Money: Its Importance, Origins, and Operations

[This article is excerpted from The Mystery of Banking.]

I. Money: Its Importance and Origins

1. The Importance of Money

Today, money supply figures pervade the financial press. Every Friday, investors breathlessly watch for the latest money figures, and Wall Street often reacts at the opening on the following Monday. If the money supply has gone up sharply, interest rates may or may not move upward. The press is filled with ominous forecasts of Federal Reserve actions, or of regulations of banks and other financial institutions.

This close attention to the money supply is rather new. Until the 1970s, over the many decades of the Keynesian Era, talk of money and bank credit had dropped out of the financial pages. Rather, they emphasized the GNP and government’s fiscal policy, expenditures, revenues, and deficits. Banks and the money supply were generally ignored. Yet after decades of chronic and accelerating inflation—which the Keynesians could not begin to cure—and after many bouts of “inflationary recession,” it became obvious to all—even to Keynesians—that something was awry. The money supply therefore became a major object of concern.

But the average person may be confused by so many definitions of the money supply. What are all the Ms about, from M1A and M1-B up to M-8? Which is the true money supply figure, if any single one can be? And perhaps most important of all, why are bank deposits included in all the various Ms as a crucial and dominant part of the money supply? Everyone knows that paper dollars, issued nowadays exclusively by the Federal Reserve Banks and imprinted with the words “this note is legal tender for all debts, public and private” constitute money. But why are checking accounts money, and where do they come from? Don’t they have to be redeemed in cash on demand? So why are checking deposits considered money, and not just the paper dollars backing them?

One confusing implication of including checking deposits as a part of the money supply is that banks create money, that they are, in a sense, money-creating factories. But don’t banks simply channel the savings we lend to them and relend them to productive investors or to borrowing consumers? Yet, if banks take our savings and lend them out, how can they create money? How can their liabilities become part of the money supply?

There is no reason for the layman to feel frustrated if he can’t find coherence in all this. The best classical economists fought among themselves throughout the nineteenth century over whether or in what sense private bank notes (now illegal) or deposits should or should not be part of the money supply. Most economists, in fact, landed on what we now see to be the wrong side of the question. Economists in Britain, the great center of economic thought during the nineteenth century, were particularly at sea on this issue. The eminent David Ricardo and his successors in the Currency School, lost a great chance to establish truly hard money in England because they never grasped the fact that bank deposits are part of the supply of money. Oddly enough, it was in the United States, then considered a backwater of economic theory, that economists first insisted that bank deposits, like bank notes, were part of the money supply. Condy Raguet, of Philadelphia, first made this point in 1820. But English economists of the day paid scant attention to their American colleagues.

2. How Money Begins

Before examining what money is, we must deal with the importance of money, and, before we can do that, we have to understand how money arose. As Ludwig von Mises conclusively demonstrated in 1912, money does not and cannot originate by order of the State or by some sort of social contract agreed upon by all citizens; it must always originate in the processes of the free market.

Before coinage, there was barter. Goods were produced by those who were good at it, and their surpluses were exchanged for the products of others. Every product had its barter price in terms of all other products, and every person gained by exchanging something he needed less for a product he needed more. The voluntary market economy became a latticework of mutually beneficial exchanges.

In barter, there were severe limitations on the scope of exchange and therefore on production. In the first place, in order to buy something he wanted, each person had to find a seller who wanted precisely what he had available in exchange. In short, if an egg dealer wanted to buy a pair of shoes, he had to find a shoemaker who wanted, at that very moment, to buy eggs. Yet suppose that the shoemaker was sated with eggs. How was the egg dealer going to buy a pair of shoes? How could he be sure that he could find a shoemaker who liked eggs?

Or, to put the question in its starkest terms, I make a living as a professor of economics. If I wanted to buy a newspaper in a world of barter, I would have to wander around and find a newsdealer who wanted to hear, say, a 10-minute economics lecture from me in exchange. Knowing economists, how likely would I be to find an interested newsdealer?

This crucial element in barter is what is called the double coincidence of wants. A second problem is one of indivisibilities. We can see clearly how exchangers could adjust their supplies and sales of butter, or eggs, or fish, fairly precisely. But suppose that Jones owns a house, and would like to sell it and instead, purchase a car, a washing machine, or some horses? How could he do so? He could not chop his house into 20 different segments and exchange each one for other products. Clearly, since houses are indivisible and lose all of their value if they get chopped up, we face an insoluble problem. The same would be true of tractors, machines, and other large-sized products. If houses could not easily be bartered, not many would be produced in the first place.

Another problem with the barter system is what would happen to business calculation. Business firms must be able to calculate whether they are making or losing income or wealth in each of their transactions. Yet, in the barter system, profit or loss calculation would be a hopeless task.

Barter, therefore, could not possibly manage an advanced or modern industrial economy. Barter could not succeed beyond the needs of a primitive village.

But man is ingenious. He managed to find a way to overcome these obstacles and transcend the limiting system of barter. Trying to overcome the limitations of barter, he arrived, step by step, at one of man’s most ingenious, important and productive inventions: money.

Take, for example, the egg dealer who is trying desperately to buy a pair of shoes. He thinks to himself: if the shoemaker is allergic to eggs and doesn’t want to buy them, what does he want to buy? Necessity is the mother of invention, and so the egg man is impelled to try to find out what the shoemaker would like to obtain. Suppose he finds out that it’s fish. And so the egg dealer goes out and buys fish, not because he wants to eat the fish himself (he might be allergic to fish), but because he wants it in order to resell it to the shoemaker. In the world of barter, everyone’s purchases were purely for himself or for his family’s direct use. But now, for the first time, a new element of demand has entered:

The egg man is buying fish not for its own sake, but instead to use it as an indispensable way of obtaining shoes. Fish is now being used as a medium of exchange, as an instrument of indirect exchange, as well as being purchased directly for its own sake.

