Rothbard Explains How to Recover from an Economic Crisis

Confronted with a severely weakened economy as the consequence of the policy-ordered lockdowns, governments now get ready to apply another severe blow to the economy. The favorite means is more deficit spending. In the United States, President Biden announced a stimulus program amounting to $1.9 trillion. This amount would enter an economy that is already flush with liquidity. During the past twelve years, the American central bank has expanded its balance sheet in three major boosts, first from $900 billion in July 2008 to $2.1 trillion in November 2008, then from $2.8 trillion in November 2012 to $4.5 trillion in November 2014, and, finally, from $3.8 trillion in September 2019 to $7.6 trillion in February 2021.

This monetary expansion has not yet led to a significant rise in the price level, because during this period the velocity of monetary transactions (GDP/M1) has fallen from a factor of 10.6 in the fourth quarter of 2007 to 3.5 in the fourth quarter of 2020. The effect of monetary inflation has not yet shown up in the prices of goods of services but lifted has the prices of financial assets and real estate.

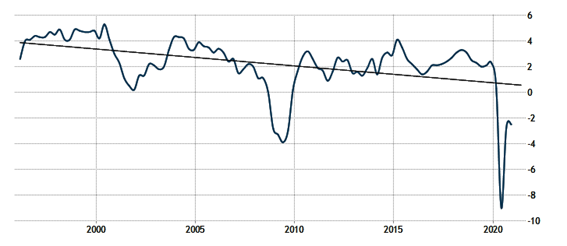

Along with the monetary stimulus came an enormous fiscal boost since 2008. The public debt quotient (federal government debt as a percent of GDP) rose from 62.6 percent in 2007 to 100 percent in 2012 and had reached 107.6 percent in 2020. Nevertheless, these massive fiscal and monetary stimulus policies in response to the crisis of 2008 have not led to strong economic growth (figure 1).

Figure 1: US Annual Economic Growth Rate of Real GDP, 1995–2020

Source: TradingEconomics

There is little to expect from the Biden plan to boost long-term economic growth. His scheme will most likely fail as have all of these past policies. After a short-lived rebound, the economy will fall back into a slump. After this quick spike, however, conditions will get worse than before. Instead of getting out of the slump, such stimulus policies deepen and prolong the stagnation in the long run.

Bringing back prosperity requires a different set of policies. What is needed is economic growth founded on capital accumulation. Such a policy is particularly urgent in the face of the current crisis, because the lockdowns have diminished the capital stock of the economy on a worldwide scale and have interrupted the supply chains. In such a situation, the application of vulgar Keynesianism amounts to outright insanity. Such a policy that promises to prevent depression and to get the economy out of stagnation will produce the opposite result. This stimulus policy will deepen and prolong the slump. There is ample evidence that the so-called fiscal multiplier of public expenditure does not work as promised.

A different path is liberating the private sector from regulatory confinements and alleviating the tax burden. Such policies prepare the path for an economic recovery. Instead of extending public assistance, the entrepreneurial spirit must be fired up. The tricks of debt management and new monetary policy schemes will not help. The key is sustainable economic growth. As the economy grows and incomes and employment rise, the public debt ratio falls, and thus the threat of higher inflation recedes.

A debt-driven recovery has two possible consequences. It may happen that even big stimuli do not lead to an expansion of demand. In this case, the final consequence of the expansionary policy is not only that the slump continues but that the policy has also brought about a higher public debt ratio, which in turn diminishes the future economic growth potential. If, however, the stimulus policy should work as intended, and the economy experiences a strong rebound, this economic expansion will be aborted by higher price inflation as the expansion of demand finds its constraint in deficient capacity.

Rothbard’s Recipe

The right way out of the mess is the application of the Rothbardian recipe as it was developed by Murray Rothbard in his analysis of the Great Depression. In this book, Rothbard explains that it is not more public debt that is the way out of a depression but the expansion of the private sector. Recent empirical studies confirm this thesis.

Reducing the obese state through fiscal retrenchment leads to economic expansion. The more the public sector shrinks, the more the private business sector can expand. It is not more public debt that drives the economy, but entrepreneurship, which thrives in liberated markets.

The private sector does not need stimuli beyond the prospect of profits. When profit expectations rise because the conditions for private business activity improve, investments will increase. More employment and rising incomes will follow. Higher profit expectations bring about capital investment, and thus the groundwork is laid for higher economic growth.

Less spending, more savings, and laissez-faire is the Rothbardian recipe against the crisis. In his book America’s Great Depression, Murray Rothbard applies the Austrian theory of the business cycle and denounces the measures that were taken by the Roosevelt administration to fight the depression of the 1930s. Measures to encourage more spending and inflate the economy while maintaining high wages and subsidizing unemployment worsened the crisis. Rothbard’s recipe for getting out of the slump is the opposite of what was done in the past during the Great Depression and what is practiced today (table 1).

Table 1: The Rothbardian Recipe: What to Do and What Not to Do

| What to Do | What Not to Do |

|---|---|

| Accelerate liquidation of bad investments | Delay liquidation of bad investments |

| Let deflation run its course | Reinflate the economy |

| Augment savings | Stimulate consumption |

| Curtail government spending | Increase government spending |

| Cut taxes | Raise taxes |

| Let wage rates fall | Stabilize wage rates |

Despite all contrary evidence about the Great Depression, due to relentless repetition in the mass media and the schools of higher learning, the myth continues to prevail that Roosevelt’s economic policies pulled the country out of the Depression. The contrary is the case. Roosevelt’s ill-conceived policies prolonged and deepened the depression. Different from the Keynesian and monetarists’ myths, neither expansive fiscal nor expansive monetary policy helped to get the economy out of the Depression.

The problem of the Great Depression was not a lack of demand but that the economic policies of Roosevelt devastated the entrepreneurial spirit and snuffed the confidence in capitalism.

Similar myths are being spread about the Marshall Plan. Its success did not depend on the size of the package (which was relatively small) but on the condition that in order to obtain the aid, the receiving countries had to consent to economic liberalization, monetary and fiscal stability, and the promotion of integration into the world economy.

Although Keynesian demand-side economics is no longer the hallmark of economics as an academic discipline, it is still deeply ingrained in politics and in central banking. Policy activism lies behind the measures, not sound economics. Governmental institutions exclude the solution, laissez-faire, from the outset without any further ado. Laissez-faire solutions are brushed aside, because politicians want action. Authorities in government play with other people’s money and they earn applause from those people who obtain some part of this public expenditure even though this kind of policy is harmful to the prosperity of the nation.

From the standpoint of Rothbardian economics this ongoing policy game is fully absurd. Rothbard’s recipe is not only a recipe to get out of the slump, but it is also a guideline not to fall into a slump: stay away from debt and let entrepreneurs in competitive markets do their job.

Conclusion

Large parts of the world have plunged into a serious economic crisis not because of a failure of the market economy, but because of the policies of the lockdowns. Now economic policy is at a crossroads. On one side, there is the temptation to go on with a policy of deficit spending and monetary expansion. The other way out would be audacious economic reforms in favor of free markets. The path of the stimulus policies would push the economy into a prolonged depression or, when accompanied by inflation, into stagflation. The other path would create a business-friendly environment and bank on the entrepreneurial spirit to bring about economic growth based on private capital investment. As of now, there is little hope that the correct path will be taken. Unfortunately, so it seems, it will take another catastrophe for many people to wake up.