2000, p. 12). A subsistence fund that is adequate only for one time period will lead, in subsequent periods, to capital consumption as the production process is forced to become more “momentary” and less roundabout.

The tension between capital goods expansion and an undiminished demand for consumer goods helps to highlight the value of the subsistence fund in explaining another key issue in ABCT, that is, why overinvestment occurs as well as malinvestment. Some critics, such as John Hicks, have asserted that while an increased money stock and cheap credit can indeed induce an artificial boom that exhibits a capital-goods bias, the excess money balances in consumers’ hands should quickly correct the restructuring of production or even prevent its appearance in the first place. As Garrison notes, “[w]ithout the over-investment, the malinvestment would be as short-lived as Hicks’s critical remarks suggest” (Garrison 2001, p. 81).

Time is the issue at hand. Entrepreneurs have overinvested in long-term projects, overinvested, that is, in higher-order goods far removed from the final goods. The mix of goods is unsustainable, and so too is the level of production (Garrison 2001, p. 74). To the extent that those higher-order goods are durable and specific, the process of correcting the imbalance will require a significant period of time.

The economy “crashes” because unjustified investments in the early stages of production have been undertaken. The economy recovers slowly, and no doubt painfully, from the contraction because the overinvestment in the early stages of production is sure to involve at least some goods that are durable as well as being firm- or even project-specific. Liquidation of such goods, and the firms or projects employing them, will be a difficult and time-consuming process. Re-establishing a sustainable level and mix of goods will take time. Quick and painless adjustments are out of the question. (Sechrest 2001, p. 68)

This becomes clear when considering the subsistence fund in real terms. Once the boom is seen to be unsustainable, cannot entrepreneurs simply sell the overproduced capital goods? Quite possibly, but this will not help to correct the underlying problem. First of all, the prices they will get are sure to be below the present values they originally thought the capital goods to have. Once the contraction begins, demand for capital goods will decline and market interest rates will rise. Both events will drive down their prices. Furthermore, even if entrepreneurs somehow did retrieve the full original value of their investments, all that will have happened is that the economy will have experienced a redistribution of liquidity. What is needed is a greater quantity of real, completed consumer goods. And capital goods cannot immediately be converted into final consumer goods. Changes in the structure of production cannot easily be reversed. There is a significant degree of “path-dependence” involved with the capital restructuring that occurs in the medium run. The economy cannot simply “erase” the errors and start over. Ultimately the only solution is to have a subsistence fund sufficient to meet consumers’ needs. But if that were the case all along, then no boom-bust cycle would have occurred in the first place.

In Diagrammatic Terms

How can the components of this ABCT scenario be illustrated? Moreover, how can they be illustrated in terms more-or-less familiar to the typical economics student? In order to respond, one will first need to revisit figures 1 and 2, which show the effects of interest rates on (a) projects’ net present value (NPV) and (b) business investment decisions. Then, to reveal the excessive risk-taking inherent in malinvestment, one can examine figure 3, a modified version of the capital asset pricing model.

Figure 3

In figure 1, the net present value of a project’s stream of discounted cash flows (the vertical axis) is affected by (a) the time needed to complete the project (the horizontal axis) and (b) market rates of interest. This is notably similar to the dimensions of the Hayekian triangle. In such triangles, “[t]he horizontal leg of the triangle represents production time. The vertical leg measures the value of the consumable output of the production process” (Garrison 2001, p. 46). In figure 1 the market interest rate declines, which increases the NPV of all capital projects. However, such increases in NPV accelerate as the time period of the project lengthens. Longer term projects rise in value by a greater percentage than do shorter term projects, for the same initial decline in interest rates. Therefore, as long as businesspeople think that the required complementary inputs will be available, there is always an incentive to undertake longer term projects in an environment of falling interest rates. And, if businesspeople think that the falling rates are a reflection of falling time preferences, they will indeed believe that those complementary inputs will be available when needed.

In figure 2, businesspeople act on the incentives created in figure 1. The market rate of interest (im), initially equal to the natural rate (in), declines to im*. Businesspeople opt for proportionately more higher-order (capital) goods and proportionately fewer lower-order (consumer) goods. This is made possible by the expansion of credit. Yet time preferences have not fallen, so there is no greater subsistence fund than there was before the credit expansion. The gap between the new level of investment expenditures and the subsistence fund is thus unsustainable.