Once a commodity begins to be used as a medium of exchange, when the word gets out it generates even further use of the commodity as a medium. In short, when the word gets around that commodity X is being used as a medium in a certain village, more people living in or trading with that village will purchase that commodity, since they know that it is being used there as a medium of exchange. In this way, a commodity used as a medium feeds upon itself, and its use spirals upward, until before long the commodity is in general use throughout the society or country as a medium of exchange. But when a commodity is used as a medium for most or all exchanges, that commodity is defined as being a money.

In this way money enters the free market, as market participants begin to select suitable commodities for use as the medium of exchange, with that use rapidly escalating until a general medium of exchange, or money, becomes established in the market.

Money was a leap forward in the history of civilization and in man’s economic progress. Money—as an element in every exchange—permits man to overcome all the immense difficulties of barter. The egg dealer doesn’t have to seek a shoemaker who enjoys eggs; and I don’t have to find a newsdealer or a grocer who wants to hear some economics lectures. All we need do is exchange our goods or services for money, for the money commodity. We can do so in the confidence that we can take this universally desired commodity and exchange it for any goods that we need. Similarly, indivisibilities are overcome; a homeowner can sell his house for money, and then exchange that money for the various goods and services that he wishes to buy.

Similarly, business firms can now calculate, can figure out when they are making, or losing, money. Their income and their expenditures for all transactions can be expressed in terms of money. The firm took in, say, $10,000 last month, and spent $9,000; clearly, there was a net profit of $1,000 for the month. No longer does a firm have to try to add or subtract in commensurable objects. A steel manufacturing firm does not have to pay its workers in steel bars useless to them or in myriad other physical commodities; it can pay them in money, and the workers can then use money to buy other desired products.

Furthermore, to know a good’s “price,” one no longer has to look at a virtually infinite array of relative quantities: the fish price of eggs, the beef price of string, the shoe price of flour, and so forth. Every commodity is priced in only one commodity: money, and so it becomes easy to compare these single money prices of eggs, shoes, beef, or whatever.

3. The Proper Qualities of Money

Which commodities are picked as money on the market? Which commodities will be subject to a spiral of use as a medium? Clearly, it will be those commodities most useful as money in any given society. Through the centuries, many commodities have been selected as money on the market. Fish on the Atlantic seacoast of colonial North America, beaver in the Old Northwest, and tobacco in the Southern colonies were chosen as money. In other cultures, salt, sugar, cattle, iron hoes, tea, cowrie shells, and many other commodities have been chosen on the market. Many banks display money museums which exhibit various forms of money over the centuries.

Amid this variety of moneys, it is possible to analyze the qualities which led the market to choose that particular commodity as money. In the first place, individuals do not pick the medium of exchange out of thin air. They will overcome the double coincidence of wants of barter by picking a commodity which is already in widespread use for its own sake. In short, they will pick a commodity in heavy demand, which shoemakers and others will be likely to accept in exchange from the very start of the money-choosing process. Second, they will pick a commodity which is highly divisible, so that small chunks of other goods can be bought, and size of purchases can be flexible. For this they need a commodity which technologically does not lose its quotal value when divided into small pieces. For that reason a house or a tractor, being highly indivisible, is not likely to be chosen as money, whereas butter, for example, is highly divisible and at least scores heavily as a money for this particular quality.

Demand and divisibility are not the only criteria. It is also important for people to be able to carry the money commodity around in order to facilitate purchases. To be easily portable, then, a commodity must have high value per unit weight. To have high value per unit weight, however, requires a good which is not only in great demand but also relatively scarce, since an intense demand combined with a relatively scarce supply will yield a high price, or high value per unit weight.

Finally, the money commodity should be highly durable, so that it can serve as a store of value for a long time. The holder of money should not only be assured of being able to purchase other products right now, but also indefinitely into the future. Therefore, butter, fish, eggs, and so on fail on the question of durability.

A fascinating example of an unexpected development of a money commodity in modern times occurred in German POW camps during World War II. In these camps, supply of various goods was fixed by external conditions: CARE packages, rations, etc. But after receiving the rations, the prisoners began exchanging what they didn’t want for what they particularly needed, until soon there was an elaborate price system for every product, each in terms of what had evolved as the money commodity: cigarettes. Prices in terms of cigarettes fluctuated in accordance with changing supply and demand.

Cigarettes were clearly the most “moneylike” products available in the camps. They were in high demand for their own sake, they were divisible, portable, and in high value per unit weight. They were not very durable, since they crumpled easily, but they could make do in the few years of the camps’ existence.1

In all countries and all civilizations, two commodities have been dominant whenever they were available to compete as moneys with other commodities: gold and silver.8

At first, gold and silver were highly prized only for their luster and ornamental value. They were always in great demand. Second, they were always relatively scarce, and hence valuable per unit of weight. And for that reason they were portable as well. They were also divisible, and could be sliced into thin segments without losing their pro rata value. Finally, silver or gold were blended with small amounts of alloy to harden them, and since they did not corrode, they would last almost forever.

Thus, because gold and silver are supremely “moneylike” commodities, they are selected by markets as money if they are available. Proponents of the gold standard do not suffer from a mysterious “gold fetish.” They simply recognize that gold has always been selected by the market as money throughout history.

Generally, gold and silver have both been moneys, side-byside. Since gold has always been far scarcer and also in greater demand than silver, it has always commanded a higher price, and tends to be money in larger transactions, while silver has been used in smaller exchanges. Because of its higher price, gold has often been selected as the unit of account, although this has not always been true. The difficulties of mining gold, which makes its production limited, make its long-term value relatively more stable than silver.

