The Case Against the New “Secular Stagnation Hypothesis”

Abstract: The new “secular stagnation hypothesis” developed by Lawrence H. Summers attempts to justify why the demand stimulus applied in the aftermath of the global financial crisis failed to revive growth in a satisfactory manner. Building on previous ideas of Keynes, Hansen, and Bernanke, Summers claims that excess savings together with feeble investment drove the natural rate of interest down to zero and advanced economies into stagnation. As the US monetary policy rate is not allowed to fall below the zero bound, Summers calls for “quantitative easing” and more expansionary fiscal policy to spur investment demand. This paper refutes Summers’s hypothesis by revealing its internal inconsistencies and presenting both theoretical arguments and empirical evidence on the long-term evolution of savings, investment, productivity, and capital stock. It also estimates the natural rate of interest following the approach of Salerno (2020), which is further refined based on Rothbard’s “pure interest rate” theory. The calculation shows that the natural interest rate did not drop to zero after the global financial crisis, but has actually remained consistently and significantly above the federal funds rate and the bank loan prime rate. This not only invalidates Summers’s central claim, but confirms once more the explanatory power of the Austrian business cycle theory in relation to the main trigger of the global financial crisis and its subsequent unfinished recovery.

JEL Classification: E43, E51, E52, E31, E32, E12, E14

Mihai Macovei (macmih_mf@yahoo.com) holds a PhD in international economics from the Academy of Economic Studies in Bucharest. He is an associated researcher at Ludwig von Mises Institute Romania and works for an international organization in Brussels, Belgium. The author is grateful for useful comments from Nikolay Gertchev and Amanda Howard.

Puzzled by the anemic growth performance in advanced economies five years after the global financial crisis (GFC) of 2007–08 and the inability of mainstream macroeconomic theories to explain it, former US Treasury secretary and Harvard professor Lawrence H. Summers (2013) expounded a new “secular stagnation hypothesis,” reviving an old Keynesian theory developed by Alvin Hansen during the Great Depression. At the core of the theory, which tries to justify government interventionist policies, lies the assumption that major structural societal changes have reduced investment demand in modern economies, whereas savings have continued increasing. This has created a “savings glut,” which has driven the equilibrium or natural real interest rate all the way down to near zero and made monetary policy largely ineffective.1 In order to combat the secular stagnation engulfing advanced economies, monetary policy would allegedly need to be recalibrated toward “quantitative easing,” and fiscal policy, in particular public investment, should be used more aggressively.

It may not be a coincidence that both Hansen and Summers released their theories precisely at times when the Keynesian theoretical framework was incapable of explaining why interventionist policies stimulating demand could not lift the economy out of recession. But instead of pouring old wine in new bottles, Summers could have usefully consulted the Austrian business cycle theory (ABCT) in order to understand the disappointing output growth following the global financial crisis. The ABCT was primarily elaborated by Austrian school economists Ludwig von Mises and Friedrich A. von Hayek and explains how excessive growth in bank credit due to artificially low interest rates set by a central bank or fractional reserve banks triggers an unsustainable boom and “malinvestments,” i.e., intertemporal misallocation of factors of production. A recession is bound to follow, because there are not enough real savings to support all the projects started in the boom. The recession liquidates the boom’s “malinvestments” and adjusts the structure of production to the economy’s new saving-investment preferences and natural interest rate. According to the ABCT, further monetary expansion via “quantitative easing” and larger fiscal stimuli, as advocated by Summers, can only prolong the gap between the loan and natural interest rates, perpetuate entrepreneurial miscalculations, and cause economic stagnation. The Keynesian supposed cure for low growth is actually its main cause.

The key point in assessing the validity of Summers’s hypothesis is the claim that chronically weak investment demand together with a “savings glut” have significantly decreased the natural interest rate to close to zero and below the market loan rate. This allegedly depresses growth and justifies “quantitative easing” and negative interest rates. After brief presentations of the new “secular stagnation hypothesis” and of Knut Wicksell’s “natural interest rate” theory in the following sections, this article explains why the main arguments underpinning Summers’s theory are flawed. Using both theoretical proof and statistical evidence on the evolution of real savings, investment, productivity, capital stock, and inflation, this article disputes Summers’s central claim that the natural rate of interest fell significantly toward zero in recent years. Going a step further, it then estimates the natural interest rate for the US economy starting from an approach devised by Joseph T. Salerno (2020), which is further refined based on Murray N. Rothbard’s “pure interest rate” theory. The latter describes how the pure rate of interest is determined in the time market and permeates the entire structure of production. The final section concludes that the refutation of the new “secular stagnation hypothesis” calls for ending the decade-long policies of stimulating demand, which have proven detrimental to reviving sound economic growth.

THE NEW “SECULAR STAGNATION HYPOTHESIS“

In the presidential address delivered at the American Economic Association in 1938, Hansen presented a new interpretation of the protracted weak recovery from the Great Depression. According to him, the US economy was suffering from “secular stagnation,” i.e., it had reached a maturity stage where savings were increasing, but investment was falling due to a decline in population growth and subdued technological progress. If the main challenge of capitalist economies in the nineteenth century had been weathering business fluctuations, the twentieth-century problem became unemployment as depressions became longer and deeper (Hansen 1939).

To remedy declining investment demand, which had theoretically fallen below the level necessary to absorb savings, and the ensuing unemployment problem, Hansen advocated more rapid technological progress and the development of new industries to replace the maturing ones by increasing investment opportunities. He also saw a role for public spending in preventing the fall in national income below a critical level. But he surprisingly cautioned, with quite strong words, against the use of public investment as a panacea for filling the saving-investment gap: “[P]ublic spending is the easiest of all recovery methods, and therein lies its danger” (Hansen 1939, 14). Carried too far, the latter would lead to higher costs and prices, prolong economic maladjustments, and displace the otherwise available flow of private investment via both taxation and borrowing. Hansen also doubted the role that the interest rate could play in spurring investment, claiming that plentiful lending at low interest would not revive stagnating real investment. Despite the fallacy of his theory, Hansen’s original view of both fiscal and monetary stimulus as a potentially dangerous and partial cure to economic stagnation seems much more reasonable than that of Summers and other modern Keynesians.2

