“Don’t Get Caught in the Overbought Rally: Weak Long-Term Participation Levels Ahead!

Intermediate-term participation levels are at near-record highs, yet markets may be poised for a pullback. According to data from Bank of America and Bloomberg, participation in the global economy is at the highest level in at least the last two decades.

Unlock the Secrets to FedEx’s Success: What You Need to Know About Its Uptrend!

With the economy in a state of flux, many companies have had to adapt or die. FedEx Corp. (FDX) is no exception and is facing a challenging market landscape. The question investors are asking is, “Is FedEx’s long-term uptrend in

“2024: Look Out – It’s All About Me!

In today's world, the rise of personalized consumer goods and services, combined with the increasing value placed on individual judgment, has given rise to a fascinating trend: The Vanity Trade of 2024. The Vanity Trade is a term for the growing

for the Future “17 Futuristic Predictions from Mish’s Outlook 2024

Consider the following article which provides an insightful outlook into what the world could look like in 2024. The year 2024 is sure to be a time of great innovation. As technology continues to evolve and improve, the world is likely

“NIFTY In Respite: How Will Seven Weeks of Gains Fare? What To Expect?

The Indian stock market has been on a roller coaster ride, with Nifty posting gains in seven out of the past eight weeks. Last week, however, the Nifty 50 took a breather and ended the week on a flat note,

MEM TV: Markets Rallying into Year-End!

Whether it's the impact of the pandemic or a wave of optimism regarding the economy, the MEM (Middle East and Maghreb) television market looks poised for a bullish finish to the year. The MEM region, which covers countries like Algeria, Bahrain,

“Year-End Cheer: Inflation Data Proves to be a Holiday Blessing!

Heading into this year-end, the inflation data is giving many investors much-needed holiday cheer. Inflation, as measured by the consumer price index, rose 0.3% in November which was the highest percentage increase since August. This brings the year-to-date inflation rate

“Capitalize on the Chance: Is It Time for a Reversal of Fortune?

Buying Opportunity or a Trend Reversal? When looking at the stock market, traders are often trying to determine if the current trend will continue, or if a trend reversal is coming. This decision making process can be a difficult one, but

#4: Unlocking the Power of Leadership: The Top 5 Leadership Themes of 2023

As we enter the final frontier of 2023, the year has been marked with many interesting happenings in the field of business leadership around the world. There have been some emerging trends in terms of how business leaders are managing

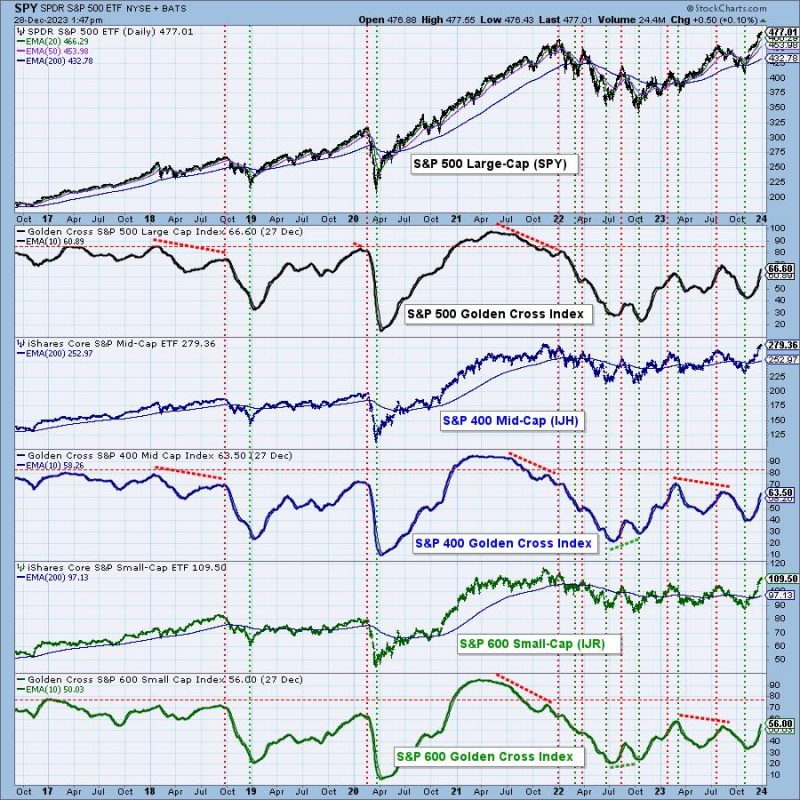

! Embrace Caution: Market Breadth is Picking Up Speed!

The stock market has been on an impressive run over the past several weeks. Many investors are wondering if this rally will continue, or if it's time to take profits and be cautious. Market breadth, which measures the number of