4. The Money Unit

We referred to prices without explaining what a price really is. A price is simply the ratio of the two quantities exchanged in any transaction. It should be no surprise that every monetary unit we are now familiar with—the dollar, pound, mark, franc, et al.—began on the market simply as names for different units of weight of gold or silver. Thus the “pound sterling” in Britain, was exactly that—one pound of silver.2

The “dollar” originated as the name generally applied to a one-ounce silver coin minted by a Bohemian count named Schlick, in the sixteenth century. Count Schlick lived in Joachimsthal (Joachim’s Valley). His coins, which enjoyed a great reputation for uniformity and fineness, were called Joachimsthalers and finally, just thalers. The word dollar emerged from the pronunciation of thaler.

Since gold or silver exchanges by weight, the various national currency units, all defined as particular weights of a precious metal, will be automatically fixed in terms of each other. Thus, suppose that the dollar is defined as 1/20 of a gold ounce (as it was in the nineteenth century in the United States), while the pound sterling is defined as 1/4 of a gold ounce, and the French franc is established at 1/100 of a gold ounce.3 But in that case, the exchange rates between the various currencies are automatically fixed by their respective quantities of gold. If a dollar is 1/20 of a gold ounce, and the pound is 1/4 of a gold ounce, then the pound will automatically exchange for 5 dollars. And, in our example, the pound will exchange for 25 francs and the dollar for 5 francs. The definitions of weight automatically set the exchange rates between them.

Free market gold standard advocates have often been taunted with the charge: “You are against the government fixing the price of goods and services; why then do you make an exception for gold? Why do you call for the government fixing the price of gold and setting the exchange rates between the various currencies?”

The answer to this common complaint is that the question assumes the dollar to be an independent entity, a thing or commodity which should be allowed to fluctuate freely in relation to gold. But the rebuttal of the pro-gold forces points out that the dollar is not an independent entity, that it was originally simply a name for a certain weight of gold; the dollar, as well as the other currencies, is a unit of weight. But in that case, the pound, franc, dollar, and so on, are not exchanging as independent entities; they, too, are simply relative weights of gold. If 1/4 ounce of gold exchanges for 1/20 ounce of gold, how else would we expect them to trade than at 1:5?4

If the monetary unit is simply a unit of weight, then government’s role in the area of money could well be confined to a simple Bureau of Weights and Measures, certifying this as well as other units of weight, length, or mass.5 The problem is that governments have systematically betrayed their trust as guardians of the precisely defined weight of the money commodity.

If government sets itself up as the guardian of the international meter or the standard yard or pound, there is no economic incentive for it to betray its trust and change the definition. For the Bureau of Standards to announce suddenly that 1 pound is now equal to 14 instead of 16 ounces would make no sense whatever. There is, however, all too much of an economic incentive for governments to change, especially to lighten, the definition of the currency unit; say, to change the definition of the pound sterling from 16 to 14 ounces of silver. This profitable process of the government’s repeatedly lightening the number of ounces or grams in the same monetary unit is called debasement.

How debasement profits the State can be seen from a hypothetical case: Say the rur, the currency of the mythical kingdom of Ruritania, is worth 20 grams of gold. A new king now ascends the throne, and, being chronically short of money, decides to take the debasement route to the acquisition of wealth. He announces a mammoth call-in of all the old gold coins of the realm, each now dirty with wear and with the picture of the previous king stamped on its face. In return he will supply brand new coins with his face stamped on them, and will return the same number of rurs paid in. Someone presenting 100 rurs in old coins will receive 100 rurs in the new.

Seemingly a bargain! Except for a slight hitch: During the course of this recoinage, the king changes the definition of the rur from 20 to 16 grams. He then pockets the extra 20 percent of gold, minting the gold for his own use and pouring the coins into circulation for his own expenses. In short, the number of grams of gold in the society remains the same, but since people are now accustomed to use the name rather than the weight in their money accounts and prices, the number of rurs will have increased by 20 percent. The money supply in rurs, therefore, has gone up by 20 percent, and, as we shall see later on, this will drive up prices in the economy in terms of rurs. Debasement, then, is the arbitrary redefining and lightening of the currency so as to add to the coffers of the State.6

The pound sterling has diminished from 16 ounces of silver to its present fractional state because of repeated debasements, or changes in definition, by the kings of England. Similarly, rapid and extensive debasement was a striking feature of the Middle Ages, in almost every country in Europe. Thus, in 1200, the French livre tournois was defined as 98 grams of fine silver; by 1600 it equaled only 11 grams.

A particularly striking case is the dinar, the coin of the Saracens in Spain. The dinar, when first coined at the end of the seventh century, consisted of 65 gold grains. The Saracens, notably sound in monetary matters, kept the dinar’s weight relatively constant, and as late as the middle of the twelfth century, it still equaled 60 grains. At that point, the Christian kings conquered Spain, and by the early thirteenth century, the dinar (now called maravedi) had been reduced to 14 grains of gold. Soon the gold coin was too lightweight to circulate, and it was converted into a silver coin weighing 26 grains of silver. But this, too, was debased further, and by the mid-fifteenth century, the maravedi consisted of only 1 1/2 silver grains, and was again too small to circulate.7

Where is the total money supply—that crucial concept—in all this? First, before debasement, when the regional or national currency unit simply stands for a certain unit of weight of gold, the total money supply is the aggregate of all the monetary gold in existence in that society, that is, all the gold ready to be used in exchange. In practice, this means the total stock of gold coin and gold bullion available. Since all property and therefore all money is owned by someone, this means that the total money stock in the society at any given time is the aggregate, the sum total, of all existing cash balances, or money stock, owned by each individual or group. Thus, if there is a village of 10 people, A, B, C, etc., the total money stock in the village will equal the sum of all cash balances held by each of the 10 citizens. If we wish to put this in mathematical terms, we can say that

M = Σ m

where M is the total stock or supply of money in any given area or in society as a whole, m is the individual stock or cash balance owned by each individual, and Σ means the sum or aggregate of each of the ms.