The secular stagnation theory fell into oblivion once the post–World War II baby boom solved at least one of Hansen’s fears, i.e., the decline in population growth. In addition, the war ended the Great Depression and new inventions like jet airplanes and computers supported the subsequent boom in productivity and output. As reality basically invalidated Hansen’s claims, his theory was laid to rest until Summers (2013) resurrected it in a speech at the International Monetary Fund (IMF). Faced with a similar challenge, i.e., a very weak recovery from the global financial crisis, despite unprecedented fiscal and monetary stimulus, Summers borrowed Hansen’s theory and refocused it on the zero lower bound, which prevents negative nominal interest rates and waters down the Keynesian monetary cure.3

Noting that growth in the United States and other advanced economies had been feeble despite buoyant financial conditions during the previous fifteen years, Summers (2014a; and 2014b) hastily concludes that mature industrial economies can hardly achieve adequate growth under conditions of full employment and financial stability. He believes that this is caused by a substantial decline in the equilibrium or natural rate of interest to close to zero, reflecting a significant shift between savings and investment. The economy has supposedly undergone an “increase in private savings, and a decrease in the level of investments” which could only be balanced at full employment at “an unattainably negative level of the nominal interest rate” (Summers 2015a). According to him, the fact that nominal short-term interest rates cannot fall below zero (or some bound close to zero)4 prevents the adjustment needed to equate saving and investment at full employment (Summers 2015b).

The question is how such a chronic excess of savings over investment can exist in flexible markets, and Summers borrows Hansen’s main contributors to secular stagnation, i.e., low population growth and weak technological progress, to answer it. In addition, he points to other complementary factors. Savings have supposedly been boosted by an increase in income inequality to the benefit of people with a higher saving propensity and, most important, by a surge in global savings. Summers emphasizes the “open economy” factor and his agreement with Ben Bernanke’s “savings glut” argument.5 Emerging economies, but also advanced ones such as Japan and Germany, have supposedly accumulated excess savings for precautionary purposes and distributed them to the industrialized world, in particular the United States, by investing them in safe assets, such as US Treasurys (Summers 2015c). In turn, the United States has not been able to channel the excess savings originating abroad into domestic investment. Summers considers that the decline in the demand for debt-financed investment, reflecting the legacy of the period of excessive leverage before the Great Recession, also played a role.6 In addition, a drop in the relative price of capital goods—he gives the example of computers—has rendered investment less costly and therefore profitable companies, such as Apple and Google, will allegedly “find themselves swimming in cash and facing the challenge of what to do with a very large cash hoard” (Summers 2014a).

In order to overcome the “secular stagnation” challenge, Summers (2013 and 2015b) calls for more intrusive macroeconomic policy measures. He advocates monetary policy expansion via quantitative easing and a sizable reduction of real interest rates down to negative levels in order to match the fall in the natural rate of interest. Investment demand should also be increased, with a substantial role to be played by public investment and measures to reduce barriers to private investment. He argues in the Keynesian tradition that a substantial increase in public investment would not increase the public debt-to-GDP ratio because the investment multipliers are quite large until full employment is reached and the zero interest rate policy would suppress the debt service costs (Summers 2014a). He even calls for global action to solve the excess of savings over investment, arguing that “secular stagnation is a contagious malady” (Summers 2015c).7

It is most striking that although Summers presents some circumstantial empirical evidence in support of his hypothesis, this does not include any substantial data on the alleged global increase in real savings and collapse of investment, which are central to his argument. Moreover, in order to prove the decline in the natural rate of interest to zero, he only relies on some estimates in Laubach and Williams (2003) complemented by data on the decline in international real interest rates. Early on, a large inconsistency is evident in his treatment of interest rates. On the one hand, Summers (2015a and 2015b) claims that savings are chronically in excess of investment because nominal interest rates are constrained by the zero lower bound. On the other hand, he argues that real interest rates need to follow the decline in the natural rate of interest in order to address the saving-investment imbalance (Summers 2014a, 2015a, and 2015b). First, even if nominal interest rates are stuck at the zero bound, real interest rates can still be significantly negative with positive inflation.8 Second, Summers (2015c) enters into a circular argument when he uses the decline in real interest rates as a proof of the sharp decline in the natural rate while at the same time blaming “secular stagnation” on the fact that real rates have not mirrored the decline in the natural rate (Summers 2014a, 2015a, and 2015b). Third, the charts with which he illustrates the decline in the natural rate of interest and in real interest rates—for the US Treasury Inflation-Protected Securities (TIPS) and for the world average—do not support his claim, but show a similar downward trend from about 3 percent per annum in 2000 toward zero in 2012–13, only that the former fell faster during the financial crisis (Summers 2014a and 2015c).

The fact that real interest rates followed the natural rate toward zero and even turned negative from 2012 to 2013, makes one wonder why the economy did not exit “secular stagnation” afterward. And yet, as economic growth performance gradually improved in the United States and the validity of his theory was questioned, Summers (2018) defended it forcefully, claiming that the economic recovery was due to “extraordinary policy and financial conditions.” But in doing so, he contradicted his own policy recipe:

There is also a question over whether the current policy mix and financial conditions can be maintained indefinitely. This is doubtful for fiscal policy especially in the US. Monetary policies involving low or negative real interest rates may be sustainable over the long term but they are likely to encourage financial risk, unsound lending and asset bubbles with potentially serious implications for medium-term stability. (Summers 2018)

And he even went further, saying that “[c]urrent palliatives are appropriate but unlikely to be long-term solutions” (Summers 2018), implicitly admitting that his policy recommendations are only short-run placebos. Such easily identifiable inconsistencies show that Summers’s main arguments are seriously flawed. Moreover, his entire theory is refuted by available statistics on savings, investment, productivity, and the estimated level of the natural interest rate, which will be presented in the next sections. But first, the theoretical foundation of the analysis, Wicksell’s “natural rate of interest” theory which was later incorporated into the ABCT, will be introduced.

THE WICKSELLIAN THEORY OF THE NATURAL INTEREST RATE

Showing a keen interest in price fluctuations, Wicksell ([1898] 1962) was among the few economists who endorsed the quantity theory of money (when this idea was largely discredited) and tried to improve it further. He noted that interest rate fluctuations played an important role in price changes and concluded that a connection must exist between the “natural” rate of interest which arises in the capital structure of the economy and the rate of interest that emerges on the credit market. Wicksell thought that these two rates of interest are supposed to converge under normal circumstances, in which case the rate of interest on loans is neutral with respect to prices. On the other hand, any persistent deviation of the market loan rate from the natural interest rate would generate a cumulative change in the price level. Keeping the money rate below the natural rate of interest would lead to an increase in prices and vice versa.

