Bitcoin: Problems and Prospects

(As many Alt-M readers will know, my interest in Bitcoin goes back to its earliest days, and even before that: like my grad school mentor and regular Alt-M contributor Lawrence White, I took part in the 1990's "cypherpunk" movement that

Warburton on Theories of Monetary Control and the Fed

In December 1946, Clark Warburton published an article in the Political Science Quarterly titled, “Monetary Control under the Federal Reserve Act,” which was reprinted in chapter 14 of his landmark book, Depression, Inflation, and Monetary Policy (1966). He argues that

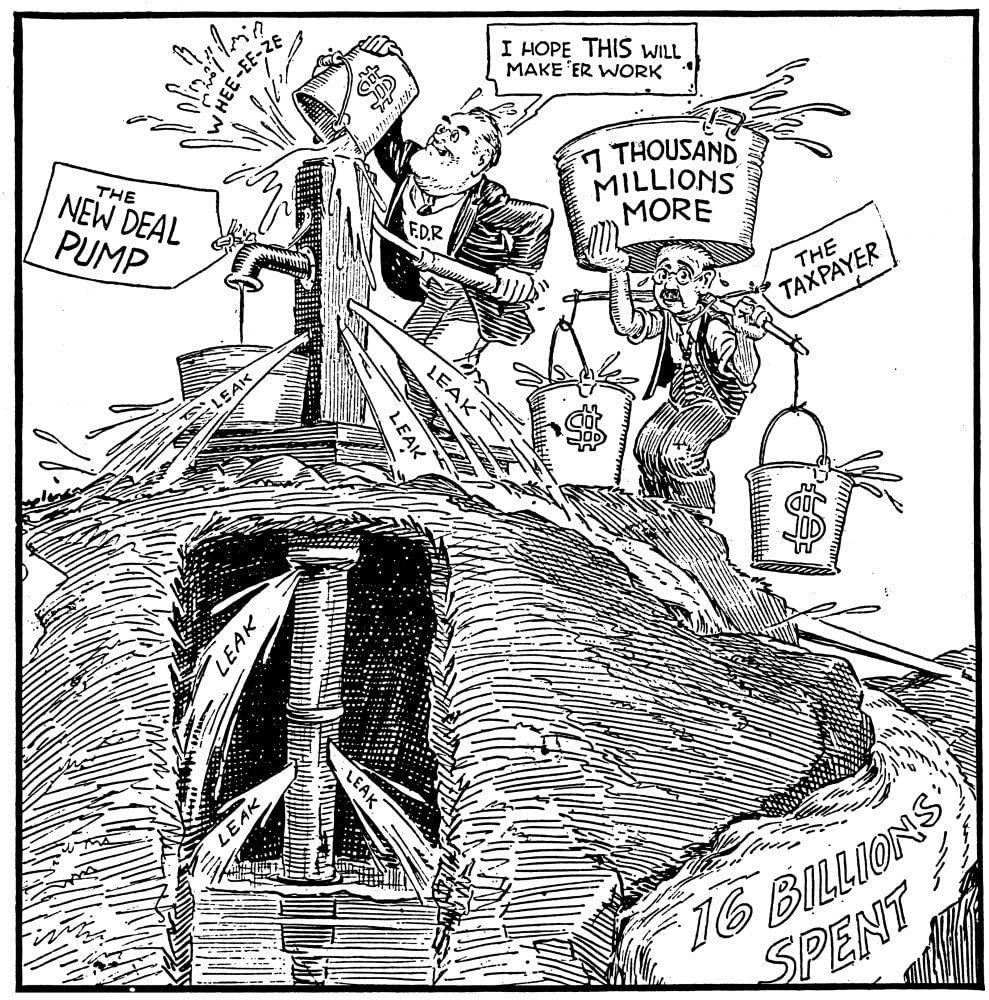

The New Deal and Recovery, Part 17: The Keynesian Myth, Concluded

(Previous installments of "The Keynesian Myth" are here and here.) Balancing Act As Richard Adelstein (1991, p. 177) observes, far from taking Keynes's advice that he ratchet-up the federal government's deficit spending, "Roosevelt held fast to the ideal of a balanced budget