After debasement, since the money unit is the name (dinar) rather than the actual weight (specific number of gold grams), the number of dinars or pounds or maravedis will increase, and thus increase the supply of money. M will be the sum of the individual dinars held by each person, and will increase by the extent of the debasement. As we will see later, this increased money supply will tend to raise prices throughout the economy.

II. What Determines Prices: Supply and Demand

What determines individual prices? Why is the price of eggs, or horseshoes, or steel rails, or bread, whatever it is? Is the market determination of prices arbitrary, chaotic, or anarchic?

Much of the past two centuries of economic analysis, or what is now unfortunately termed microeconomics, has been devoted to analyzing and answering this question. The answer is that any given price is always determined by two fundamental, underlying forces: supply and demand, or the supply of that product and the intensity of demand to purchase it.

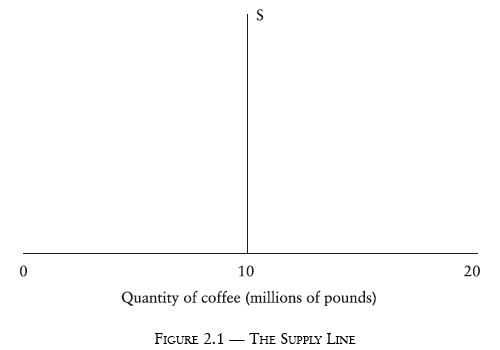

Let us say that we are analyzing the determination of the price of any product, say, coffee, at any given moment, or “day,” in time. At any time there is a stock of coffee, ready to be sold to the consumer. How that stock got there is not yet our concern. Let’s say that, at a certain place or in an entire country, there are 10 million pounds of coffee available for consumption. We can then construct a diagram, of which the horizontal axis is units of quantity, in this case, millions of pounds of coffee. If 10 million pounds are now available, the stock, or supply, of coffee available is the vertical line at 10 million pounds, the line to be labeled S for supply.

The demand curve for coffee is not objectively measurable as is supply, but there are several things that we can definitely say about it. For one, if we construct a hypothetical demand schedule for the market, we can conclude that, at any given time, and all other things remaining the same, the higher the price of a product the less will be purchased. Conversely, the lower the price the more will be purchased. Suppose, for example, that for some bizarre reason, the price of coffee should suddenly leap to $1,000 a pound. Very few people will be able to buy and consume coffee, and they will be confined to a few extremely wealthy coffee fanatics. Everyone else will shift to cocoa, tea, or other beverages. So if the coffee price becomes extremely high, few pounds of coffee will be purchased.

On the other hand, suppose again that, by some fluke, coffee prices suddenly drop to 1 cent a pound. At that point, everyone will rush out to consume coffee in large quantities, and they will forsake tea, cocoa or whatever. A very low price, then, will induce a willingness to buy a very large number of pounds of coffee.

A very high price means only a few purchases; a very low price means a large number of purchases. Similarly we can generalize on the range between. In fact we can conclude: The lower the price of any product (other things being equal), the greater the quantities that buyers will be willing to purchase. And vice versa. For as the price of anything falls, it becomes less costly relative to the buyer’s stock of money and to other competing uses for the dollar; so that a fall in price will bring nonbuyers into the market and cause the expansion of purchases by existing buyers. Conversely, as the price of anything rises, the product becomes more costly relative to the buyers’ income and to other products, and the amount they will purchase will fall. Buyers will leave the market, and existing buyers will curtail their purchases.The result is the “falling demand curve,” which graphically expresses this “law of demand” (Figure 2.2). We can see that the quantity buyers will purchase (“the quantity demanded”) varies inversely with the price of the product. This line is labeled D for demand. The vertical axis is P for price, in this case, dollars per pound of coffee.

Supply, for any good, is the objective fact of how many goods are available to the consumer. Demand is the result of the subjective values and demands of the individual buyers or consumers. S tells us how many pounds of coffee, or loaves of bread or whatever are available; D tells us how many loaves would be purchased at different hypothetical prices. We never know the actual demand curve: only that it is falling, in some way; with quantity purchased increasing as prices fall and vice versa.

We come now to how prices are determined on the free market. What we shall demonstrate is that the price of any good or service, at any given time, and on any given day, will tend to be the price at which the S and D curves intersect (Figure 2.3).

In our example, the S and D curves intersect at the price of $3 a pound, and therefore that will be the price on the market.

To see why the coffee price will be $3 a pound, let us suppose that, for some reason, the price is higher, say $5 (Figure 2.4). At that point, the quantity supplied (10 million pounds) will be greater than the quantity demanded, that is, the amount that consumers are willing to buy at that higher price. This leaves an unsold surplus of coffee, coffee sitting on the shelves that cannot be sold because no one will buy it.

At a price of $5 for coffee, only 6 million pounds are purchased, leaving 4 million pounds of unsold surplus. The pressure of the surplus, and the consequent losses, will induce sellers to lower their price, and as the price falls, the quantity purchased will increase. This pressure continues until the intersection price of $3 is reached, at which point the market is cleared, that is, there is no more unsold surplus, and supply is just equal to demand. People want to buy just the amount of coffee available, no more and no less.

At a price higher than the intersection, then, supply is greater than demand, and market forces will then impel a lowering of price until the unsold surplus is eliminated, and supply and demand are equilibrated. These market forces which lower the excessive price and clear the market are powerful and twofold: the desire of every businessman to increase profits and to avoid losses, and the free price system, which reflects economic changes and responds to underlying supply and demand changes. The profit motive and the free price system are the forces that equilibrate supply and demand, and make price responsive to underlying market forces.

