Carola Binder on Technopopulism and Central Banks

In her CMFA working paper, Carola Binder discusses a new approach for understanding why central bankers are pressured—by both politicians and the public—to deviate from their mandates. Further, Binder argues that this new approach "strengthens the case for limiting monetary

Technopopulism and Central Banks (CMFA Working Paper No. 004)

TechnopopulismAndCentralBanks_CarolaBinder_CMFAWP004 The post Technopopulism and Central Banks (CMFA Working Paper No. 004) appeared first on Alt-M.

The New Deal and Recovery, Part 12: Fear Itself

"This great Nation will endure as it has endured, will revive and will prosper. …[T]he only thing we have to fear is fear itself." — FDR, in his first inaugural address. "There is no place for industry; because the fruit thereof

Fiscal Dominance and Fed Complacency

In his first speech as a member of the Federal Reserve's Board of Governors, Christopher Waller defended Fed independence and reassured his audience that "deficit financing and debt servicing issues play no role in our policy decisions and never will."

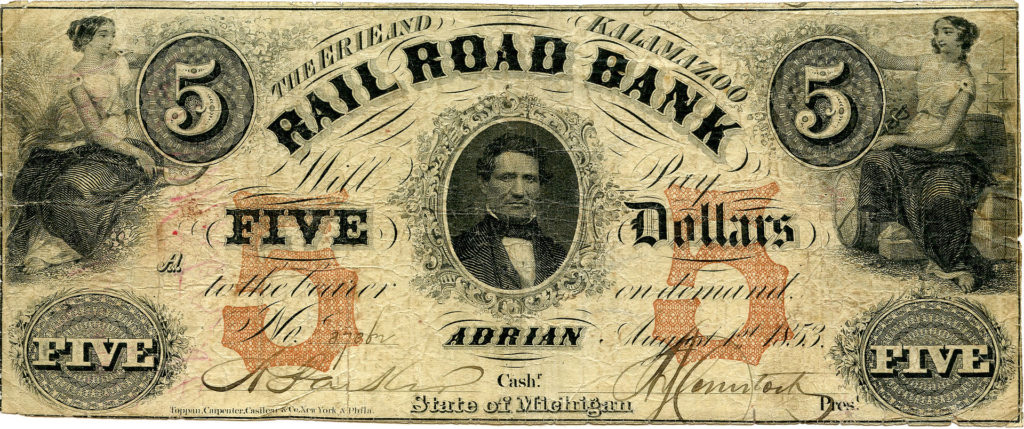

Joshua Greenberg on Antebellum Paper Money

Alerted by a tweet by him, I recently listened to a December 2020 C-SPAN talk, on "Paper Money in Antebellum America," by historian Joshua Greenberg, the author of Bank Notes and Shinplasters: The Rage for Paper Money in the Early

Lawrence White on Private Gold Mints

Every hoary myth about the private market's unfitness to supply means of exchange has roots that trace back to the hoariest monetary platitude of all, namely, the claim that governments alone, whether republican or absolutist or otherwise, are fit to

The Private Mint In Economics: Evidence from American Gold Rushes (CMFA Working Paper No. 003)

ThePrivateMintInEconomics_LawrenceHWhite_CMFAWP003 The post The Private Mint In Economics: Evidence from American Gold Rushes (CMFA Working Paper No. 003) appeared first on Alt-M.

Ron Paul and our Big, Fat Fed

Regular readers of Alt-M don't need to be told that yours truly is no fan of the Fed's gigantic credit footprint. Even before the recent crisis, he lamented both the extent to which the Fed had switched from regulating this

The New Deal and Recovery, Part 11: The Roosevelt Recession, Continued

"Massive jolts of New Deal spending had stopped the economic slide, [but the economy crashed again when] over two years, FDR slashed government spending 17 percent." (From a 2011 NPR presentation.) In the last installment of this series, I discussed

COVID Cash (CMFA Working Paper No. 002)

COVIDCash_KennethRogoffAndJessicaScazzero_CMFAWP002 The post COVID Cash (CMFA Working Paper No. 002) appeared first on Alt-M.