Monetary Savings versus Real Savings

According to the National Income and Product Accounts (NIPA) the US personal savings rate stood at 13.6 percent in February 2021 against 8.3 percent in February 2020. Since consumption expenditure is considered as the driving force of the economy, obviously a strengthening in savings, which implies less spending, cannot be good for economic activity, so it is held. Conversely, a decline in savings, which is an increase in spending is considered as good news for economic activity.

The NIPA framework is based on the view that spending by one individual becomes part of the earnings of another individual. The spending of the purchaser is the income of the seller, or we can say that spending equals income.

Therefore, if people maintain their spending, this keeps overall income going. An increase in savings is regarded by popular economics as less expenditure on consumption.

In the NIPA, the saving rate is established as the ratio of personal saving to disposable income. Disposable income is defined as the summation of all personal money income less tax and nontax payments to government. Personal income includes wages and salaries, transfer payments less social insurance, income from interest and dividends, and net rental income. Once we deduct personal monetary outlays from disposable money income, we get the personal saving.1

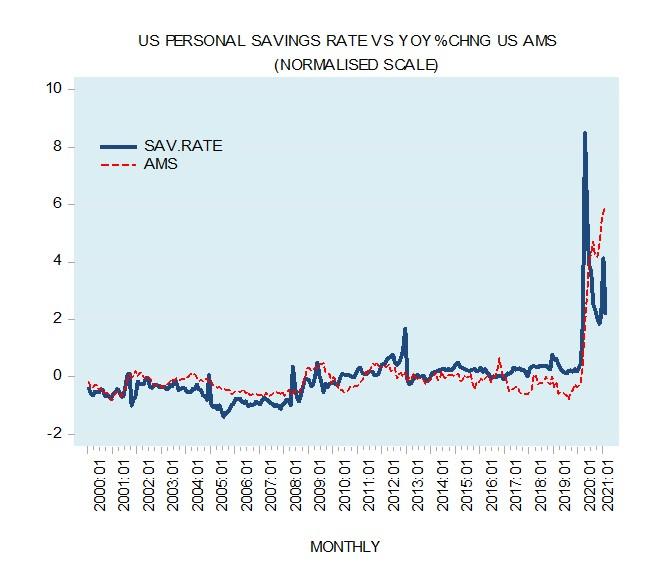

Now, a change in the supply of money affects the total amount of money spent. Consequently, the greater the expansion in money supply, the more money will be spent, all other things being equal, and therefore the greater the NIPA’s national income is going to be. It will also result in an increase in personal savings. Thus, it should not be surprising that the personal savings rate closely resembles the momentum of the money supply (see chart). By this framework, the US central bank can exercise control over individuals’ spending and hence economic growth.

On this, April 2021 research from the Federal Reserve Bank of New York says, “The additional U.S. fiscal package passed in December boosted household incomes and savings starting in January, and the much larger package passed in March will add even more.”2

Furthermore, according to the research, “[h]ow freely households spend out of their newly accumulated savings will be a key factor determining the strength of economic recoveries. Consumer spending would soar if households run down these funds aggressively when economies reopen.”3

Again, by popular thinking an increase in savings by itself is negative for economic growth. However, if savings were to be employed to support more consumer spending, then economic growth would strengthen.

Saving and Wealth: What Is the Relation?

To maintain their lives and well-being, individuals require access to consumer goods. What allows an increase in the production of consumer goods is the enhancement of the infrastructure of an economy. With better infrastructure, a greater quantity and a better quality of consumer goods can be generated—more real wealth can be produced.

The enhancement and the maintenance of the infrastructure becomes possible because of the availability of consumer goods that sustain the lives and well-being of the various individuals who are busy expanding and maintaining the infrastructure.

Observe that it is the producers of consumer goods who pay the various individuals that are engaged in the maintenance and enhancement of the infrastructure. The producers of consumer goods pay these individuals, i.e., the intermediary producers, out of their saved or unconsumed production of consumer goods.

Note that when a producer of consumer goods decides to save more, i.e., to consume less, the decline in his consumption is offset by an increase in the consumption of individuals that are engaged in the intermediary stages of production. This means that overall consumption is not declining because of an increase in saving—as popular thinking has it.