On the other hand, suppose that the price, instead of being above the intersection, is below the intersection price. Suppose the price is at $1 a pound. In that case, the quantity demanded by consumers, the amount of coffee the consumers wish to purchase at that price, is much greater than the 10 million pounds that they would buy at $3. Suppose that quantity is 15 million pounds. But, since there are only 10 million pounds available to satisfy the 15 million pound demand at the low price, the coffee will then rapidly disappear from the shelves, and we would experience a shortage of coffee (shortage being present when something cannot be purchased at the existing price).

The coffee market would then be as shown in Figure 2.5.

Thus, at the price of $1, there is a shortage of 4 million pounds, that is, there are only 10 million pounds of coffee available to satisfy a demand for 14 million. Coffee will disappear quickly from the shelves, and then the retailers, emboldened by a desire for profit, will raise their prices. As the price rises, the shortage will begin to disappear, until it disappears completely when the price goes up to the intersection point of $3 a pound. Once again, free market action quickly eliminates shortages by raising prices to the point where the market is cleared, and demand and supply are again equilibrated.

Clearly then, the profit-loss motive and the free price system produce a built-in “feedback” or governor mechanism by which the market price of any good moves so as to clear the market, and to eliminate quickly any surpluses or shortages. For at the intersection point, which tends always to be the market price, supply and demand are finely and precisely attuned, and neither shortage nor surplus can exist (Figure 2.6).

Economists call the intersection price, the price which tends to be the daily market price, the “equilibrium price,” for two reasons: (1) because this is the only price that equilibrates supply and demand, that equates the quantity available for sale with the quantity buyers wish to purchase; and (2) because, in an analogy with the physical sciences, the intersection price is the only price to which the market tends to move. And, if a price is displaced from equilibrium, it is quickly impelled by market forces to return to that point—just as an equilibrium point in physics is where something tends to stay and to return to if displaced.

If the price of a product is determined by its supply and demand and if, according to our example, the equilibrium price, where the price will move and remain, is $3 for a pound of coffee, why does any price ever change? We know, of course, that prices of all products are changing all the time. The price of coffee does not remain contentedly at $3 or any other figure. How and why does any price change ever take place?

Clearly, for one of two (more strictly, three) reasons: either D changes, or S changes, or both change at the same time. Suppose, for example, that S falls, say because a large proportion of the coffee crop freezes in Brazil, as it seems to do every few years. A drop in S is depicted in Figure 2.7.

Beginning with an equilibrium price of $3, the quantity of coffee produced and ready for sale on the market drops from 10 million to 6 million pounds. S changes to S′, the new vertical supply line. But this means that at the new supply, S′, there is a shortage of coffee at the old price, amounting to 4 million pounds. The shortage impels coffee sellers to raise their prices, and, as they do so, the shortage begins to disappear, until the new equilibrium price is achieved at the $5 price.

To put it another way, all products are scarce in relation to their possible use, which is the reason they command a price on the market at all. Price, on the free market, performs a necessary rationing function, in which the available pounds or bushels or other units of a good are allocated freely and voluntarily to those who are most willing to purchase the product. If coffee becomes scarcer, then the price rises to perform an increased rationing function: to allocate the smaller supply of the product to the most eager purchasers. When the price rises to reflect the smaller supply, consumers cut their purchases and shift to other hot drinks or stimulants until the quantity demanded is small enough to equal the lower supply.

On the other hand, let us see what happens when the supply increases, say, because of better weather conditions or increased productivity due to better methods of growing or manufacturing the product. Figure 2.8 shows the result of an increase in S:

Supply increases from 10 to 14 million pounds or from S to S′. But this means that at the old equilibrium price, $3, there is now an excess of supply over demand, and 4 million pounds will remain unsold at the old price. In order to sell the increased product, sellers will have to cut their prices, and as they do so, the price of coffee will fall until the new equilibrium price is reached, here at $1 a pound. Or, to put it another way, businessmen will now have to cut prices in order to induce consumers to buy the increased product, and will do so until the new equilibrium is reached.

In short, price responds inversely to supply. If supply increases, price will fall; if supply falls, price will rise.

The other factor that can and does change and thereby alters equilibrium price is demand. Demand can change for various reasons. Given total consumer income, any increase in the demand for one product necessarily reflects a fall in the demand for another. For an increase in demand is defined as a willingness by buyers to spend more money on—that is, to buy more—of a product at any given hypothetical price. In our diagrams, such an “increase in demand” is reflected in a shift of the entire demand curve upward and to the right. But given total income, if consumers are spending more on Product A, they must necessarily be spending less on Product B. The demand for Product B will decrease, that is, consumers will be willing to spend less on the product at any given hypothetical price. Graphically, the entire demand curve for B will shift downward and to the left. Suppose that we are now analyzing a shift in consumer tastes toward beef and away from pork. In that case, the respective markets may be analyzed as follows:

We have postulated an increase in consumer preference for beef, so that the demand curve for beef increases, that is, shifts upward and to the right, from D to D′. But the result of the increased demand is that there is now a shortage at the old equilibrium price, 0X, so that producers raise their prices until the shortage is eliminated and there is a new and higher equilibrium price, 0Y.

On the other hand, suppose that there is a drop in preference, and therefore a fall in the demand for pork. This means that the demand curve for pork shifts downward and to the left, from D to D′, as shown in Figure 2.10:

Here, the fall in demand from D to D′ means that at the old equilibrium price for pork, 0X, there is now an unsold surplus because of the decline in demand. In order to sell the surplus, therefore, producers must cut the price until the surplus disappears and the market is cleared again, at the new equilibrium price 0Y.

In sum, price responds directly to changes in demand. If demand increases, price rises; if demand falls, the price drops.

