The New Deal and Recovery, Part 17: The Keynesian Myth, Concluded

(Previous installments of “The Keynesian Myth” are here and here.)

Balancing Act

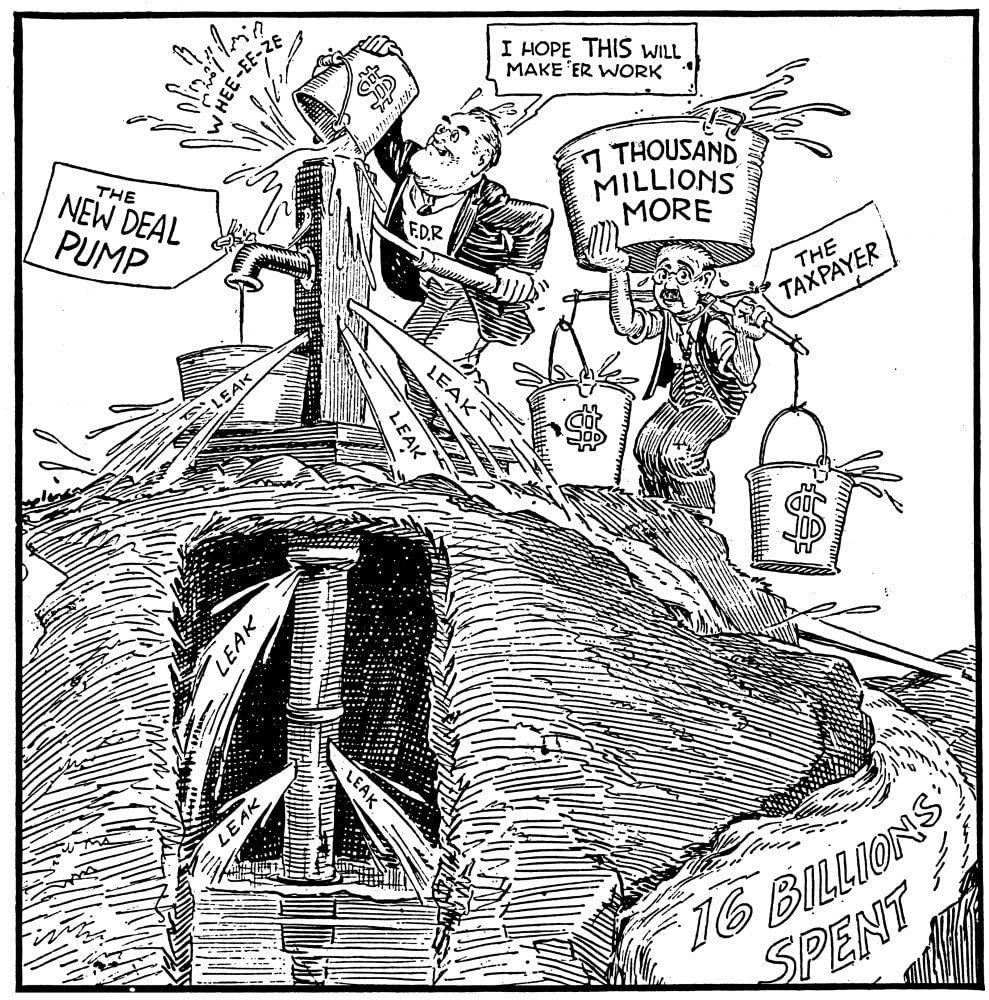

As Richard Adelstein (1991, p. 177) observes, far from taking Keynes’s advice that he ratchet-up the federal government’s deficit spending, “Roosevelt held fast to the ideal of a balanced budget and remained the chief opponent within the administration of an aggressive program of public works.” Instead of making spending on public works a central component of the New Deal’s recovery program, Vladimir Kazakévich (1938, p. 476) explains, FDR regarded it as a mere “auxiliary to [that program’s] other schemes.”