Figure 3 applies a modified version of the capital asset pricing model to ABCT. Here the required rate of return (the vertical axis) should be thought of as the internal rate of return (IRR) on specific capital projects. Risk, on the horizontal axis, is not the systematic risk of an asset, measured by the asset’s β, but the total risk, measured by the variance of the returns to the project (σ2). As the central bank expands the supplies of money and credit, market interest rates fall, so the rate at which cash flows are discounted declines, driving up net present values. But the forecasted cash flows themselves will also rise, since, in an inflationary environment, output prices usually rise faster than do input prices. From both directions, NPVs increase, with the longer term projects exhibiting the greater percentage increases. This makes it appear as if, for the same level of risk exposure, businesses can now enjoy a higher rate of return. The capital market line (CML) seems to rotate upward from CML (actual) to CML (perceived), and businesspeople move toward what they think will be a higher level of utility (U1 to U2). However, in fact this moves businesses into the realm of exceedingly risky—indeed, ultimately unsustainable—capital investments.

Summary

Profit, the return to the entrepreneur, is the original form of income, not wages. Wage incomes only come into being when and if capitalists set aside a part of their income instead of consuming it all. Out of these savings comes productive expenditure (or in real terms the subsistence fund), including the demand for labor, because consumers’ demand for final goods is not the source of demand for originary factors of production. The subsistence fund is the source of demand for originary factors and sets the limit on sustainable expansions by identifying the proper intertemporal allocation of resources.

Both malinvestment and overinvestment appear whenever credit expansions are initiated by a central bank, because in such circumstances the subsistence fund will be inadequate to sustain the new, artificially lengthened production process. An excess of money and credit creates the problem. The solution takes time, because real capital goods cannot be transformed into real consumer goods overnight. Monetary changes can be effected rather quickly, but once undertaken, their impacts on real goods cannot easily or quickly be reversed. To view these issues through the lens of the subsistence fund can be very helpful. To do so certainly reminds one that it is capitalist/entrepreneurs who lie at the center of the process, most critically with regard to a distinction emphasized by Rothbard. That is, it is not the gap between saving and credit per se that matters, but the gap between saving in the hands of businesspeople (the subsistence fund) and credit in the hands of businesspeople.

The subsistence fund has really always been an implicit part of ABCT. The verbal and diagrammatic analysis found in the present paper has attempted to make it an explicit part of ABCT. Moreover, in order to more readily convey these essentials of Austrian macro thought to mainstream students of economics, certain rather conventional constructions have been employed. It is hoped that pedagogical considerations, important though they may be, have not detracted from the more important, theoretical objective.

- 1. The author recognizes that, at least in terms of emphasis if nothing else, there exist some differences between these two theorists’ treatments of cycles. Nevertheless, the purpose of this essay lies elsewhere, so herein rather little will be made of those differences.

- 2. Recently, Roger Garrison has expanded this approach by also employing a modified version of the conventional production possibilities frontier (2001, pp. 59–83). This very helpful technique sets investment versus consumption as the alternative production choices, along with the further distinction between sustainable and unsustainable boundaries.

- 3. In financial terms, could one say that the parallel universals are risk and return?

- 4. Critics of ABCT have challenged the plausibility of pervasive business “errors” of this sort. Carilli and Dempster (2001) have provided an intriguing game-theoretic rebuttal to such a challenge.

- 5. It is likely that this error, plus the absence of marginal analysis, has caused some Austrians to pay rather little attention to classical economics.

- 6. Here “profit is taken in the accounting sense, rather than the economic sense of the term. That is, the imputed values of the resources possessed by the capitalist are not subtractedfrom his gross receipts. And Since, initially, he makes no payments to the owners of resources, his “explicit costs” are zero. Thus, in the primitive state, all income is profit.

- 7. Subsistence fund is really the more accurate term, since businesspeople must compensate the suppliers of any and all inputs, not just the suppliers of labor.

- 8. It must be noted at this point that there is one category of laborers whose wage incomes do not depend on prior saving by capitalists, namely labor which is not used as a means to the end of generating revenues for businesses. The best examples are domestic servants and government employees (Reisman 1996, p. 695).

- 9. On the other hand, in a central banking system with fiat currency, the supply of loanable funds is not coextensive with saving. Therefore, the funds at the disposal of businesses can increase while real saving remains constant, or even declines. This latter situation is, of course, a distinctive feature of ABCT.

- 10. See, for example, Rothbard’s presentation of this approach (1970, pp. 387–424), in the course of which he reminds us that “wages are paid out of capital.”

- 11. However, in one summary of ABCT, Rothbard surprisingly refers only to overinvestment (1978, pp. 152–53).