Why Some People Are Poorer

Throughout history, until about the middle of the 18th century, mass poverty was nearly everywhere the normal condition of man. Then capital accumulation and a series of major inventions ushered in the Industrial Revolution. In spite of occasional setbacks, economic

How the Fed’s Easy Money Spurred Today’s Financial Frenzies

It was government policies that kick-started the engine of financial innovation, wrongly blamed by many in the press and left-leaning academia for this increased economic instability. Original Article: "How the Fed's Easy Money Spurred Today's Financial Frenzies" This Audio Mises Wire is

Is Solidarity a Good Thing?

In his book Let’s Have Socialism Now! (Yale University Press, 2001), the French economist Thomas Piketty places great emphasis on “solidarity,” and his opposition to the free market rests to a large extent on its conflict with that purported value. In

Why a Bear Market in Bonds Points to a Weakening Economy

Years of bubbles and malinvestment have a downside: the destruction of the productive, wealth-building parts of the economy. And that could mean higher interest rates. Original Article: "Why a Bear Market in Bonds Points to a Weakening Economy" This Audio Mises Wire

Central Banks and Socialism Are Forever Linked Together

It is well known that socialism is a shortage economy. It is the economy of inefficiency and corruption, of indifferent workers and of bigwigs, of lacking spare parts, of lacking funds, of failure, of permanent reform needs and of constantly

Understanding Money Velocity and Prices

The yearly growth rate of US's "Austrian money supply" jumped by almost 80 percent in February 2021 (see chart). Given such massive increase in money supply, it is tempting to suggest that this lays the foundation for an explosive increase in the

Rothbard: With Interest Rates, “There Are Two, Opposite Causal Chains at Work.”

Editor's Note: Interest rates and inflation are certainly connected to efforts on the parts of central banks to loosen and tighten the money supply. These relationships, however, are much more complex than many people suppose. As we've seen in recent

The Weak Jobs Report Shows the Failure of Keynesian Policies

We can see that these massive trillion-dollar stimulus programs generate a virtually nonexistent long-term positive impact, just a short-term bounce that lasts less than a quarter. Original Article: "The Weak Jobs Report Shows the Failure of Keynesian Policies" This Audio Mises Wire

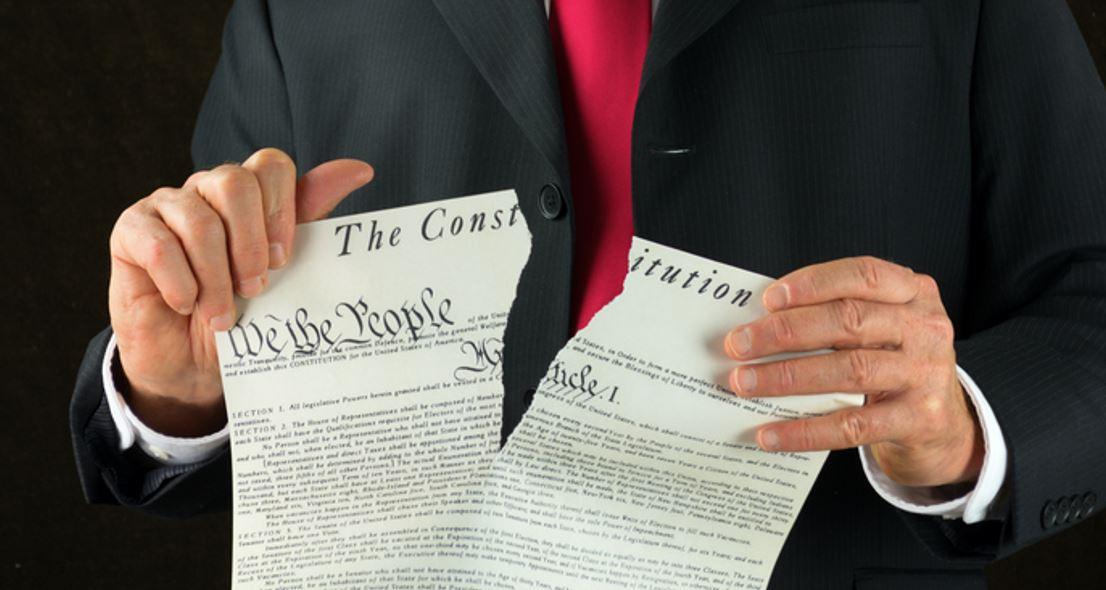

What Spooner Can Teach Us in Our Age of Neofascism

Mises Wire readers are probably familiar with nineteenth-century American proto-libertarian Lysander Spooner (1808–87). Spooner’s radical challenges to statism are best summed up by the title of Murray Rothbard’s edited collection of Spooner’s greatest writings: Let’s Abolish Government. Spooner was a great American, an

Why Did Google Ads Ban LewRockwell.com?

Google says it can only tolerate "accurate" information and has banned LewRockwell.com from its advertising program. This position only makes sense if one makes some faulty assumptions about how information is spread. Original Article: "Why Did Google Ads Ban LewRockwell.com?" This Audio