Wide World of ESG: Understanding Investor Demand

As we continue to span the globe to bring the constant variety of ESG topics, I’m reminded of my favorite part of watching live sports: being part of a crowd. The energy inside the stadium is never more electric than

A Primer on Inflation

Everyone is talking about inflation, but what is it? Why does it matter? What causes it? And what can the Federal Reserve do about it? This primer will address those questions with the goal of improving the public’s understanding of

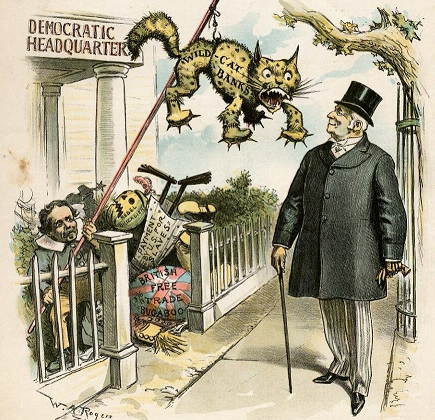

The Fable of the Cats

The comparison has by now been made so often that it may qualify as a platitude. I mean that between stablecoin issuers and "wildcat" banks, the fly-by-night scams that supposedly flooded the antebellum United States with notes nominally worth some

Should We Fear Stablecoins?

A “stablecoin” is a cryptocurrency whose value is pegged to a fiat currency, gold, or another continuously traded asset. USD Tether (USDT) and USD Coin (USDC), the two stablecoins with the largest values in circulation, are each managed to maintain

The Bitcoin Law: Counterfeit Free Choice in Currency

“Why should we not let people use freely what money they want to use? [They] ought to have the right to decide whether they want to buy or sell for francs, pounds, dollars, D-marks, or ounces of gold. I have

The GameStop Episode: What Happened And What Does It Mean? (CMFA Working Paper No. 005)

TheGameStopEpisode_AllanMalz_CMFAWP005 The post The GameStop Episode: What Happened And What Does It Mean? (CMFA Working Paper No. 005) appeared first on Alt-M.

How U.S. Government Paper Currency Began, and How Private Banknotes Ended

A couple months ago, in arguing that "The Fed should give everyone a bank account," journalist Matt Yglesias cited what he took to be an instructive precedent: "Once upon a time, governments didn't issue paper currency, and instead banknotes were

Digital Currency: Risk or Promise?—New Issue of the Cato Journal

(This editor's note is cross-posted from the Spring/Summer 2021 edition of the Cato Journal.) In 1996, Cato held its 14th Annual Monetary Conference, "The Future of Money in the Information Age." The proceedings, along with additional essays, appeared in a book

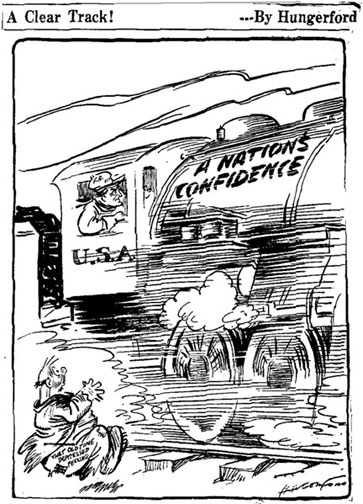

The New Deal and Recovery, Part 14: Fear Itself (Conclusion)

(This post completes my three-part discussion of the "regime uncertainty" hypothesis, according to which the New Deal hampered recovery by causing businessmen to fear policy changes that might render their investments unprofitable. Links to the previous posts about regime uncertainty,

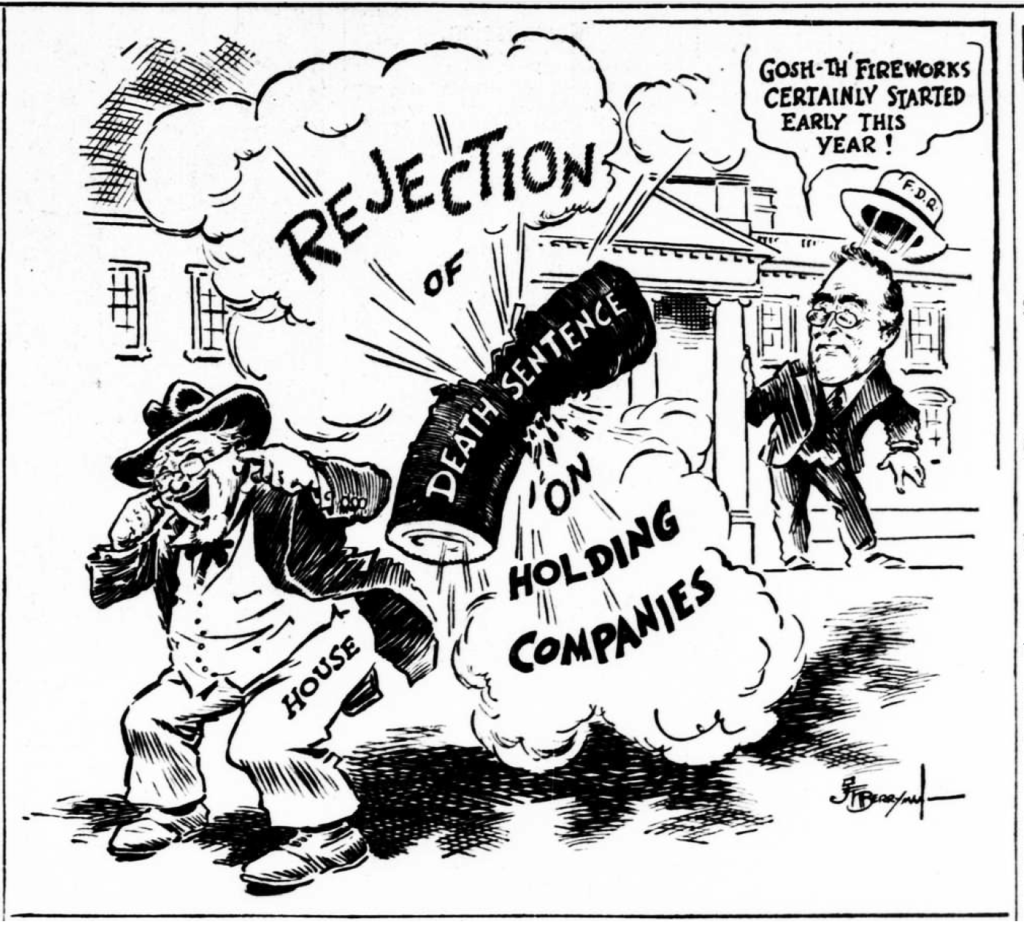

The New Deal and Recovery, Part 13: Fear Itself (Continued)

(This post continues my discussion of the "regime uncertainty" hypothesis, according to which the New Deal hampered recovery by causing businessmen to fear policy changes that might render their investments unprofitable.) Insull's Monstrosity The 1935 Revenue Act wasn't the only measure that