Building on the work of Eugen von Böhm-Bawerk, Wicksell argued that the natural interest rate is determined by the supply and demand for real capital goods, as if the latter were lent in kind in an imaginary economy without money. As a result, the natural rate is ultimately determined by the relative excess or scarcity of real capital goods and should be “roughly the same thing as the real interest of actual business” (Wicksell, [1898] 1962, xxv), i.e., the businesses’ return on capital investment.

Although the supply of real capital is limited physically by economic output, the money supply can be expanded without limit in theory. Wicksell stated very clearly that fractional reserve banks are able, especially in concertation, to lend “any desired amount of money for any desired period of time at any desired rate of interest, no matter how low, without affecting their solvency, even though their deposits may be falling due all the time” ([1898] 1962, 111). He even acknowledged the possibility that “the money rate of interest could fall almost to zero without any increase in the amount of real capital!” ([1898] 1962, 111; his italics). This is the extreme case that Summers and the modern proponents of negative interest rates are asking for, supposedly in order to match the fall in the natural rate of interest, which is prevented by the zero lower bound of monetary policy. Although an exact coincidence of the money and natural rates of interest is unlikely, Wicksell argued that any permanent negative difference, even small, between the money and natural rates would raise the general level of prices continuously and to an unlimited level. Therefore, if Summers’s assumption is wrong, reducing the money rate of interest all the way down to zero (or even below) when the natural rate hasn’t changed accordingly is bound to increase prices considerably and negatively impact the economy, as Mises later posited.

Wicksell described in detail the negative impact of the divergence between the money and natural interest rates on changes in the price level, but it was Mises who extrapolated the effects of interest rate manipulation to the capital structure of the economy. This was to become the backbone of his Austrian business cycle theory. According to Mises ([1949] 1998, 521–34), the interest rate is determined by the prevailing “time preference” in the society, i.e., the degree to which people prefer present to future satisfaction. A lower time preference rate will be reflected in a greater share of investment to consumption, a lengthening of the structure of production, and a building up of capital. Mises called “originary” interest the interest rate that is price neutral. This rate is similar to Wicksell’s “natural rate of interest,” and is determined by the discount of future goods versus present goods ([1949] 1998, 539–48). Originary interest is a methodological tool which cannot be attained in a uniform way in the reality of a changing economy and explains the formation of the “gross market rate of interest” on the loan market, which includes in addition to the former an entrepreneurial risk component and a price premium. Rothbard ([1962] 2009, 348–451) elaborated further on the formation of what he called the “pure” rate of interest, which is also determined by time preference and emerges as a price spread between stages of production.

According to Mises’s ABCT ([1949] 1998, 535–83), an artificial expansion of the supply of credit on the loan market can lead to fluctuations in gross market interest rates, i.e., loan rates, even in the absence of an equivalent change in originary interest. When “the market rate deviates from the height which the state of originary interest and the supply of capital goods available for production would require” entrepreneurs are misled into investing in the wrong lines of business, creating “malinvestments,” and households into overconsumption (Mises [1949] 1998, 544). This triggers an unsustainable boom where businessmen overestimate the stock of real savings and embark on “longer processes of production.” This lengthens the capital structure by shifting investment from consumer-goods to capital-goods industries. The resulting intertemporal misallocation of factors of production cannot be indefinite, because the lengthened structure of production can be sustained only through larger real savings, and not through money creation. As soon as the expanded credit reaches the owners of factors of production in wages, rents, and interest, they try to reestablish their preferred consumption-investment pattern and several business investments are revealed as unprofitable. The ensuing recession liquidates the boom’s malinvestment and allows the structure of production to adjust to the new savings and investment pattern reflecting the new natural interest rate prevalent in the economy.

If Summers is wrong and the natural interest rate has not dropped to zero, justifying an equivalent reduction in the monetary policy rate, significant negative economic consequences can follow this reduction according to the ABCT. They go beyond undesired cumulative changes in the price level, as originally claimed by Wicksell, fostering a boom of malinvestment, output losses, and capital consumption. And if the deviation of the market interest rate from the natural rate of interest continues during the ensuing recession, the latter will be prolonged unnecessarily. The economy would be caught in a vicious cycle of dwindling growth and anticrisis monetary policy, exacerbating the economic debacle that looked like “secular stagnation” to Hansen and Summers.

FALLACIES OF THE “EXCESS SAVINGS” ARGUMENT

Summers claims that savings have risen while investment has dropped, causing the equilibrium, or natural, interest rate to fall to zero, but he does not specify whether he refers to nominal or real savings and investment. He mentions that a substantial part of excess savings emanate from abroad, but the only statistical evidence that he points to is the rise in the nominal amount of foreign central banks’ reserves of US dollars and US Treasurys, which is a strong indication that he thinks in nominal terms. Moreover, Summers’s idea of the surge in savings derives from the “global savings glut” theory of Ben Bernanke (2005), who tried to pin the widening US current account deficit on an alleged global excess of savings, also measured in nominal terms. Trying to justify a downward trend in the equilibrium real interest rate with nominal data on savings is obviously wrong and this inaccuracy resembles the confusion he makes between nominal and real interest rates. Summers’s methodology is also inconsistent with the way in which Wicksell derives the natural rate of interest, from changes in the supply and demand for real capital goods.

