How Nixon and FDR Used “Crises” to Destroy the Dollar’s Links to Gold

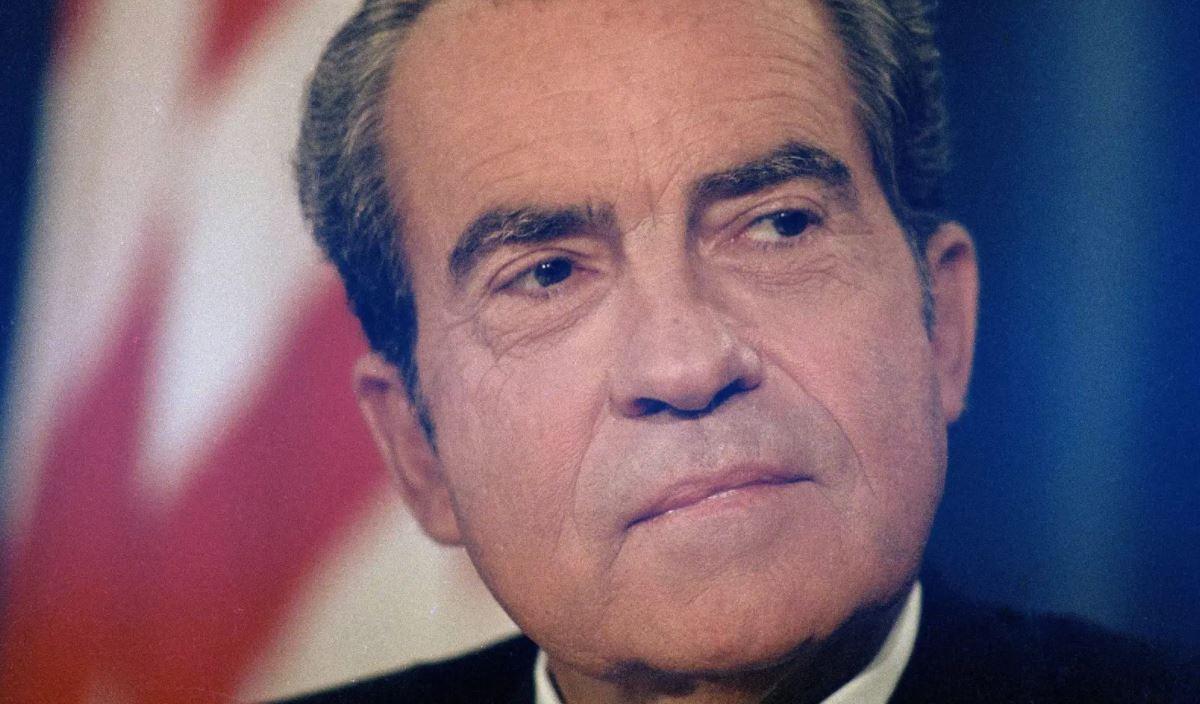

Since August 15, 1971, the US dollar has been completely severed from gold. President Richard Nixon suspended the most important component of the Bretton Woods system, which had been in effect since the end of World War II. Nixon announced that the US would no longer redeem dollars for gold for the last remaining entities that could: foreign governments. Gold redemption had been made illegal for everybody else, so this action finally ended any semblance of a gold standard for the US dollar.

In Crisis and Leviathan, Robert Higgs showed how in the twentieth century the US government grew in size and scope primarily during crisis periods like wars or economic depressions. The powers gained during those periods were often advertised as “temporary,” but history shows that governments rarely relinquish powers. This “ratchet effect” applies to the way Nixon “temporarily” suspended gold redemption in 1971—the resulting regime of unbacked fiat dollars remains in effect today.

What Was the Bretton Woods System?

The Bretton Woods system was designed by the Allied nations, led by the United States, near the end of World War II as a postwar international monetary order. The US dollar would become the world’s reserve currency, which foreign governments could redeem for gold, even though US citizens could not. This prohibition was not new for US citizens, since Franklin D. Roosevelt outlawed private ownership of gold coins and bullion in 1933.

To get foreign governments to join the agreement, the US promised to redeem dollars for gold at $35 per ounce, which limited the extent to which the supply of dollars could be expanded. International trade was slow to restart after World War II, which meant that the Bretton Woods system of gold exchange was not fully tested until the late 1950s.1 Yet, even by this time, US inflation meant that Japan and countries in Western Europe were holding a reserve currency that was falling in value, especially relative to the promised $35-per-ounce price of gold.

The US could only use diplomatic pressure to slow the foreign governments’ requests for gold redemption. Even so, the US lost about 55 percent of its stock of gold from the early 1950s to the end of the Bretton Woods system in 1971.

In a last-ditch effort to maintain the Bretton Woods system in 1968, the US tried to implement a “two-tier gold market” such that central banks around the world would participate in one market that would seek to keep the $35-per-ounce dollar-to-gold ratio, and would not buy or sell in the other tier: the private, free gold market.

This, of course, quickly fell apart. By 1971, President Nixon could not contain the effects of the monetary inflation used to pay for the Vietnam War and Lyndon B. Johnson’s Great Society programs (including Nixon’s own expansions). Amid a host of desperate interventions such as new tariffs and wage and price controls, Nixon also “temporarily” suspended gold convertibility. He sought to “protect the position of the American dollar as a pillar of monetary stability around the world.”

The dollar was completely severed from any commodity backing, making it a purely fiat money. The Federal Reserve could now inflate without any regard for redemption demands from private citizens, businesses, foreign governments, or foreign central banks.

