Can State Power Cancel Economic Law?

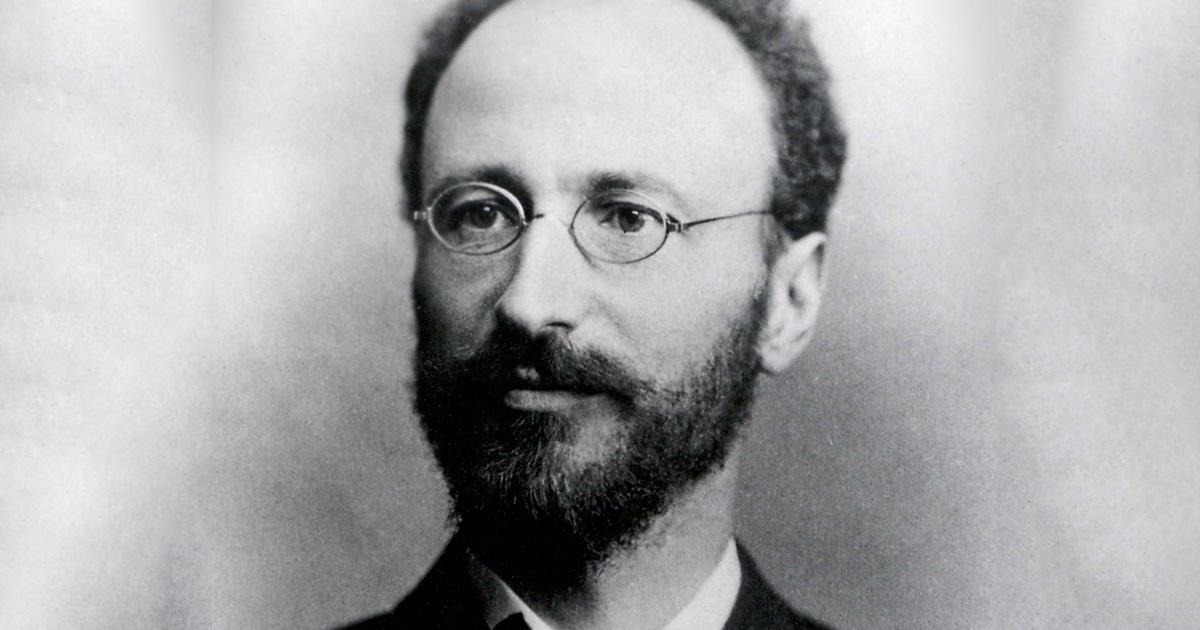

[In this introduction to his essay “Control or Economic Law,” Böhm-Bawerk examines how the reality of the “mixed economy” means we must be able to understand the interplay between market action and the countless efforts to distort the market through state legislation and social action. Ultimately, we find it is folly to think that economic laws can be overcome by government “control.”]

The Scientific Foundation of a Rational Economic Policy

Economic theory, from its very beginnings, has endeavored to discover and formulate the laws governing economic behavior. In the early period, which was under the influence of Rousseau and his doctrines of the laws of nature, it was customary to apply to these economic laws the name and character of physical laws. In a literal sense, this characterization was, of course, open to objection, but possibly the term “physical” or “natural” laws was intended merely to give expression to the fact that, just as natural phenomena are governed by immutable eternal laws, quite independent of human will and human laws, so in the sphere of economics there exist certain laws against which the will of man, and even the powerful will of the state, remain impotent; and that the flow of economic forces cannot, by artificial interference of societal control, be driven out of certain channels into which it is inevitably pressed by the force of economic laws.

Such a law, among others, was considered to be that of supply and demand, which again and again had been observed to triumph over the attempts of powerful governments to render bread cheap in lean years by means of “unnatural” price regulations, or to confer upon bad money the purchasing power of good money. And inasmuch as in the last analysis, the remuneration of the great factors of production—land, labor, and capital—in other words, the distribution of wealth among the various classes of society, represents merely one case, although the most important practical case of the general laws of price, the entire all-important problem of distribution of wealth became dependent upon the question of whether it was regulated and dominated by natural economic laws, or by the arbitrary influence of social control.

The early economists did not hesitate to decide this question with fearless consistency in favor of the exclusive predominance of “natural laws.” The most famous, or rather notorious, illustration of this interpretation was the “wage-fund theory” of the classic and postclassic school of economists, according to which the amount of wages was determined by a natural relationship of almost mathematical accuracy thought to exist between the amount of capital available in a country for the payment of wages, the so-called “wage fund,” and the number of workers. All workers jointly were considered incapable of ever receiving more than the existing “wage fund,” and the average was thought to result with mathematical accuracy from the division of the wage fund by the number of workers. No artificial outside interference, including strikes, could change the operation of this law. For if, through a successful strike, the wages of one group of workers were to have been raised artificially, a correspondingly smaller portion of the wage fund would be available for the remaining workers, whose wages would then have to come down accordingly. A general or average increase of wages above the total of the “wage fund” was held to be out of the question.