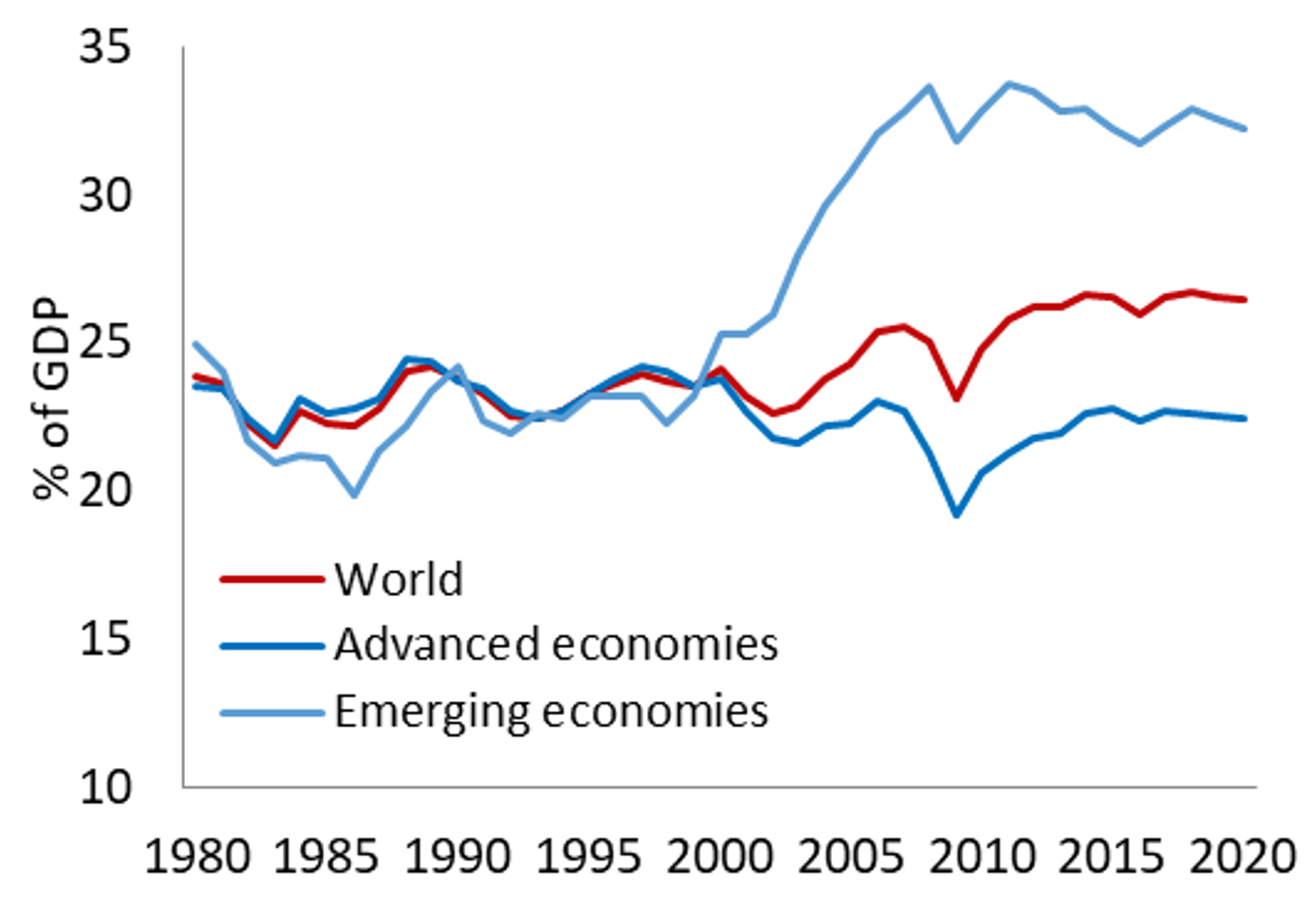

Most important, Summers’s (and Bernanke’s) “global savings glut” argument is refuted by statistical data on global real savings, proxied by the ratio between gross national savings and nominal GDP. Over the last four decades, the world savings ratio has been almost flat, barely increasing from about 24 percent of GDP in 1980 to 26 percent of GDP in 2020 (graph 1). As a matter of fact, the savings ratio had been declining for about 2 percentage points until the early 2000s and started growing moderately only afterward. The much-feared “savings glut,” which allegedly originates in emerging markets, in particular in China, has raised the global savings ratio only marginally, because the saving propensity has dropped concomitantly in advanced economies. Germany has recorded a large increase in its savings ratio since 1980, but this has been compensated for by significant drops in the US and Japanese savings ratios. China’s savings ratio has also trended downward, from above 52 percent of GDP in 2008 to around 44 percent of GDP in 2019, after growing steadily at the beginning of the country’s transition to a market economy.

Graph 1. World savings rate

Source: data from the IMF World Economic Outlook Database.

The dramatic fall in investment bemoaned by Summers has not taken place either, according to statistics. The global investment ratio, expressed as gross fixed capital formation to GDP, has been broadly flat at about 26 percent of GDP from 1980 to 2020, and has actually increased in tandem with savings, from around 23 percent of GDP in 2009 to 26 percent of GDP in 2019 (graph 2). Since the financial crisis, savings and investment have balanced out almost every year in both emerging and advanced economies. Therefore, there has not been any global “savings glut” originating from emerging economies, as claimed by Summers and Bernanke. This was to be expected, because a gap between savings and investment at a global level would occur only in nominal terms, i.e., if money newly created by credit expansion were parked in bank accounts and were not spent on new investments. However, such a mismatch would not occur in real terms. In terms of goods, savings always equal investments, as reported in national accounts statistics too, because the part of production which is not consumed is used up in the formation of capital goods, i.e., investment.

Graph 2. World investment rate

Source: data from the IMF World Economic Outlook Database.

It does not seem to be a coincidence that the savings ratio started growing in the early 2000s, at the exact time when the Federal Reserve System (Fed), followed by all the other major central banks, reduced interest rates to a historical low level, giving a boost to credit expansion by fractional reserve banks. Deposits in US commercial banks more than doubled in size every decade, from $3.5 trillion in 2000 to above $7 trillion in 2010 and about $16 trillion in 2020.9 In parallel, foreign exchange reserves of central banks have surged from less than 15 percent of GDP in 2000 to about 30 percent of GDP (Summers 2014). But this reflects primarily an increase in fiduciary media and not in real savings, i.e., output which is not consumed but invested in the production of capital goods. Therefore, Summers and Bernanke mistook for a “savings glut” an abundance of newly created fiduciary media following a radical easing of monetary policy originating in the United States and other advanced economies; however, the growth in bank deposits and foreign reserves does not represent an abundance of real savings available to increase the real stock of capital goods.10 The opposite of Summers’s argument is actually true: it was not plentiful real savings that drove down the equilibrium real rate of interest, rather record-low nominal interest rates which spurred monetary credit expansion, as will be elaborated below.11

If time preference goes down in a society and the saving propensity grows, the increase in real savings would be matched by an increase in real investments, i.e., the saving-investment pattern would shift simultaneously. It has been noted that the ratios of saving and investment to GDP, as calculated in national accounts statistics, have increased mildly during the last twenty years. But could this have triggered the claimed significant drop in the natural interest rate? Looking at the evolution of the real stock of capital goods and productivity will provide useful indications given the interconnections between these variables.

WHAT DO PRODUCTIVITY AND CAPITAL ACCUMULATION SUGGEST?