Despite Roosevelt’s desire to avoid large deficits, for three fiscal years during the 30’s—1934, 1936, and 1939—his administration’s deficits were higher than Hoover’s largest. But as I noted in a previous essay, the ’36 deficit was only as large as it was because Congress passed a $2 billion veteran’s bonus bill over FDR’s veto. As the chart below shows, though federal expenditures themselves more than doubled between 1933 and 1937, federal receipts also rose considerably. Consequently, Roosevelt’s deficit spending never quite reached 7 percent of GDP in any fiscal year before the U.S. entered the war.

Furthermore, as Bradford Lee (1982, p. 65) points out, according to standard measures of the “full employment surplus,” no two consecutive New Deal budgets packed a greater fiscal-stimulus punch than that of Hoover’s 1930 and 1931 budgets; and relative to modern notions of fiscal stimulus, that punch was nothing more than a feeble jab. “In brief,” E. Cary Brown (1956, p. 869) says, wrapping-up his classic reappraisal of “Fiscal Policy in the ‘Thirties,” “it took the massive expenditures forced on the nation by the second world war to realize the full potentialities of fiscal policy. Until then, the record fails to show its effective use as a recovery measure.”

If these facts seem surprising, it’s because, as Keynes’s influence grew during the 1950s and 1960s, historians became increasingly inclined to treat the New Deal as a practical application of Keynesian thinking, to which FDR gave his unstinting support. According to this account, if deficit-financed spending on public works didn’t go far enough, it was the fault, not of FDR himself, but of his more conservative cabinet members and advisors. The generally excellent Zach Carter (2020, p. 292), for example, follows many other writers in pinning the blame on Henry Morgenthau who, he says, “urged Roosevelt to pursue a balanced budget to improve the confidence of businessmen in his leadership.”

But such accounts should be taken with a grain of salt. In truth, Julian Zelizer says in an essay published a little over two decades ago, fiscal conservatism was less a constraint upon than “a key component” of the New Deal, and that was so not just because some of Roosevelt’s most important appointees and advisors were fiscal conservatives but because Roosevelt was one as well. Hence his condemnation of Hoover’s deficits during the ’32 campaign. Hence his own promise, during his October 1932 campaign speech in Pittsburgh, to balance the federal budget, provided he could do it without letting anyone starve. Far from seeing “a complete and honest balancing of the Federal budget” as a goal at odds with ending the depression, Roosevelt considered it the only “sound foundation” for a “permanent economic recovery.”

Nor did Roosevelt change his tune once in office. Determined to keep his promise, he chose the rabidly orthodox Lewis Douglas as his Budget Director in 1933, and had him prepare the legislation that became the Economy Act of March 1933, slashing the Federal budget by $243 million. Roosevelt had hoped to slash it by more than twice that amount. “Too often in recent history,” he told Congress in a message defending his economic plan, “liberal governments have been wrecked on rocks of loose fiscal policy.” According to Arthur Schlesinger (1958, p. 10), whose account of Roosevelt’s efforts is nothing if not sympathetic, “Roosevelt spoke with deep sincerity. His fiscal notions were wholly orthodox. He saw little difference so far as budgets were concerned between a household or a state government on the one hand and the federal government on the other.”

Though the Economy Act failed to balance the budget, Roosevelt did not stop trying, especially by finding new ways to increase tax revenues, until the outbreak of the Roosevelt recession, when it became all too clear that the cause was lost.

None of this attempted budget-balancing was forced upon a reluctant FDR. If he never managed to balance the budget, and if his deficits were sometimes larger than Hoover’s, it wasn’t because he defied his orthodox advisors: it was because, between them, the state of the economy, essential relief spending (to which FDR had committed himself), and much federal spending that he did oppose, made unwanted deficits inevitable. Keynesian thinking had nothing to do with it.