We have been treating supply throughout as a given, which it always is at any one time. If, however, demand for a product increases, and that increase is perceived by the producers as lasting for a long period of time, future supply will increase. More beef, for example, will be grown in response to the greater demand and the higher price and profits. Similarly, producers will cut future supply if a fall in prices is thought to be permanent.

Supply, therefore, will respond over time to future demand as anticipated by producers. It is this response by supply to changes in expected future demand that gives us the familiar forward-sloping, or rising supply curves of the economics textbooks.

As shown in Figure 2.9, demand increases from D to D′. This raises the equilibrium price of beef from 0X to 0Y, given the initial S curve, the initial supply of beef. But if this new higher price 0Y is considered permanent by the beef producers, supply will increase over time, until it reaches the new higher supply S′′. Price will be driven back down by the increased supply to 0Z. In this way, higher demand pulls out more supply over time, which will lower the price.

To return to the original change in demand, on the free market a rise in the demand for and price of one product will necessarily be counterbalanced by a fall in the demand for another. The only way in which consumers, especially over a sustained period of time, can increase their demand for all products is if consumer incomes are increasing overall, that is, if consumers have more money in their pockets to spend on all products. But this can happen only if the stock or supply of money available increases; only in that case, with more money in consumer hands, can most or all demand curves rise, can shift upward and to the right, and prices can rise overall.

To put it another way: a continuing, sustained inflation—that is, a persistent rise in overall prices—can either be the result of a persistent, continuing fall in the supply of most or all goods and services, or of a continuing rise in the supply of money. Since we know that in today’s world the supply of most goods and services rises rather than falls each year, and since we know, also, that the money supply keeps rising substantially every year, then it should be crystal clear that increases in the supply of money, not any sort of problems from the supply side, are the fundamental cause of our chronic and accelerating problem of inflation. Despite the currently fashionable supply-side economists, inflation is a demand-side (more specifically monetary or money supply) rather than a supply-side problem. Prices are continually being pulled up by increases in the quantity of money and hence of the monetary demand for products.

III. Money and Overall Prices

1. The Supply and Demand for Money and Overall Prices

When economics students read textbooks, they learn, in the “micro” sections, how prices of specific goods are determined by supply and demand. But when they get to the “macro” chapters, lo and behold! supply and demand built on individual persons and their choices disappear, and they hear instead of such mysterious and ill-defined concepts as velocity of circulation, total transactions, and gross national product. Where are the supply-and-demand concepts when it comes to overall prices?

In truth, overall prices are determined by similar supply-and-demand forces that determine the prices of individual products. Let us reconsider the concept of price. If the price of bread is 70 cents a loaf, this means also that the purchasing power of a loaf of bread is 70 cents. A loaf of bread can command 70 cents in exchange on the market. The price and purchasing power of the unit of a product are one and the same. Therefore, we can construct a diagram for the determination of overall prices, with the price or the purchasing power of the money unit on the Y-axis.

While recognizing the extreme difficulty of arriving at a measure, it should be clear conceptually that the price or the purchasing power of the dollar is the inverse of whatever we can construct as the price level, or the level of overall prices. In mathematical terms,

PPM = 1 / P

where PPM is the purchasing power of the dollar, and P is the price level.

To take a highly simplified example, suppose that there are four commodities in the society and that their prices are as follows:

In this society, the PPM, or the purchasing power of the dollar, is an array of alternatives inverse to the above prices. In short, the purchasing power of the dollar is:

Suppose now that the price level doubles, in the easy sense that all prices double. Prices are now:

In this case, PPM has been cut in half across the board. The purchasing power of the dollar is now:

Purchasing power of the dollar is therefore the inverse of the price level.

Let us now put PPM on the Y-axis and quantity of dollars on the X-axis. We contend that, on a complete analogy with supply, demand, and price above, the intersection of the vertical line indicating the supply of money in the country at any given time, with the falling demand curve for money, will yield the market equilibrium PPM and hence the equilibrium height of overall prices, at any given time.

Let us examine the diagram in Figure 3.1. The supply of money, M, is conceptually easy to figure: the total quantity of dollars at any given time. (What constitutes these dollars will be explained later.)

We contend that there is a falling demand curve for money in relation to hypothetical PPMs, just as there is one in relation to hypothetical individual prices. At first, the idea of a demand curve for money seems odd. Isn’t the demand for money unlimited? Won’t people take as much money as they can get? But this confuses what people would be willing to accept as a gift (which is indeed unlimited) with their demand in the sense of how much they would be willing to give up for the money. Or: how much money they would be willing to keep in their cash balances rather than spend. In this sense their demand for money is scarcely unlimited. If someone acquires money, he can do two things with it: either spend it on consumer goods or investments, or else hold on to it, and increase his individual money stock, his total cash balances. How much he wishes to hold on to is his demand for money.

Let us look at people’s demand for cash balances. How much money people will keep in their cash balance is a function of the level of prices. Suppose, for example, that prices suddenly dropped to about a third of what they are now. People would need far less in their wallets, purses, and bank accounts to pay for daily transactions or to prepare for emergencies. Everyone need only carry around or have readily available only about a third the money that they keep now. The rest they can spend or invest. Hence, the total amount of money people would hold in their cash balances would be far less if prices were much lower than now. Contrarily, if prices were triple what they are today, people would need about three times as much in their wallets, purses, and bank accounts to handle their daily transactions and their emergency inventory. People would demand far greater cash balances than they do now to do the same “money work” if prices were much higher. The falling demand curve for money is shown in Figure 3.2.

Here we see that when the PPM is very high (i.e., prices overall are very low), the demand for cash balances is low; but when PPM is very low (prices are high), the demand for cash balances is very high.

We will now see how the intersection of the falling demand curve for money or cash balances, and the supply of money, determines the day-to-day equilibrium PPM or price level.

