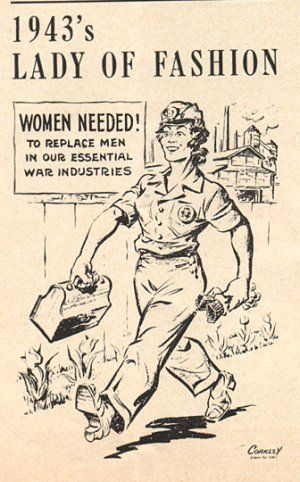

The New Deal and Recovery, Part 20, Appendix: The Fate of Rosie the Riveter

In assessing the possibility that a severe downturn occurred at the end of WWII, I took issue with conventional wartime and postwar output statistics, while taking the period's unemployment statistics at face value. In so doing I set aside a

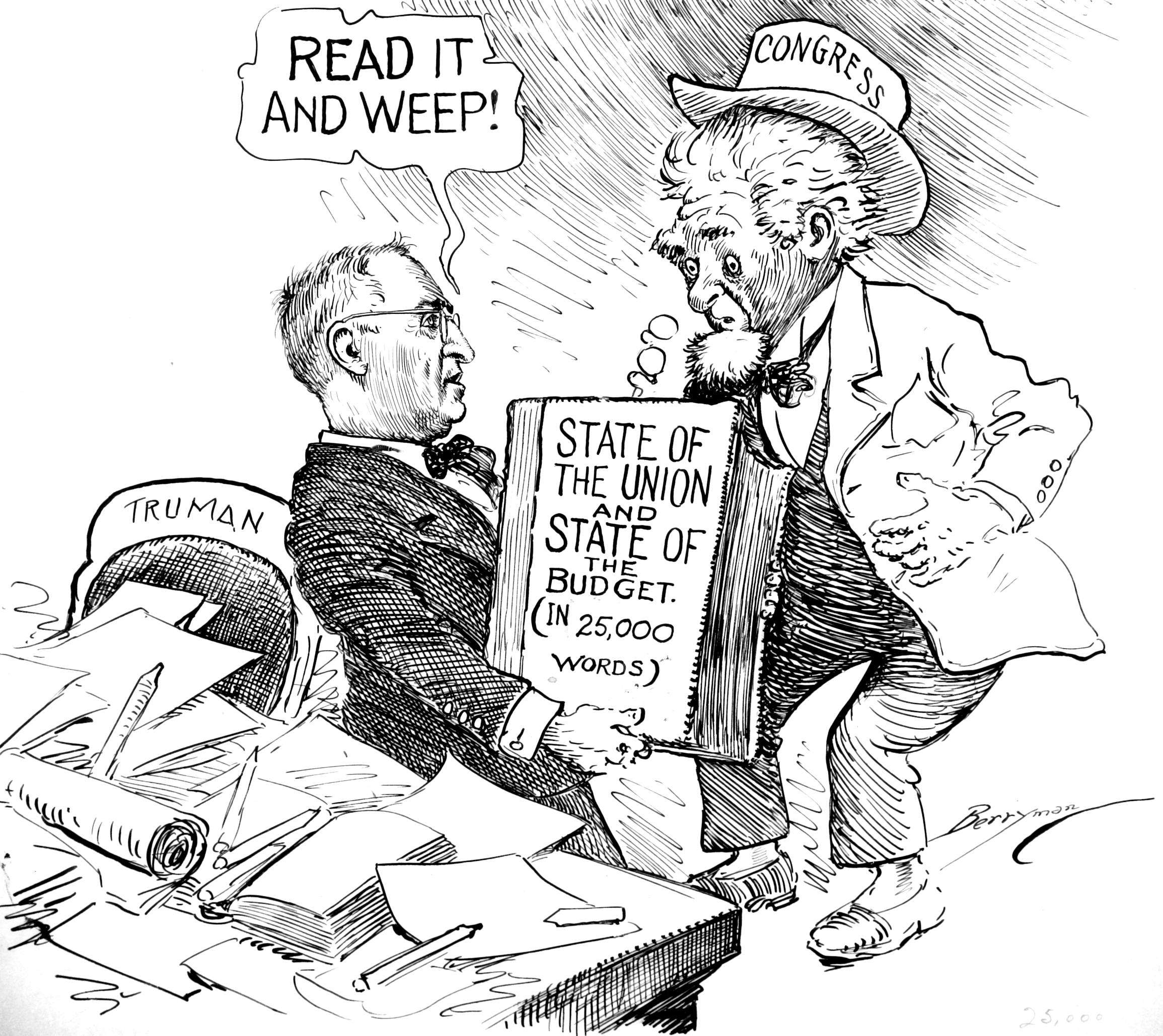

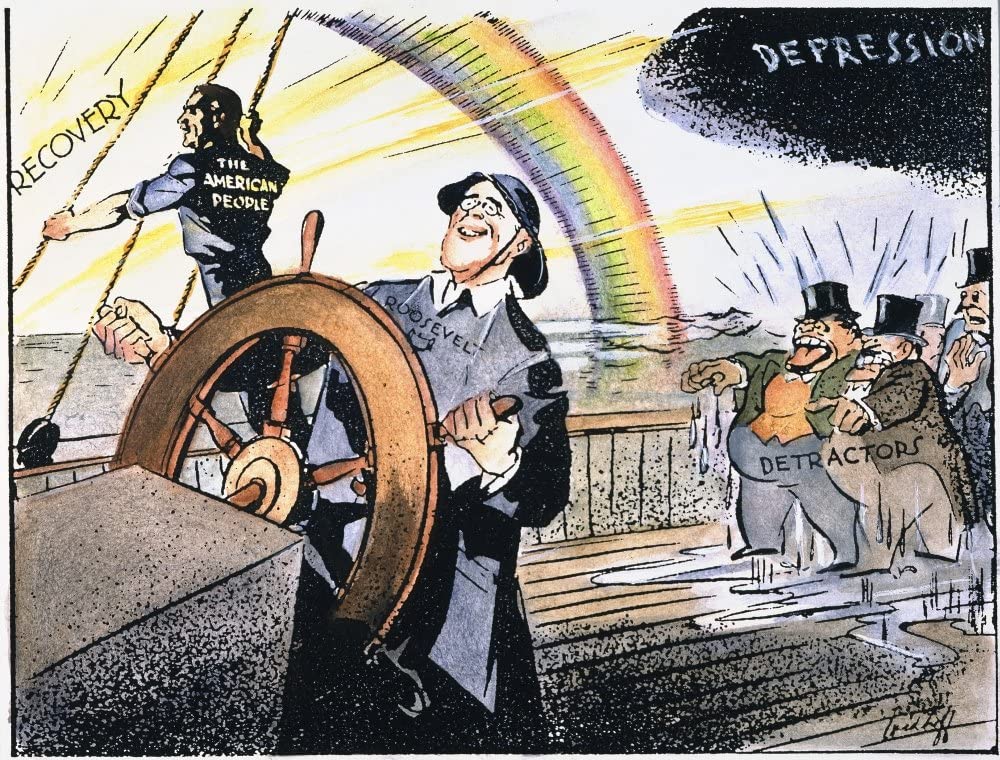

The New Deal and Recovery, Part 20: The Phantom Depression

It was supposed to be a debacle. As the Second World War drew to a close, the nation's leading economists feared that, once the armed services demobilized, at least 8 million men and women, perhaps many more, would be unemployed. That