According to Rothbard ([1962, 1970] 2009, 526), in the absence of monetary expansion, the real interest rate is supposed to fall in a progressing economy and not in one which is stagnating or regressing, as assumed by Summers. In a progressing economy the production processes are longer and more productive due to an increase in gross investment and capital accumulation, supported by growing savings as time preference and interest rates fall. In a regressing economy, the opposite is true—gross savings and investment decline and consumption increases. Time preference increases together with the interest rate, widening the spread between cumulative prices in the stages of production (Rothbard [1962] 2009, 531). Wicksell ([1898] 1962, xi) argues in the same way that the real rate of interest will fall when the quantity of real capital increases. This is contrary to what Summers claims, i.e., that the natural interest rate has fallen in a stagnating economy, by wrongly assuming that real savings and investments have moved in opposite directions.

A fall in the natural rate of interest is moreover associated with increasing productivity and capital accumulation, as explained by Rothbard, but such an increase has not taken place. In recent years, many economic analysts, both mainstream and nonmainstream, have noted and searched for the causes of a significant decline in productivity in both advanced and emerging economies (IMF 2017; OECD 2016; and Macovei 2018). Organisation for Economic Co-operation and Development (OECD) statistics show that productivity, measured as the annual growth in real GDP per employee, has fallen across the board in most advanced economies over the last two decades (graph 3). Emerging economies, illustrated by China in the chart, have undergone a similar decline in productivity following the financial crisis. One would not have to search much to uncover the mystery of the steady decline in productivity. The same OECD statistics reveal that the annual growth in the capital stock per employee has decelerated significantly over the last two decades, not only in major advanced economies such as Germany, Japan, Switzerland, and the United States, but also in middle-income economies such as South Korea and Spain (graph 4).12

Graph 3. Productivity (change in real GDP per employee)

Source: data from OECD Statistics. Data as of 1995 for the OECD.

Graph 4. Capital stock per employee percentage change

Source: data from OECD Statistics; own calculations.

Since the global financial crisis, the capital accumulation per worker has slowed significantly in many economies and reached almost zero in countries like Japan and Germany. At the same time, a modest increase in the investment-to-GDP ratio has taken place globally, both in emerging and advanced economies. This may appear counterintuitive but illustrates well the malinvestment that took place both in the boom years before the GFC and thereafter, when aggressive fiscal and monetary policies prolonged the misallocation of factors of production. Even if investment appeared robust, it was actually tied up in wasteful projects that later had to be liquidated and which have not contributed to a durable increase in the capital stock. As the monetary expansion originating in advanced economies spread to the rest of the world via artificially reduced interest rates and large capital flows searching for yield, emerging markets also underwent short-lived consumption or real estate booms due to surging indebtedness during the last two decades (IMF 2015; and BIS 2016).

As a matter of fact, the real cause of the longer-term economic slowdown in many advanced economies has been the gradual erosion of the stock of capital goods, dwindling productivity growth following the offshoring of productive activities to emerging markets, and a drop in the domestic investment-to-GDP ratio of about 4 percentage points since the 1980s. This was brought about by heavy regulatory burdens and welfare policies that limited economic freedom, together with steady credit expansion and increased financial leverage, which led to larger booms and busts. The “secular stagnation” hypothesis not only fails to identify the plausible explanation of the West’s economic decline, but advocates policies that would accelerate it further.

Arguments such as slowing population growth and weak technological progress are, first, not valid and, second, could only play a circumstantial role in explaining “secular stagnation.” The world’s population growth has indeed decelerated from about 1.8 percent per annum in the late 1980s to 1 percent per annum in 2020 (graph 5). Due to the government-enforced one-child policy, a major contributor has been the decline in the population growth of China from about 2 percent per annum to 0.4 percent per annum over the same period.13 India’s population growth also dropped from 2.4 percent per annum at the beginning of the 1980s to about 1 percent in 2020.14 Yet, despite the steep decline in population growth, investment-to-GDP ratios and capital accumulation advanced significantly in both China and India, which runs against Summers’s argument. The same holds true at the global level, where investment-to-GDP increased (see the previous section) despite the fact that population growth slowed as well.

Graph 5. World population growth rate (% p.a.)

Source: data from OECD Statistics.

It should not come as a surprise that investment and capital accumulation per worker increase even if population growth slows, because this is a prerequisite for improving living standards. Countries where the growth of output, investment, and capital stock plummeted or stagnated have been faced with other serious economic issues or misguided polices in addition to the demographic headwinds. Japan is the classic mainstream example of a country whose economic woes are allegedly due to the decline and aging of its population. Yet Japan’s economy has actually never properly recovered from the collapse of its real estate boom in the early 1990s because of ultraloose fiscal and monetary policies and lack of structural reforms. Government intervention has perpetuated the survival of zombie companies and the misallocation of factors of production, resulting in slashed investment, falling productivity growth, and hefty capital outflows, which in turn have gradually eroded the capital stock per worker. And despite a minor decline in population since the Great Recession, Japan’s labor force has actually grown but has increasingly been used in less productive activities while real wages have stagnated (Macovei 2020).

The second argument, about feeble technological advance, is not supported by facts either. Technological progress has actually accelerated over the last two decades if one considers the growing number of patent applications, the increase in research and development (R&D) spending as a share of GDP (graph 6) and the exponential improvement in computing power, microchip capacity, artificial intelligence, big data, and nanotechnology (UNCTAD 2018). However, neither accelerating innovation nor investment can lead to sustainable growth in the capital stock and output if the factors of production are misallocated by counterproductive government intervention. The bottom line is that monetary policy can completely misguide investment if interest rates are set too low due to a gross underestimation of the natural interest rate, as shown in the reminder of the article.

Graph 6. Number of world patents and R&D spending

Source: data from World Bank and OECD Statistics.

ESTIMATING THE NATURAL RATE OF INTEREST

Summers’s claim that the natural interest rate has declined significantly is based on calculations by Thomas Laubach and John C. Williams, two Fed economists who estimated that the natural interest rate fell to almost zero in the United States during the financial crisis and remained at that level until 2016 (Holston, Laubach, and Williams 2017; and Laubach and Williams 2003). Using a statistical technique known as the Kalman filter, they derived the natural rate of interest from the deviation of the model’s prediction of GDP from actual GDP. The GDP deviation from potential output is used as a proxy for the neutrality of the monetary policy and indicates how much the real federal funds rate has deviated from the natural rate of interest.