Later generations have adopted a different view of this matter and of economic “laws” in general, and have developed different new formulas in accordance with their changed views. Following the example of Rodbertus and Adolf Wagner, a distinction was drawn between “purely economic categories” and “historic legal categories.” The former were to include all that was permanent, generally valid, and recurrent in economic phenomena under any conceivable social order; the latter were to represent the historically varying types, brought about by changed legal systems, laws, or social institutions. Henceforth, a determining, or at any rate far-reaching influence upon the laws of distribution was ascribed to this latter or “social” category, a term used frequently ever since, especially by Stolzmann.1

This may have been right or wrong, but it was certainly not without some justification. But how far-reaching was the influence of control to be, and how and where was it to be delimited against the influences emanating from the other “categories”? These questions were not, and have never been, definitely settled to this day. A few years ago, at another occasion, I wrote, “Nowadays it would be idiotic to try to deny the influence of institutions and regulations of social origin on the distribution of goods.”

It is obvious that distribution under a communistic order would have to be materially different from that in an individualistic society, based on the principle of private property. Nor could any sensible person deny that the existence of labor organizations with their weapon of strikes has been of pronounced influence on the fixation of wages of labor. But, on the other hand, no intelligent person would claim social “price regulation” as being omnipotent and decisive in itself alone.

Often enough one has seen governmental price regulations to be incapable of providing cheap bread in lean years. Every day we may see strikes failing, when they are directed towards the attainment of wages “not justified in the economic situation,” as it is commonly expressed. The question, therefore, is not whether the “natural” or “purely economic” categories on the one hand, and the “social” categories on the other, do exert any appreciable influence on the terms of distribution; that both do, no intelligent person will deny.

The sole question is this: how much influence do they exert? Or, as I have expressed myself several years ago, in reviewing an older work by Stolzmann entitled “Die Soziale Kategorie,”

The great problem, not adequately settled so far, is to determine the exact extent and nature of the influence of both factors, to show how much one factor may accomplish apart from, or perhaps in opposition to, the other. This chapter of economic theory has not yet been written satisfactorily.

I should like to go almost so far as to say that, until quite recently, not even a serious attempt has been made to elaborate this problem by either one of the two great schools that compete with each other in the perfecting of our science: the theoretical school, represented primarily by the well-known “marginal-utility theory,” and the historic or sociological school, which, in its struggle against both the old classicists and the modern marginal-value theorists, likes to place the influence of control (Macht) into the very heart of its theory of distribution.

The “marginal-value” school has not ignored the problem confronting us here, but so far, it has not elaborated it extensively; it has conducted its investigations up to the confines of the whole problem, so to speak, but so far, has stopped at these confines. So far, it has principally occupied itself with the developing of the laws of distribution under the assumption of free and perfect competition, perfect both in theory and in practice, thus precluding the predominance of one party, as would be implied in the term “influence of control.”

Under this, and the other modifying assumption of the exclusive prevalence of purely economic motives, the marginal-value theory has come to the conclusion that, in the process of distribution, each separate factor of production receives approximately that amount in payment for its contribution to the total production that, according to the rules of imputation, is due to its cooperation in the process of production. The shortest formulation of this idea is contained in the familiar concept of the “marginal productivity” of each factor.

But in making this contribution, the marginal-value school had furnished only an incomplete skeleton of the theory of distribution as a whole, and it was well aware of this shortcoming. It never pretended to have fully covered the complex reality with that concept; on the contrary, it never failed to emphasize, again and again, that its past findings had to be supplemented by a second series of investigations, whose task it would be to inquire into the changes that would be produced in this fundamental concept by the advent of changed conditions, particularly those of “social” origin.2

The reason why the marginal-value school took up that part of its investigation first was only that it seemed to require priority in methodical treatment, that primarily one should know and understand how the process of distribution, or more generally, that of price formation took place in the absence of all outside social interference.3

First of all, a starting point, or point of comparison, had to be reached from which the changes might be measured that would be produced by the advent of special outside factors of a “social” origin. The marginal-value theory, thus, as a whole, first laid down a general theoretical frame for the problem in formulating its general value and price theories, and, within that frame, it elaborated in detail only the theory of free competition, while until now it had left a gap where the influence of social “control” should have been studied and described.