What keeps the flow of economic activity going is the fact that the producers of consumer goods—the wealth generators—invest part of their saved wealth in the expansion and the maintenance of the production structure. This permits the increase in the production of consumer goods. Therefore, the motor of the economy is actually not consumption but rather real savings.

Since real savings enable the production of capital goods, real savings are obviously at the heart of the economic growth that raises people’s living standards. In addition, once there has been a sufficient increase in the pool of real savings, people may aim at enhancing their well-being by seeking other things such as entertainment and service-related products—such as medical treatment et cetera.

Observe that the saved consumer goods support all the stages of production, from the producers of consumer goods and services down to the producers of raw materials and all other intermediate goods.

Introducing Money

When the producer of a consumer good sells his saved goods for money to another producer, he has supplied the other producer with his saved consumer goods. The supplied consumer goods sustain the other producer and allow him to produce other goods.

Note that the money received by the producer is fully backed by his unconsumed production. Whenever he deems it necessary, he can always exchange his money for goods, all other things being equal.

Whenever individuals buy capital goods such as machinery, they transfer money to the individuals who are employed in the making of the machinery.

With money, the machinery maker can choose to purchase not only consumer goods but also various services. The service provider who receives the money could in turn acquire consumer goods and services to support his life and well-being.

Without the medium of exchange, money, no market economy, and hence no division of labor, could take place. Money enables the goods of one specialist to be exchanged for the goods of another specialist.

By means of money, people can channel real savings, i.e., unconsumed consumer goods, to others, which in turn permits the widening of the process of real wealth generation.

When the stock of money stays unchanged, it is instrumental to an exchange of something for money, and the money in turn is exchanged for something else. We have here an exchange of something for something. This means that produced goods are exchanged for other produced goods with the help of money. Note that these other produced goods can be various consumer goods, services, or intermediate goods, which will be transformed into consumer goods sometime in the future.

However, when money is printed or generated out of “thin air,” this means that nothing was produced for this money. It is like counterfeit money. This type of money sets in motion an exchange of nothing for money (since nothing was produced here to obtain this money) and then this phony money, is exchanged for something, i.e., an exchange of nothing for something. Alternatively, what we have here is no production, which is then exchanged for produced goods.

The printing of money cannot result in more real savings but on the contrary results in the weakening of the pool of real savings. It causes the diversion of real savings from wealth generators to the holders of the newly generated money out of “thin air,” who consume without producing anything. Consequently, this weakens real economic growth.

While it is true that the central bank monetary pumping increases the monetary savings of individuals, it weakens the pool of real savings while doing so because of the diversion of real savings from wealth generators to the holders of the newly generated money.

Therefore, increases in money supply, which boost monetary savings, are bad news for real economic growth, because these increases weaken the process of real savings formation.

Can Real Savings Be Quantified?

Take an individual, Joe, who has produced twelve loaves of bread of which he consumes two. The ten loaves are his real savings. Now, if he exchanges the ten loaves of bread for ten dollars, his savings in terms of money is ten dollars.

In the same way, an individual, Bob, produces twenty tomatoes of which he consumes ten. The ten tomatoes are his real savings, i.e., savings in terms of tomatoes. He exchanges the saved tomatoes for five dollars. His savings in terms of money is now five dollars.

Observe that the total savings in money terms of Joe and Bob amount to fifteen dollars (Joe’s savings are ten dollars and Bob’s savings are five dollars). While we can establish the overall savings of Joe and Bob in monetary terms, it is not possible to ascertain total real savings. It is not possible to obtain a meaningful total by adding ten loaves of bread to ten tomatoes.

However, the state of total real savings can be ascertained qualitatively by examining the key factors that undermine or enhance the pool of real savings. For instance, it is clear that loose fiscal and monetary policies undermine the formation of real savings. Conversely, a decline in monetary pumping and in government outlays are factors that support the formation of real savings.

- 1. Milt Marquis, “What’s behind the low US Personal Saving Rate?,” FRBSB Economic Letter, March 29, 2002.

- 2. Matthew Higgins and Thomas Klitgaard, “What Is behind the Global Jump in Personal Saving during the Pandemic?,” Liberty Street Economics (Federal Reserve Bank of New York blog), Apr. 14, 2021.

- 3. Ibid.