Zelizer is especially scornful of what he calls “Whiggish” attempts to portray Roosevelt, and the New Dealers generally, as Keynesians. In fact, a strong case can be made that FDR’s fiscal conservatism was even less “Keynesian” than Herbert Hoover’s had been, because, as Herbert Stein (1966, p. 223) explains, resorting to aggressive deficit spending required more than “a new, Keynesian model of the economic system,” and even a determined Keynesian would have hesitated to advise heavy deficit spending under the conditions the prevailed during Hoover’s presidency. “What was necessary,” Stein says,

was a change in the basic facts. There had to be a coordinated or permissive monetary policy, so that government not force up interest rates to an undesired degree. There had to be either international economic independence or international economic cooperation so that domestic expansionary policy would not be hamstrung by adverse international trade reactions or flight from the currency. … The Government’s fiscal policy did not begin to change until after these facts had changed.”

By February 1934, the facts had changed. Yet FDR wouldn’t really embrace deficit spending for several more years. Only the limited extent of the recovery, and his unwillingness to withdraw needed relief spending, kept him from actually balancing the budget. Come 1937, which another overwhelming election victory behind him and the economy appeared to be making real progress, Roosevelt decided to have another crack at it.

The Keynesian Conversion

The turning point was the Roosevelt Recession. In response to it, in his 1938 Annual Message to Congress, Roosevelt stated his intention to seek funding for large-scale massive government spending, to be financed by borrowing rather than increased taxation. Some suppose that Keynes finally won the president over to his thinking; and it’s true that Keynes wrote him around that time, chiding him for having done little since his 1934 visit to arrange for spending at the required scale, particularly on housing, public utilities, and transport. Keynes also blamed the 1937 downturn on Roosevelt’s having “greatly curtailed” public works spending earlier that year, and told him that only “a large sale recourse” to such spending could “maintain prosperity at a reasonable level.”

But Keynes’s letter—his first to Roosevelt in several years—was dated February 1st, whereas Roosevelt gave his Annual Message to Congress on January 3rd. The President had therefore already formed tentative plans to spend more before Keynes wrote. He accordingly had Morgenthau draft a perfunctory reply, on March 3rd, thanking the “eminent economist” for “his confirmation” of what was already FDR’s settled policy.

But there are also good reasons for supposing that, if anyone really got FDR to change his mind about deficits, it was Eccles and Currie. Eccles had tried to discourage FDR’s attempts at budget balancing with a 1936 memo on the subject, only to have Morgenthau resolved to “dynamite” his arguments, as Eccles later told his staff, lest Eccles should end up displacing him as Roosevelt’s fiscal policy advisor. The dynamite worked—for a while. But, when the economy nose-dived in autumn of 1937, no amount of high explosives could prevent many from thinking that Eccles had been right all along. Eccles took advantage of this when, the day after FDR’s Annual Message, he told the Senate Unemployment and Relief Committee that the government would have to raise public spending by $1 billion to keep the recession from getting worse.

But bold as it was, Eccles’ recommendation was modest compared to the $3 billion in new relief spending that Currie and E.L. Henderson recommended when they met with Roosevelt at Warm Springs that March. To cinch the argument, Currie prepared his now-famous April Fool’s day memo on “Causes of the Recession”, in which he explained in great detail how net “activity-creating” Federal expenditures had contributed to the recovery, and how their reduction undid much of it. Just how much credit Eccles and Currie each deserve for getting FDR to finally decide, on April 14th, 1938, to resume deficit spending, isn’t clear. Dean May (1976, p. 98) says that Currie’s views “provided the most convincing justification for a resumption of spending policies forced by circumstances upon a reluctant president,” while Patrick Renshaw (1999, p. 35) gives Curries top billing. But it hardly matters since both men held virtually identical opinions, and neither of them was John Maynard Keynes.

What’s more, it is far from clear that Roosevelt’s new-found willingness to tolerate deficit spending really marked a sea-change in his thinking, let alone a genuine embrace of “Keynesian” thinking. Renshaw himself doesn’t think so: FDR’s April 14th decision, he says, “did not mark his conversion to Keynesian notions about how to manage the trade cycle of a capitalist economy.” John Kenneth Galbraith, who knew all the actors involved, is still more adamant: in his opinion, despite their temporary victory Currie and Lauchlin “did not, at any time, persuade F.D.R.” to overcome his dislike of deficits:

It is my view, supported by the weight of modern historical judgment, that Roosevelt remained committed to the deeper canons of conservative finance—the broad principle of the balanced budget—until the advent of war swept this issue aside.