The macroeconomic model used by Laubach and Williams suffers from the inherent limitations of economic modeling in general. It provides an oversimplified image of the real world and assumes that past trends will continue unabated in the future. Laubach and Williams did not calculate the natural rate of interest based on past observations, but derived it from projections of an unobservable concept of potential output. There is a more fundamental issue in their specific case, however. As noted by Salerno ([2017] 2020), New Keynesians, including Laubach and Williams, have borrowed Wicksell’s concept of natural rate of interest but applied it differently. New Keynesians have defined the “neutral,” or “natural,” interest rate as the interest rate that prevails when the economy is expanding at its potential rate, i.e., with full employment of factors of production and at stable inflation. As a result, this new concept of a “full employment real interest rate” used by Summers reflects different characteristics than Wicksell’s natural rate, which is only the loan interest rate, which is neutral in respect to commodity prices. Therefore, the results of Laubach and Williams’s model are not necessarily consistent with the natural rate of interest described by Wicksell.

Starting from Wicksell’s original definition, Salerno ([2017] 2020, 122) notes that the natural rate of interest “is nothing but the basic or long-run rate of return on investment in the structure of production,” and makes his own estimates of the natural rate based on the rates of profit for US nonfinancial corporations, as calculated by the US Bureau of Economic Analysis (BEA). The return on investment is calculated either as (i) the ratio of companies’ net operating surplus to net stock of produced assets, i.e., fixed assets and inventory, or (ii) the ratio of companies’ corporate profits to their net stock of produced assets. The numerator, i.e., the measure of corporate profitability, includes the pure rate of interest and entrepreneurial profit. Rothbard ([1962, 1970] 2009, 370) explains that in an “evenly rotating economy” (ERE) the rate of return on investment is equal to the pure rate of interest because there is no uncertainty and the entrepreneurial profit rate is zero.15 In turn, Salerno argues that the entrepreneurial profit rate is close to zero or only slightly positive also in a real economy where output per capita grows very slowly such as the United States. He notes afterward that the US companies’ after-tax average corporate rate of return has varied between 6.2 percent and 8 percent from 2006 to 2015.16 Salerno concludes that Wicksell’s natural rate of interest showed no trend of significant decline toward zero as claimed by Summers, but actually increased to around 8 percent in 2015.

This article follows Salerno’s methodological approach and tries to estimate the natural rate of interest based on the BEA’s US National Income and Product Accounts (NIPA), but uses a somewhat different and more granular calculation of capital and corporates’ return on investment. The approach, suggested by Wicksell and elaborated upon by Rothbard ([1962, 1970] 2009, 373),17 treats capital differently from other productive factors, such as land and labor.18 The production of capital is imputable in the long run to land, labor, and time; capital is therefore not an independent factor of production that earns a net interest rent for its owner, not least because capitalist-entrepreneurs take a risk in advancing money to the other factors of production “in the expectation of being able to recoup their money with a surplus for interest and profit after sale to the consumers” (Rothbard [1962, 1970] 2009, 355).19

Accordingly, the businesses’ return on investment is calculated by subtracting from the net operating surplus of private enterprises20 all advances to factor owners which are not directly linked to interest on “liquid capital,” such as “rental income”, “proprietors’ income” which includes a significant wage component of sole proprietorships and partnerships, and negligible “business current transfer payments.” The result includes the sum of “corporate profits adjusted for inventory valuation and capital consumption of domestic companies”21 and of “net interest paid on financial assets.” This amount is divided by the net stock of produced assets (private and nonresidential),22 to which, deviating from the results presented by Salerno, the capitalists’ expenditure on factor incomes, labor, and land are added. According to Rothbard, investment in each stage of production includes both durable and nondurable capital goods. The latter represent the services of original factors which, although assimilated to consumer goods in mainstream economics and statistics, are actually mixed with existing durable capital in the production process in order to yield a final product. As a result, Rothbard ([1962] 2009, 401) argues that “it is inadmissible to leave the consumption of nondurable goods out of the investment picture” and to “single out durable goods, which are themselves only discounted embodiments of their nondurable services and therefore no different from nondurable goods.”

According to this calculation, the US companies’ return on investment, which is here assimilated with the normal, i.e., natural, rate of interest in the real monetary world, varied between 5 percent and 7.8 percent from 1951 to 2019 (graph 7). The level of about 6 percent recorded over 2015–19 refutes once more Summers’s assertion that that natural rate of interest has declined to almost zero in the United States since the Great Recession. There has been a moderate decline in US companies’ return on investment from 7.5 percent in 1985 to around 6 percent in 2019, split between a larger drop of about 2 percentage points in the rate of net interest payments and an increase in the rate of corporate profits of about 0.5 percentage points. This decomposition of return on investment illustrates well the fact that even if loose monetary policy and credit expansion have artificially reduced the loan interest rate in the economy, the return on investment, i.e., the discount between present and future goods, has not been reduced proportionally, because business uncertainty drove up the entrepreneurial profit component.

Graph 7. Natural rate of interest (% p.a.)

Source: data from US Bureau of Economic Analysis; own calculations.

It is hardly possible to achieve a precise decomposition of the return on investment into its two components, identified by Mises and Rothbard—natural rate and profit risk rate—in the absence of modeling approximations. But it does not even appear to be necessary to make this split, because “the interest rate is equal to the rate of price spread in the various stages” of production, which tends to be uniform for every good and every stage throughout the economy (Rothbard [1962, 1970] 2009, 371). In a real market economy this interest rate deviates from the natural or pure rate of interest, because uncertainty creates entrepreneurial risk. However, as Salerno explains, these deviations are likely to be modest, not least because the market process selects the entrepreneurs which are most able to deal with uncertainty. At the same time, increased government intervention in the economy can add to uncertainty and may raise the entrepreneurial risk rate, as seems to have happened in the US economy over the last two decades (graph 8). Nevertheless, this would only increase the spread between the various stages of production and the discount between present and future goods, which is in fact the interest rate guiding economic activity and reflecting changes in time preference.

Graph 8. US business confidence index

Source: data from FRED.

According to the calculation presented here, the natural interest rate did not drop to zero after the financial crisis and has actually remained consistently and significantly above the federal funds rate and the bank loan prime rate since the early 2000s, when monetary policy was eased significantly (graph 9). Moreover, the gap has widened considerably since the Great Recession, contradicting Summers’s “secular stagnation” hypothesis. At the same time, the large deviation of both the key monetary policy and the bank lending rates from the natural rate, accompanied by an acceleration of credit growth to double-digit rates at the onset of the boom preceding the GFC fits the Austrian business cycle theory very well (graph 10).23

Graph 9. Interest rates vs. the natural rate (% p.a.)