Suppose that PPM is suddenly very high, that is, prices are very low. M, the money stock, is given, at $100 billion. As we see in Figure 3.3, at a high PPM, the supply of total cash balances, M, is greater than the demand for money. The difference is surplus cash balances—money, in the old phrase, that is burning a hole in people’s pockets. People find that they are suffering from a monetary imbalance: their cash balances are greater than they need at that price level. And so people start trying to get rid of their cash balances by spending money on various goods and services.

But while people can get rid of money individually, by buying things with it, they can’t get rid of money in the aggregate, because the $100 billion still exists, and they can’t get rid of it short of burning it up. But as people spend more, this drives up demand curves for most or all goods and services. As the demand curves shift upward and to the right, prices rise. But as prices overall rise further and further, PPM begins to fall, as the downward arrow indicates. And as the PPM begins to fall, the surplus of cash balances begins to disappear until finally, prices have risen so much that the $100 billion no longer burns a hole in anyone’s pocket. At the higher price level, people are now willing to keep the exact amount of $100 billion that is available in the economy. The market is at last cleared, and people now wish to hold no more and no less than the $100 billion available. The demand for money has been brought into equilibrium with the supply of money, and the PPM and price level are in equilibrium. People were not able to get rid of money in the aggregate, but they were able to drive up prices so as to end the surplus of cash balances.

Conversely, suppose that prices were suddenly three times as high and PPM therefore much lower. In that case, people would need far more cash balances to finance their daily lives, and there would be a shortage of cash balances compared to the supply of money available. The demand for cash balances would be greater than the total supply. People would then try to alleviate this imbalance, this shortage, by adding to their cash balances. They can only do so by spending less of their income and adding the remainder to their cash balance. When they do so, the demand curves for most or all products will shift downward and to the left, and prices will generally fall. As prices fall, PPM ipso facto rises, as the upward arrow shows. The process will continue until prices fall enough and PPM rises, so that the $100 billion is no longer less than the total amount of cash balances desired.

Once again, market action works to equilibrate supply and demand for money or cash balances, and demand for money will adjust to the total supply available. Individuals tried to scramble to add to their cash balances by spending less; in the aggregate, they could not add to the money supply, since that is given at $100 billion. But in the process of spending less, prices overall fell until the $100 billion became an adequate total cash balance once again.

The price level, then, and the purchasing power of the dollar, are determined by the same sort of supply-and-demand feedback mechanism that determines individual prices. The price level tends to be at the intersection of the supply of and demand for money, and tends to return to that point when displaced.

As in individual markets, then, the price or purchasing power of the dollar varies directly with the demand for money and inversely with the supply. Or, to turn it around, the price level varies directly with the supply of money and inversely with the demand.

2. Why Overall Prices Change

Why does the price level ever change, if the supply of money and the demand for money determine the height of overall prices? If, and only if, one or both of these basic factors—the supply of or demand for money—changes. Let us see what happens when the supply of money changes, that is, in the modern world, when the supply of nominal units changes rather than the actual weight of gold or silver they used to represent. Let us assume, then, that the supply of dollars, pounds, or francs increases, without yet examining how the increase occurs or how the new money gets injected into the economy.

Figure 3.4 shows what happens when M, the supply of dollars, of total cash balances of dollars in the economy, increases.

The original supply of money, M, intersects with the demand for money and establishes the PPM (purchasing power of the dollar) and the price level at distance 0A. Now, in whatever way, the supply of money increases to M′. This means that the aggregate total of cash balances in the economy has increased from M, say $100 billion, to M′, $150 billion. But now people have $50 billion surplus in their cash balances, $50 billion of excess money over the amount needed in their cash balances at the previous 0A prices level. Having too much money burning a hole in their pockets, people spend the cash balances, thereby raising individual demand curves and driving up prices. But as prices rise, people find that their increased aggregate of cash balances is getting less and less excessive, since more and more cash is now needed to accommodate the higher price levels. Finally, prices rise until PPM has fallen from 0A to 0B. At these new, higher price levels, the M′—the new aggregate cash balances—is no longer excessive, and the demand for money has become equilibrated by market forces to the new supply. The money market—the intersection of the demand and supply of money—is once again cleared, and a new and higher equilibrium price level has been reached.

Note that when people find their cash balances excessive, they try to get rid of them, but since all the money stock is owned by someone, the new M′ cannot be gotten rid of in the aggregate; by driving prices up, however, the demand for money becomes equilibrated to the new supply. Just as an increased supply of pork drives down prices so as to induce people to buy the new pork production, so an increased supply of dollars drives down the purchasing power of the dollar until people are willing to hold the new dollars in their cash balances.

What if the supply of money, M, decreases, admittedly an occurrence all too rare in the modern world? The effect can be seen in Figure 3.5.

In the unusual case of a fall in the supply of money, then, total cash balances fall, say, from $100 billion (M) to $70 billion (M′). When this happens, the people find out that at the old equilibrium price level 0A, aggregate cash balances are not enough to satisfy their cash balance needs. They experience, therefore, a cash balance shortage. Trying to increase his cash balance, then, each individual spends less and saves in order to accumulate a larger balance. As this occurs, demand curves for specific goods fall downward and to the left, and prices therefore fall. As this happens, the cash balance shortage is alleviated, until finally prices fall low enough until a new and lower equilibrium price level (0C) is established. Or, alternatively, the PPM is at a new and higher level. At the new price level of PPM, 0C, the demand for cash balances is equilibrated with the new and decreased supply M′. The demand and supply of money is once again cleared. At the new equilibrium, the decreased money supply is once again just sufficient to perform the cash balance function.