The Result: Inflation

Anyone should have been able to predict the consequences of this event. A government with a ready buyer of debt in the form of an unrestrained central bank can spend much more, since the redistributive effects of inflation are less obvious than taxation. Gold redemption was a strict limiting factor for the Fed—now the only constraints are political and subjective, despite the appearance of technical expertise at the Fed.

The threat of running out of gold has been replaced with the softer, lagged-consequence question: “To what extent will voters tolerate price increases and financial crises?” And even the negative political consequences may be exploited via Cantillon effects by creating and rewarding a chosen set of powerful, politically connected winners at the expense of a less powerful, propagandized population of losers.

The consequences of the closure of the Bretton Woods system and the remaining façade of sound money it represented are well documented. Time series of almost any macroeconomic statistic show a “structural break,” i.e., an abrupt change in the trajectory of the series, around 1971 or shortly after. A website with the tongue-in-cheek URL WTFHappenedIn1971.com provides numerous such examples. Measures of monetary inflation, price increases, inequality, financial crises, saving rates, government spending, government size and scope, social/cultural indicators, incarceration rates, and even meat consumption and the number of lawyers all have inflection points in the early 1970s.

Financial Crisis and Leviathan

Besides the economic consequences of unhinged central banks, we should also understand the means by which the government was able to acquire so much control over money. Looking at episodes like Woodrow Wilson’s creation of the Federal Reserve, FDR’s confiscation of gold, and Nixon’s cancellation of Bretton Woods, as well as all of the other times the government chipped away at sound money, we notice a commonality. Crises, real or merely perceived, are exploited each time.

Wilson rode the wave of fear of financial panics and the concern for farmers desperate for credit that had been stirred up by William Jennings Bryan and other progressives. Wilson emphasized the “urgent necessity that special provision be made also for facilitating the credits needed by the farmers of the country” and painted an apocalyptic picture of a world without his proposed banking system reforms:

I need not stop to tell you how fundamental to the life of the Nation is the production of its food. Our thoughts may ordinarily be concentrated upon the cities and the hives of industry, upon the cries of the crowded market place and the clangor of the factory, but it is from the quiet interspaces of the open valleys and the free hillsides that we draw the sources of life and of prosperity, from the farm and the ranch, from the forest and the mine. Without these every street would be silent, every office deserted, every factory fallen into disrepair.

FDR was the master of crisis exploitation. Executive Order 6102 begins this way:

By virtue of the authority vested in me by Section 5 (b) of the Act of October 6, 1917, as amended by Section 2 of the Act of March 9, 1933, entitled “An Act to provide relief in the existing national emergency in banking, and for other purposes,” in which amendatory Act Congress declared that a serious emergency exists, I, Franklin D. Roosevelt, President of the United States of America, do declare that said national emergency still continues to exist and pursuant to said section do hereby prohibit the hoarding of gold coin, gold bullion, and gold certificates within the continental United States by individuals, partnerships, associations and corporations.

Just one month earlier, FDR had mandated a bank holiday, suspending all withdrawals of gold from banks. His proclamation cited a “national emergency” due to “increasingly extensive speculative activity” and “heavy and unwarranted withdrawals of gold and currency from our banking institutions for the purpose of hoarding.”

Almost forty years later, we see speculators being used as scapegoats again. In Nixon’s announcement, he accused “international money speculators” of profiting off monetary crises and “waging an all-out war on the American dollar” as if they were the ones causing the volatility in foreign exchange markets and the wholesale drainage of gold from the US, not the US government’s own irresponsible profligacy.

In all of these episodes, the US presidents framed the power grab as a necessary and sometimes temporary response to a crisis. Financial panics, the threat of starvation, gold hoarders, and external speculative attackers were all used as a basis and cover for doing what governments have done for millennia: debasement, coin clipping, and money printing for the purpose of surreptitious extraction of wealth from a population.

Only the most naïve could see the history of money and banking in the US as anything other than a ratchet of government growth, especially in the twentieth century. Even recent Fed actions follow the same pattern.

Conclusion

The Bretton Woods system was the last remaining vestige of the gold standard. As weak as it was, it limited the Fed’s ability to expand the supply of dollars due to the possibility of other governments redeeming their dollars for gold. When Nixon suspended the key component of the international agreement, he ushered in a new era of central bank monetary policy unhindered by any promise to redeem dollars for a certain weight of gold.

The economic and cultural consequences of this event have been disastrous: even more inflation; exacerbated inequality via Cantillon effects; more government, both in size and scope; higher rates of time preference; severe financial crises and business cycles; and, of course, higher prices.

The end of the Bretton Woods system followed the same pattern all other episodes in the demise of the gold standard followed. A crisis (real or just perceived) was exploited to announce a “temporary” measure or an “essential reform” of the existing system. The bigger picture shows a government that has finally gained 100 percent control over money and banking in the form of unbacked fiat money issued by an unrestrained central bank.

1. In What Has Government Done to Our Money?, Murray N. Rothbard also notes that most world currencies were overvalued because they started out at their pre–World War II exchange ratios with gold (through the US dollar), even though much inflation had transpired over the course of the war. This, combined with a very large stock of gold, gave the US some “room” to inflate, which is one reason why the Bretton Woods system lasted as long as it did. See Rothbard, What Has Government Done to Our Money?, 5th ed. (Auburn, AL: Ludwig von Mises Institute, 2010), pp. 99–100. (Thanks to Kristoffer Hansen for pointing this out to me.)