Source: data from FRED and the BEA; own calculations.

Graph 10. Bank credit expansion (% p.a.)

Source: data from FRED.

A final argument that Summers (2015a and 2015c) made to reinforce his claim that monetary policy had not been expansionary was the perceived “substantial decline in the rate of inflation” and outright fears of deflation in the wake of the financial crisis. Although Consumer Price Index (CPI) inflation has moderately trended downward in the United States since the early 1990s and was briefly slightly negative at –0.4 percent in 2009 (Graph 11), Summers’s reliance on a single inflation indicator can be very misleading about the underlying inflationary pressures and structural imbalances in the economy. First, consumer price inflation has averaged about 1.8 percent per year since the GFC and until the start of the COVID-19 pandemic,24 which is very close to the Fed’s annual inflation target of 2 percent, thus invalidating Summers’s fears that inflation would persistently remain below target. Second, as Rothbard ([1962, 1970] 2009, 1003; his italics) notes, “credit expansion raises prices beyond what they would have been in the free market and thereby creates the business cycle.” The fact that inflation decelerated is not the relevant point, because consumer prices continued growing consistently when deflation should have accompanied a curative recession following the GFC. Rising consumer prices, in particular when labor productivity was also growing by about 1 percent annually (OECD, 2021) and the recovery was incomplete and dependent on unprecedented government support, indicates that the market rate continued to be set below the natural interest rate and not the opposite.25 Third, the long-term decline in CPI inflation was most likely due to other factors than an alleged restrictive monetary policy. Williams (2021) claims that CPI inflation in the United States has been underestimated due to changes in the calculation methodology. According to his “Alternate Inflation Chart,” which calculates CPI inflation with the 1990 formula, inflation has actually ranged between 4 and 6 percent annually for the past decade.

Graph 11. CPI and import price inflation (% p.a.)

Source: data from FRED.

In addition, the mainstream definition of inflation as an increase in prices is considered inadequate by Austrian economists. Price inflation lumps together different monetary and nonmonetary causal factors, based on both voluntary changes in preferences on the market and government intervention, which have different consequences for the structure of production, incomes, and individual wealth. Therefore, Austrian economists define inflation as an increase in the supply of money beyond any increase in specie, i.e., commodity money such as gold or silver (Rothbard [1962, 1970] 2009, 1021–22). According to this definition, monetary policy was clearly expansionary after the financial crisis, as the Fed increased the monetary base almost five times from August 2008 until a prepandemic peak of about $4 trillion six years later (graph 12). Broad money supply increased at a slower pace due to the postboom debt overhang, bank balance sheet repair, piling up of excess reserves with the Fed, and greater uncertainty, which bolstered cash balances. Yet, the M2 monetary aggregate almost doubled to around $15 trillion from 2009 until 2019, triggering substantial asset price inflation. The stock market, as reflected by the S&P 500 Index, increased by over 260 percent, whereas housing prices, according to the S&P/Case-Shiller U.S. National Home Price Index, increased by almost 60 percent from their post-GFC troughs until the end of 2019.26 Moreover, substantial net financial outflows and a strong US dollar, facilitated by the latter’s “exorbitant privilege,”27 have limited the impact of the large monetary expansion on domestic consumer prices. This is illustrated by subdued import price inflation, which held back overall CPI inflation in the United States (graph 11).

Graph 12. US money supply

Source: date from FRED.

According to the ABCT, the depression is the recovery phase which allows market forces to liquidate the malinvestments and distortions from the boom while the economy moves toward a higher natural rate of interest. The latter provides incentives to entrepreneurs to start new investments that deliver sound economic growth. During a depression, a higher natural rate of interest is implicit in a larger price differential between the various stages of production, which is usually the result of a contraction in the supply of money and credit (Rothbard [1962, 1970] 2009, 1005–06). But this curative recession has not taken place in the wake of the financial crisis. Policies advocated by Summers, such as the Fed’s drastic cut of the policy rate down to zero and aggressive quantitative easing have maintained the misalignment of the bank lending rates with the natural rate of interest, inflating both the money supply and the price level. This has prolonged the boom’s distortions in the structure of production and relative prices, hampering a sound economic recovery and stoking the next crisis, as evidenced by the growing asset price bubbles, which were subsequently exacerbated by the unprecedented monetary and fiscal stimulus during the COVID-19 pandemic.

CONCLUSION

Summers’s new “secular stagnation” hypothesis has been instrumental in providing a theoretical justification for the extension of ultraloose monetary and fiscal policies in the aftermath of the global financial crisis even as they failed to revive economic growth. His main argument that an excess of savings over investment has led to a significant decline in the natural rate of interest not only suffers from inner inconsistencies, such as the insufficient distinction between nominal and real interest rates and between nominal and real savings and investment, but is also refuted by available statistics on savings, investment, capital stock, and productivity. Moreover, his claim that the natural rate of interest has dropped to zero while monetary policy has been constrained by the zero lower bound is wrong. Both the federal funds rate and the bank prime loan rate have been consistently suppressed well below the natural rate of interest since the early 2000s, triggering and subsequently prolonging the current business cycle, as anticipated by the Austrian business cycle theory.

It follows that Summers’s policy recommendations, which he himself calls “palliatives” and “unlikely to be long-term solutions,” are also bound to do more harm than good. Before the United States and other major economies worsen their decline in productivity growth and head toward long-term stagnation, punitive indebtedness, and gradual impoverishment, it is time to change course, normalize monetary policy, and reduce the heavy burden of interventionist policies. This would clean up malinvestments, realign the structure of production with the time preference prevalent in society, and rekindle business initiative and sound growth. If policies to stimulate demand have not worked for about three decades in Japan and for one decade in the rest of the world, then it should be obvious to policymakers that this has been the wrong recipe all along.28