Or, put another way, at the lower money supply people scramble to increase cash balances. But since the money supply is set and outside their control, they cannot increase the supply of cash balances in the aggregate.9 But by spending less and driving down the price level, they increase the value or purchasing power of each dollar, so that real cash balances (total money supply corrected for changes in purchasing power) have gone up to offset the drop in the total supply of money. M might have fallen by $30 billion, but the $70 billion is now as good as the previous total because each dollar is worth more in real, or purchasing power, terms.

An increase in the supply of money, then, will lower the price or purchasing power of the dollar, and thereby increase the level of prices. A fall in the money supply will do the opposite, lowering prices and thereby increasing the purchasing power of each dollar.

The other factor of change in the price level is the demand for money. Figures 3.6 and 3.7 depict what happens when the demand for money changes.

The demand for money, for whatever reason, increases from D to D′. This means that, whatever the price level, the amount of money that people in the aggregate wish to keep in their cash balances will increase. At the old equilibrium price level, 0A, a PPM that previously kept the demand and supply of money equal and cleared the market, the demand for money has now increased and become greater than the supply. There is now an excess demand for money, or shortage of cash balances, at the old price level. Since the supply of money is given, the scramble for greater cash balances begins. People will spend less and save more to add to their cash holdings. In the aggregate, M, or the total supply of cash balances, is fixed and cannot increase. But the fall in prices resulting from the decreased spending will alleviate the shortage. Finally, prices fall (or PPM rises) to 0B. At this new equilibrium price, 0B, there is no longer a shortage of cash balances. Because of the increased PPM, the old money supply, M, is now enough to satisfy the increased demand for cash balances. Total cash balances have remained the same in nominal terms, but in real terms, in terms of purchasing power, the $100 billion is now worth more and will perform more of the cash balance function. The market is again cleared, and the money supply and demand brought once more into equilibrium.

Figure 3.7 shows what happens when the demand for money falls.

The demand for money falls from D to D′. In other words, whatever the price level, people are now, for whatever reason, willing to hold lower cash balances than they did before. At the old equilibrium price level, 0A, people now find that they have a surplus of cash balances burning a hole in their pockets. As they spend the surplus, demand curves for goods rise, driving up prices. But as prices rise, the total supply of cash balances, M, becomes no longer surplus, for it now must do cash balance work at a higher price level. Finally, when prices rise (PPM falls) to 0B, the surplus of cash balance has disappeared and the demand and supply of money has been equilibrated. The same money supply, M, is once again satisfactory despite the fall in the demand for money, because the same M must do more cash balance work at the new, higher price level.

So prices, overall, can change for only two reasons: If the supply of money increases, prices will rise; if the supply falls, prices will fall. If the demand for money increases, prices will fall (PPM rises); if the demand for money declines, prices will rise (PPM falls). The purchasing power of the dollar varies inversely with the supply of dollars, and directly with the demand. Overall prices are determined by the same supply-and-demand forces we are all familiar with in individual prices. Micro and macro are not mysteriously separate worlds; they are both plain economics and governed by the same laws.

1. See the justly famous article by R.A. Radford, “The Economic Organization of a P.O.W. Camp,” Economica (November 1945): 189–201. 8. Conventionally, and for convenience, economists for the past four decades have drawn the demand curves as falling straight lines. There is no particular reason to suppose, however, that the demand curves are straight lines, and no evidence to that effect. They might just as well be curved or jagged or anything else. The only thing we know with assurance is that they are falling, or negatively sloped. Unfortunately, economists have tended to forget this home truth, and have begun to manipulate these lines as if they actually existed in this shape. In that way, mathematical manipulation begins to crowd out the facts of economic reality. 2. At current writing, silver is approximately $13 an ounce, and the pound is about $1.50, which means that the British “pound sterling,” once proudly equal to one pound of silver, now equals only 1/8 of a silver ounce. How this decline and fall happened is explained in the text. 3. The proportions are changed slightly from their nineteenth century definitions to illustrate the point more clearly. The “dollar” had moved from Bohemia to Spain and from there to North America. After the Revolutionary War, the new United States changed its currency from the British pound sterling to the Spanish-derived dollar. From this point on, we assume gold as the only monetary metal, and omit silver, for purposes of simplification. In fact, silver was a complicating force in all monetary discussions in the nineteenth century. In a free market, gold and silver each would be free to become money and would float freely in relation to each other (“parallel standards”). Unfortunately, governments invariably tried to force a fixed exchange rate between the two metals, a price control that always leads to unwelcome and even disastrous results (“bimetallism”). 4. In older periods, foreign coins of gold and silver often circulated freely within a country, and there is, indeed, no economic reason why they should not do so. In the United States, as late as 1857, few bothered going to the U.S. Mint to obtain coins; the coins in general use were Spanish, English, and Austrian gold and silver pieces. Finally, Congress, perturbed at this slap to its sovereignty, outlawed the use of foreign coins within the U.S., forcing all foreign coinholders to go to the U.S. Mint and obtain American gold coins. 5. Thus, Frederick Barnard’s late nineteenth-century book on weights and measures has a discussion of coinage and the international monetary system in the appendix. Frederick A.P. Barnard, The Metric System of Weights and Measures, rev. ed. (New York: Columbia College, 1872). 6. This enormous charge for recoinage is called “seigniorage,” payment to the seignieur or sovereign, the monopoly minter of coins. 7. See Elgin Groseclose, Money and Man (New York: Frederick Ungar, 1961), pp. 57–76. Many of the European debasements were made under the guise of adjusting the always-distorted fixed bimetallic ratios between gold and silver. See Luigi Einaudi, “The Theory of Imaginary Money from Charlemagne to the French Revolution,” in F.C. Lane and J.C. Riemersma, eds., Enterprise and Secular Change (Homewood, Ill.: Irwin, 1953), pp. 229–61. 9. Why doesn’t an excess demand for cash balances increase the money supply, as it would in the case of beef, in the long run? For a discussion of the determinants of the supply of money, see chapter IV.