This imperfection has always been felt as such; with every new decade it is being sensed more because in our modern economic progress, the intervention of social means of control is continuously gaining in importance. Everywhere trusts, pools, and monopolies of all kinds interfere with the fixation of prices and with distribution. On the other hand, there are the labor organizations with their strikes and boycotts, not to mention the equally rapid growth of artificial interference emanating from the economic policies of governments. In the eyes of the classical economists, the theory of free competition could claim to be the systematic foundation of the entire problem, as well as the theory of the most important normal case. But at present, the number and importance of those phenomena that no longer find an adequate explanation in the theory of free competition probably already exceed the number of those cases that may still be explained by that one formula.

Nor has this gap left open by the marginal-value theory ever been filled by that other school of economists, those who place the influence of the “social” category in the foreground.4 The reason for this is that they again overestimated the explanatory power of their favorite formulas. When, with an air of conviction, they proclaimed that under this or that condition, for instance, in the fixation of wages, it was “power” that ultimately decided matters, they thought to have given a content to their explanation, which, if applying at all, was to supplant or exclude explanations on purely economic grounds. Where power or “control” entered into the price, there was no economic law, they thought, and thus the mere mention of “control” was both the beginning and the end of the explanation to be given. It was accompanied more often by a fierce denunciation of the “economic laws” developed by other theoretical schools, than by a careful investigation of the question of where and how the two “categories” relate to each other. Moreover, the term “two categories” was merely a phrase of a rather vague and ill-defined meaning, and thus by no means very suitable to the conducting of clear and penetrating investigations.

At the present time it is probably Stolzmann who may be considered as the typical representative of that school of thought. Other authors of a similar type, like Stammler or Simmel, may have become more widely known and influential, but Stolzmann has the merit of having tried to follow up, one by one, and to elaborate systematically the suggestions made by older economists, since Rodbertus and Wagner, and then he has the additional asset of having shown himself more familiar with economic theory than many authors starting from different approaches. He is thus, I think, the one representative of his school best qualified to discuss these basic principles.

Now, Stolzmann declares as the fundamental idea in his theory of distribution that it is not, as taught by the marginal-utility theory, the purely economic conditions of imputation, i.e., not the contribution of each factor of production to the total, that determine the distribution of the produce among landowner, capitalist, and laborer, but rather that it is social control. It is “power alone that determines the size of each factor’s share.”

What determines its distribution is not “what each factor of production contributes to the total produce, but what the men standing behind the factors of production are able, by virtue of their control, to command for themselves as remuneration according to the social power exerted by each. These and similar statements are coupled with an incessant attack on the marginal-value theory based on this very same consideration, that in its theory of distribution it had failed to give any place to the decisive factor of “power,” and instead had reversed into the old “naturalistic” interpretation, the theory of the eternal and unchanging laws of nature.

But obviously this was not a correct method of penetrating into the intricacies of the problem before us. To have “power” alone determine the manner of distribution was just as one-sided. It was all too obvious that power could not determine everything in distribution, and that the purely economic factors meant something too. Nor could this dilemma be solved by a compromise in assigning determining and decisive influence to control, and only a vague and restricted influence to natural forces. A true solution, it seems to me, is still to be sought, in spite of Stolzmann’s 800 pages, and by other means than evasive dialectics.

Let us then first state what is really before us in this controversy much neglected in economic science: neither more nor less than the scientific foundation of a rational economic policy. For it is obvious that any artificial outside interference in the economic sphere will be without sense, unless the preliminary question of whether anything can be accomplished through the influence of “power” in opposition to the “natural economic laws” can be answered in the affirmative. The problem is to gain a clear and correct insight into the extent and nature of the influence of “control” against the natural course of economic phenomena. This is what we must see, or we shall grope in the dark! I do not think that this seeing can be facilitated or replaced by simply interchanging two terms for the different causal influences, or by ascribing a merely conditional influence to the former and a determining one to the other.

1. “Die Soziale Kategorie in der Volkswirtschaftslehre,” Berlin 1896; “Der Zweck in der Volkswirtschaft,” Berlin 1909. 2. I may refer, for instance, to my statement in regard to two complementary parts of the price theory, published as early as 1886. See my “Foundations of the Theory of Economic Value,” in Conrad’s Jahrbuecher, N.F. 1886, Bd. XIII, pp. 486; and my Positive Theory of Capital, Chap. IV. 3. Of course, there must always exist a certain minimum of outside interference, as shown in detail further on, because there always must exist a social order of some kind. 4. A few gratifying attempts to fill this gap have begun to appear in recent English and American literature, particularly in the form of a careful study of the theory of monopoly prices. But these attempts do not suffice to render superfluous the presentation offered in these pages.