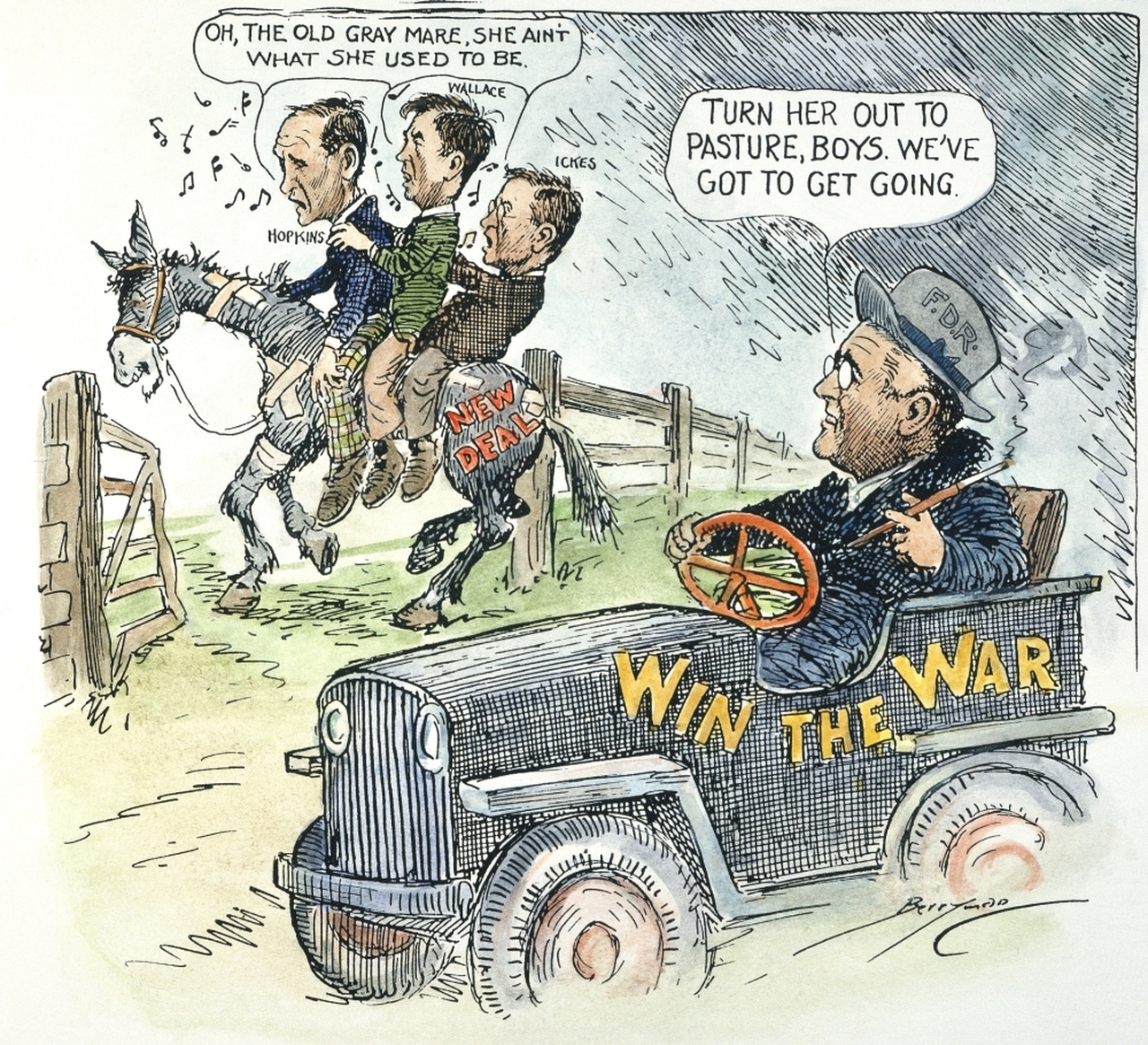

The New Deal and Recovery, Part 19: War, and Peace

Thanks to the Roosevelt Recession, in the spring of 1938 the New Deal's "Keynesians" finally found themselves in the saddle, displacing the planners, reformers, and trust-busters whose legislative efforts had already run out of steam some months before. The Keynesians'

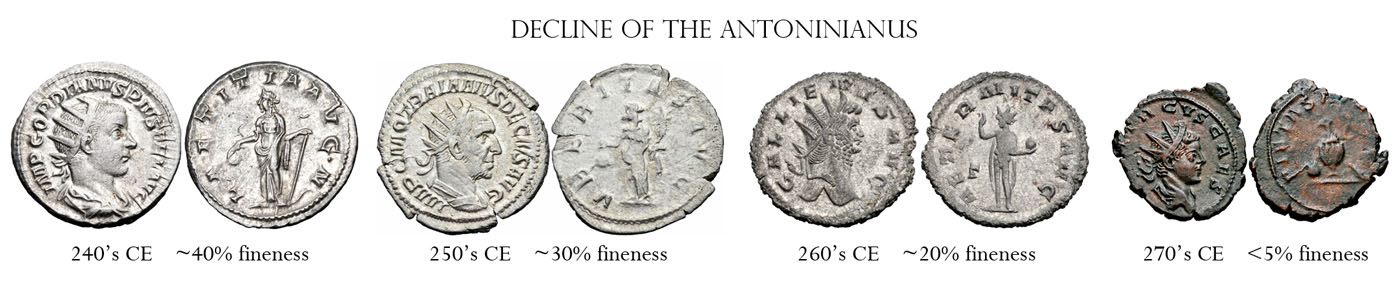

The Menace of Fiscal Inflation

Today, inflation has reached a 40-year high, in response to fiscal profligacy and accommodative monetary policy. Direct cash payments to individuals and businesses in 2020 and 2021, which totaled more than $5 trillion, along with the rapid growth of base

Monetary Progress

(From the entry on "Money," by Charles Francis Bastable, in the famous 11th edition of the Encyclopedia Britannica): The very large number of the autonomous cities of Greece, which possessed the right of issuing money, was the cause of the

Paul Krugman and the “Ersatz” Theory of Private Currencies

Although I've devoted many essays here to exploding myths about historical private currencies, there's one I've yet to directly challenge. That's the belief that such currencies only thrive in the absence of official alternatives. Otherwise, the argument goes, people would

The New Deal and Recovery, Part 18: The Recovery So Far

(Although my contributions to this series have so far been more-or-less in their proper order, this one isn't: it occurred to me only relatively recently that it would be worthwhile to take stock of the overall progress of the recovery

Should the Fed Devalue Our Currency to Implement Negative Interest Rates?

In a thought-provoking article published by the IMF in April, Ruchir Agarwal and Miles Kimball argue for moving away from a “paper money standard” and toward an "electronic money standard." The promised benefits include shorter recessions and lower average inflation.

Populism and the Future of the Fed: A New Book from Cato’s Center for Monetary and Financial Alternatives

The distinguished contributors to Populism and the Future of the Fed examine populist demands to expand the Fed’s mandate and the threat to the demarcation between fiscal and monetary policy. All the essays, except those by Charles Plosser and me,

Revising the Bank Secrecy Act to Protect Privacy and Deter Criminals (CMFA Working Paper No.007)

RevisingTheBankSecrecyAct_NorbertMichelAndJenniferSchulp_CMFAWP007 The post Revising the Bank Secrecy Act to Protect Privacy and Deter Criminals (CMFA Working Paper No.007) appeared first on Alt-M.