Zelizer (2000, pp. 352-3) likewise considers the view that the 1938 deficit signaled FDR’s fiscal conservatism to Keynesian thinking “misleading.” Relative to what Keynes considered necessary, he points out, the ’38 deficit was very modest: as a proportion of U.S. GDP it was, in fact, smaller than the 1936 “Bonus Payment” deficit passed over Roosevelt’s veto. “Moreover,” Zelizer says, “within a year…a conservative congressional coalition of southern Democrats and Republicans” was able to push deficit spending back down until the start of World War II took the lid off government spending altogether. In truth, Alan Brinkley (1995, p. 104) argues, the 1938 deficit was a mere “augury of the timid, halfhearted way in which Americans would embrace Keynesianism for most of the next forty years.”

Or was it? Although Renshaw (1999, p. 337) claims that “what could be called a ‘Keynesian approach’ to economic management had emerged by 1945,” the vast amounts the U.S. government spent in “defense of democratic existence” can hardly be said to have reflected the influence of Keynesian economics. If a “Keynesian approach” did take hold, the proof would have to come afterwards—such as during postwar reconstruction. Yet Robert Skidelsky (pp. 498-505), who is nothing if not devoted to Keynes, doubts that it did so even then. “To be sure,” he says, “governments consumed a larger share of the national income than before the war and this contributed to stability. But this was because of the extensive post-war nationalisations and expansion of the social services. Neither had an explicit warrant in Keynesian theory; neither was undertaken for Keynesian reasons. Nor for that matter was America’s recession-proof military spending.” It could be the case, in other words, that long after the New Deal, Keynesian economists were still telling presidents “to do what they’d already been doing.”

***

To return to where this last set of essays began: although I claim that, instead of helping to end the Great Depression, many New Deal policies actually made it worse, I don’t do so because I object to Keynesian economics, or because I reject the more general claim that expansionary monetary and fiscal policies can counter economic downturns. On the contrary: I take for granted that the depression was fundamentally due to the collapse of spending after 1929, and that recovery depended on a revival of spending, however it might be accomplished. If this combination of beliefs seems paradoxical, it’s only because so many people wrongly suppose that the New Deal was an exercise in Keynesian economic policy, when in fact it was, for the most part, nothing of the kind.

The popular tendency to identify the New Deal with Keynesian economics has had an unfortunate effect on discourses concerning the merits of each. It causes fans of Keynesian economics to rush to the defense of New Deal policies that Keynes himself disparaged. It even causes some to claim that the New Deal brought the depression to an end—an opinion Keynes (and everyone who lived through the depression) would have considered risible. On the other hand, it causes the New Deal’s conservative critics to treat the New Deal’s failure to end the depression as evidence of the wrongheadedness of “Keynesian” thinking. To think clearly about what the New Deal did, or failed to do, one has to recognize that the New Deal and Keynesianism were very different things, just as Roosevelt and Keynes were very different men.

Continue Reading The New Deal and Recovery:

Intro Part 1: The Record Part 2: Inventing the New Deal Part 3: The Fiscal Stimulus Myth Part 4: FDR’s Fed Part 5: The Banking Crises Part 6: The National Banking Holiday Part 7: FDR and Gold Part 8: The NRA Part 8 (Supplement): The Brookings Report Part 9: The AAA Part 10: The Roosevelt Recession Part 11: The Roosevelt Recession, Continued Part 12: Fear Itself Part 13: Fear Itself, Continued Part 14: Fear Itself, Concluded Part 15: The Keynesian Myth Part 16: The Keynesian Myth, Continued Part 17: The Keynesian Myth, Concluded

The post The New Deal and Recovery, Part 17: The Keynesian Myth, Concluded appeared first on Alt-M.