1. The natural rate of interest concept was developed by Wicksell ([1898] 1962), and although mainstream economists started using it as well, they modified its meaning, as explained below. Summers uses interchangeably the concepts of “natural,” “equilibrium,” or “neutral” rates, which he defines as “the interest rate that will prevail when the economy is at full employment and price stability” (Summers 2017). 2. Hansen (1939, 14) concludes his speech by saying that economists “will not perform their function if they fail to disclose the possible dangers which lurk in the wake of vastly enlarged governmental activities.” This is another surprising statement coming from someone often referred to as “the American Keynes.” 3. Professor and Nobel Prize winner for his Keynesian modelling Lawrence Klein had linked secular stagnation to the idea of a negative natural rate of interest for the first time in 1947. 4. Despite the fact that from 2009 to 2015 and since March 2020 the Federal Reserve System has kept the federal funds rate close to zero and the Bank of Japan and the European Central Bank have been even bolder in slashing monetary policy rates. The former has kept its key interest rate at –0.1 percent since 2016 and also added a 0 percent target for the ten-year Japanese government bond yield. The latter has operated with a 0 percent key rate and a negative rate on its deposit facility since 2014. 5. “Particularly in the 2003–07 period it is appropriate to regard Ben’s savings glut coming from abroad as an important impediment to demand in the United States. Ben and I are, I think, in agreement that it is important to think about the saving-investment balance not just for countries individually, but for the global economy“ (Summers 2015b). 6. Although this has not prevented the U.S. nonfinancial corporate debt from soaring over the last decade while a sizeable portion of it was used for financial risk taking in share buybacks, fuelling another stock market bubble (Howard 2020). 7. Summers argues that Europe and Japan are exporting their secular stagnation to the U.S. by having very low equilibrium interest rates which cause capital outflows, a depreciation of their currencies, and a transfer of demand from the United States. This argument resembles John Hobson’s theory of domestic underconsumption leading to imperialistic expansion in search for new markets and investment opportunities overseas which later influenced Lenin and modern Marxists (Hobson, 1902). 8. Bernanke was also critical of this inconsistency, noting that real interest rates can fall to –2 percent with a 2 percent inflation target (Summers 2015b). CPI inflation averaged 1.8 percent in the U.S. during the decade following the global financial crisis and Summers himself (2015c) presents a chart showing that the real yield of ten-year U.S. Treasury Inflation-Protected Securities (TIPS) has been negative for almost two years over 2012–13. 9. Board of Governors of the Federal Reserve System (US), Deposits, All Commercial Banks [DPSACBW027SBOG], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DPSACBW027SBOG, June 25, 2021. 10. The Federal Reserve System has gradually cut the federal funds rate to an almost record low of 1 percent from August 2003 to June 2004, a level not seen since the 1950s. 11. For an additional critique of Summers’s neglect of “real savings” in his “secular stagnation” hypothesis see also Shostak (2020). 12. The capital stock per employee is calculated from the annual change in “capital services,” which is estimated by the OECD using the rate of change of the productive capital stock, taking into account wear and tear, retirements, and other sources of reduction in the productive capacity of fixed capital assets. To ensure data comparability, the OECD capital services measures are based on a common computation method for all countries. See data at OECD Statistics (Growth in GDP Per Capita, Productivity and ULC, accessed June 23, 2021), https://stats.oecd.org/Index.aspx?DataSetCode=PDB_GR. The total capital stock decelerated in the US as well during 2000–09 and only the relatively larger drop in employment during the global financial crisis has caused the capital stock per employee to advance further. 13. China and India are the two most populous countries in the world, each of them accounting for about 19 percent of world population. 14. In countries such as the US, Germany, UK, and France, population growth was pretty constant on average from the 1970s until the GFC and only declined more visibly after the GFC, most likely because of the weak economy due to failed policy response. 15. Rothbard also uses the methodological device of the ERE introduced by Mises, which abstracts from change and uncertainty and helps define a state of equilibrium where all prices are final prices, the rate of originary interest is the same for all commodities, and all factors of production are employed to provide the highest-valued service possible. This analytical tool is used to better understand the entrepreneurial function and isolate interest income. 16. When using net operating surplus rather than corporate profits to calculate the return on investment, results vary: the after-tax corporate rate of return is then between 11.7 percent in 2009 to 13.6 percent in 2015. 17. Rothbard has in turn built on the works of Böhm-Bawerk and Frank A. Fetter in developing a unified and consistent theory of factor distribution explaining the relationship between capital, interest, and rent. 18. In Wicksell’s ([1898] 1962, 168) own words, “It might be possible to obtain some information from the accounts of individual enterprises and from the annual reports and dividends of companies. But it has to be remembered that the thing that is commonly regarded as interest does not correspond to the use to which we are applying the term; for it usually covers not only interest on liquid capital, but consists far more largely of rents of every kind: rents of land, monopoly rents, the return on buildings and durable machinery.” 19. In other words, interest income is not derived from concrete capital goods, but from the fact that capital owners restrict their present consumption and advance present goods, i.e., money, to factor owners who are producing the future goods that capitalist-entrepreneurs acquire, hold, and process before they later sell to consumers. For this service of advancing time to the owners of factors, capitalists are paid the pure interest, which is equivalent to the price discount between present and future goods (Rothbard [1962, 1970] 2009,348 and 374). 20. Presented in BEA NIPA (table 1.10, “Percentage Shares of Gross Domestic Product,” last modified May 27, 2021), https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey. 21. This adjustment is important to exclude from corporate profits “capital gains or losses, which reflect changes in the prices of existing assets, but not in the real stock of produced assets” and account for the consumption of capital in production. 22. Presented in BEA NIPA (Table 5.10, “Changes in Net Stock of Produced Assets (Fixed Assets and Inventories),” last modified Sept. 2, 2020), https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey. 23. For a detailed account of how the economic developments surrounding the GFC can be explained by the ABCT, see Salerno (2012). 24. US Bureau of Labor Statistics; Consumer Price Index (CPI) Databases; All items in U.S. city average, all urban consumers, not seasonally adjusted; series ID CUUR0000SA0; https://data.bls.gov/cgi-bin/surveymost; June 25, 2021. 25. Salerno ([2017] 2020, 120) explains that Wicksell’s cumulative increase in the price level implies a steady increase in the price level, not necessarily accelerating inflation, and refutes Selgin’s claim that zero interest rates were not the result of the Fed’s expansionary monetary policy. 26. Macrotrends; S&P 500 Index – 90 Year Historical Chart; https://www.macrotrends.net/2324/sp-500-historical-chart-data; June 25, 2021 and S&P Dow Jones Indices LLC, S&P/Case-Shiller U.S. National Home Price Index [CSUSHPISA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CSUSHPISA, June 26, 2021. 27. This refers to the advantage derived by the US dollar as the world’s international reserve currency in terms of increased foreign demand for US dollar cash holdings, following the Bretton Woods arrangement. 28. Several contemporary Austrian economists have argued that the 2020 financial crisis and economic slump were already in the making before the COVID-19 pandemic hit. See Bishop (2020).