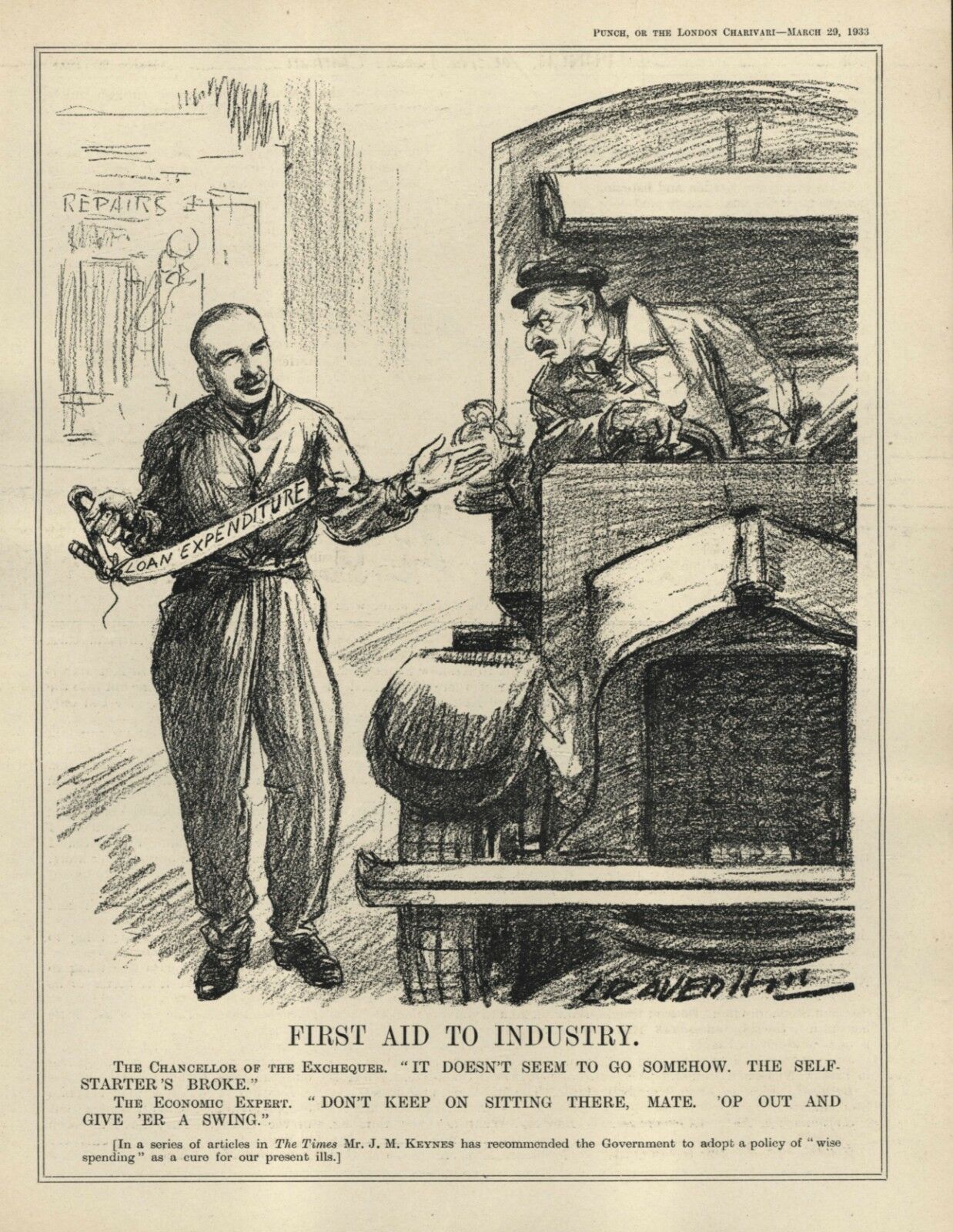

The New Deal and Recovery, Part 16: The Keynesian Myth, Continued

(The first installment of "The Keynesian Myth" is here.) All-American Money Makers Although conventional wisdom has it that Keynes considered government spending far more capable of ending the depression than monetary expansion, that certainly wasn't his view in 1931: during lectures he

The New Deal and Recovery, Part 15: The Keynesian Myth

(The first of an essay in 3 installments.) In The Money Makers, his 2015 book on the New Deal and its aftermath, Eric Rauchway says that FDR "conducted an active monetary and fiscal program of recovery…working along lines suggested by Keynes."

How to Think Straight about Bitcoin’s Social Costs and Benefits

Building a bridge is costly: It takes labor and machinery and raw materials that have alternative uses. Does it follow that building it is a waste? No. Waste occurs when the cost incurred exceeds the benefit attained. Cost greater than

Friday Flashback:Why there is no Fiscal Case for the Fed’s Large Balance Sheet

(As the Fed is once again planning to unwind its balance sheet, the size of which doubled as a result of its COVID-19-crisis Quantitative Easing, we think it worthwhile to draw your attention to a 2017 exchange, on the fiscal

Making Money Myths

Twice now, on this forum back in 2013, and on Twitter more recently (see here and here), I've taken Yale economics professor Gary Gorton's publications to task for misrepresenting the historical record of private currency systems. In particular, I've criticized him

The Contagion Concoction: The Truth About Runs and the Great Financial Crisis (CMFA Working Paper No. 006)

The post The Contagion Concoction: The Truth About Runs and the Great Financial Crisis (CMFA Working Paper No. 006) appeared first on Alt-M.

Missed it by That Much: Where the Fed’s Digital Currency Proposal Goes Wrong

The Fed's long-awaited report on central bank digital currencies is finally out. Although the report makes it clear that the Fed has no immediate plans to issue a digital currency, it does point to the approach the Fed would be