The NYT’s Willow article allows issue advocates to alternately assume perfectly elastic demand and supply

The decision to allow mining in Alaska is controversial (Biden Administration Expected to Move Ahead on a Major Oil Project in Alaska):

In one of its most consequential climate decisions, the Biden administration is planning to greenlight an enormous $8 billion oil drilling project in the North Slope of Alaska, according to two people familiar with the decision.

Alaska lawmakers and oil executives have put intense pressure on the White House to approve the project, citing President Biden’s own calls for the industry to increase production amid volatile gas prices.

But the proposal to drill for oil has also galvanized young voters and climate activists, many of whom helped elect Mr. Biden and who would view the decision as a betrayal of the president’s promise that he would pivot the nation away from fossil fuels.

On one side is the “environmental activist” worried about a “carbon bomb” (in fairness to issue advocates, this is not a quote from an activist):

Still, Willow would be the largest new oil development in the United States, expected to pump out 600 million barrels of crude over 30 years. Burning all that oil could release nearly 280 million metric tons of carbon emissions into the atmosphere. On an annual basis, that would translate into 9.2 million metric tons of carbon pollution, equal to adding nearly two million cars to the roads each year. …

Environmental activists, who have labeled the project a “carbon bomb” have argued that the project would deepen America’s dependence on oil and gas at a time when the International Energy Agency said nations must stop permitting such projects to avert the most catastrophic impacts of climate change.

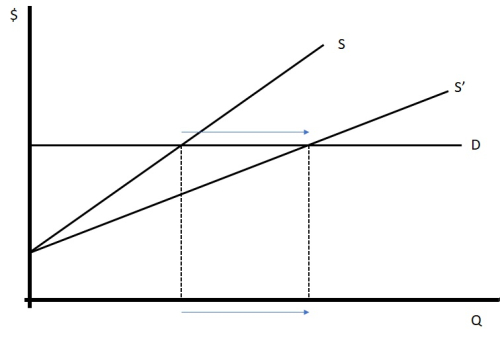

Increasing the amount of oil produced would increase the supply of oil if we consider new mines as firms entering the industry. But, the only way that the amount of oil produced would increase the amount consumed by the same amount (the “carbon bomb” scenario) is if the demand for oil is perfectly elastic. In the picture below the additional mining shifts (rotates) the supply of oil from S to S’ and buyers in the market snap it up at the existing price. The increased quantity of oil consumed is equal to the increased supply at the market price (both arrows are the same size).

But, if the demand for oil is sensitive to price (note: it is) then the amount consumed (the bottom arrow) will be less than the supply increase (the upper arrow):

On the other side is the energy industry making even less sense:

Kevin Book, managing director of Clearview Energy Partners, a research firm, … argued that the emissions linked to burning oil drilled from the Willow project would not have been eliminated if Mr. Biden had rejected the project, but simply generated elsewhere.

This quote assumes that there is some demand increase, the source of which I don’t know, and a perfectly elastic supply from existing miners.

If the supply curve is upward sloping (it is) then the increase in consumption would be less than the demand increase. I’m not going to dignify this scenario by drawing this out because I’m not sure where the demand increase is coming from. As far as I can tell, if there is no oil from the Willow project nothing changes in the oil market.

Happy to be corrected, what have I missed?