Monetary and Fiscal “Stimulus” Is Undermining the Global Recovery

Expansionary monetary and fiscal policies have gone into overdrive all over the world since the beginning of the pandemic. This raises the obvious question of how long they can last before another crash follows. In its latest World Economic Outlook, from April 2021, the International Monetary Fund (IMF) is also concerned about rising macroeconomic vulnerabilities, noting that both governments and corporations are emerging from the pandemic overindebted, while financial vulnerabilities have surged. Nevertheless, the IMF’s policy recommendation remains almost unchanged: growth stimulus is indispensable and should continue to support an “inclusive recovery.” Government support should just be better targeted in order to reduce financial and macroeconomic risks. This article shows why the IMF’s recipe will not work.

Growth at Any Cost

The IMF claims that without the “unprecedented” policy support deployed during the pandemic, the contraction of the global economy by 3.3 percent last year would have been three times worse. Moreover, the government stimulus has allegedly prevented another systemic financial crisis. With an effective stimulus in place, the IMF is optimistic that the global economy will recover strongly, by 6 percent in 2021 and by 4.4 percent in 2022, and continue growing by about 3.3 percent over the medium term.

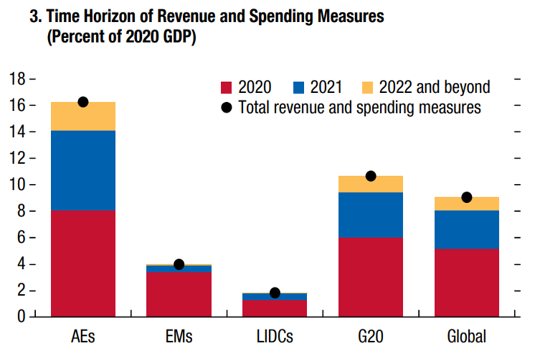

From a growth-accounting point of view, the IMF may be correct. Especially when its Fiscal Monitor reveals that a gargantuan fiscal stimulus of $6 trillion has been deployed globally until March 2021. This is a massive amount relative to a global GDP estimated at $85 trillion in 2020. Just the advanced economies have spent about 8 percent of GDP in fiscal measures in 2020 and have announced additional ones of about 6 percent of GDP for 2021 (graph 1). On top, central bank asset purchases of almost $10 trillion globally and relaxation of prudential rules for banks have reinforced already loose financial conditions and very low interest rates.

Graph 1

Source: IMF, World Economic Outlook: Managing Divergent Recoveries (Washington, DC: IMF, April 2021). AEs = advanced economies; EMs = emerging market economies; LIDCs = low-income developing countries.

But from a praxeological point of view, the IMF is definitely wrong. Government intervention on such a gigantic scale cannot rekindle sustainable economic growth and foster long-term prosperity. First, the brunt of the economic contraction did not come from the pandemic itself, but from misguided strict lockdowns of economic activity. With better-designed health measures this enormous government support would not have been necessary. Second, rising financial fragilities during the botched recovery from the Global Financial Crisis were already calling for bigger stimuli in order to avoid a new crash before the pandemic set in. The health crisis and irrational decisions to shut down entire economies only offered a convenient excuse for governments to act. Third, according to the Austrian business cycle theory (ABCT), growth stimuli cannot achieve sustainable growth, but only prolong a recession that ends an artificial boom. New credit injections and fiscal expansion are actually hampering a sound economic recovery by not allowing the liquidation of the boom’s malinvestment and the adjustment of the structure of production to the time preference prevalent in society.

As Daniel Lacalle notes, the current economic recovery in the US is very feeble relative to the size of the government support. Despite massive monetary and fiscal stimuli, which are almost three times larger than during the 2008 crisis, key economic data on capacity utilization, labor force participation, and unemployment have been disappointing so far. In the euro area, countries that have spent enormous amounts of money on policy support are still in recession. The euro area GDP has recorded another decline in real terms of –0.6 percent in Q1 2021, following a drop by –0.7 percent in Q4 2020. Even if major economies reach their prepandemic output level this year (the US) or next (the euro area and Japan), in line with the IMF’s projections, the serious problem of growing financial bubbles, malinvestment, and overindebted public sectors and zombie companies is not going away.

Mounting Financial Vulnerabilities

The IMF is well aware that this “unprecedented” policy support poses a great risk for financial stability. While it praises the extremely easy financial conditions that are allegedly growth supportive, it admits that they may fuel financial vulnerabilities which “were already elevated before the pandemic in some sectors.” On the latter we can obviously agree, and also on the fact that equity markets have surged to levels which are not justified by fundamentals according to the IMF’s models (graph 2). The IMF also shows that, in search of yield, pension funds and insurance companies expanded their investments into alternative assets such as private equity, infrastructure, and real estate, with greater leverage and risk. Nevertheless, the IMF remains adamant that monetary policy should stay accommodative to support credit growth, the economic recovery, and the stability of the financial system. And in order to prevent a further buildup of financial vulnerabilities, the IMF asks policymakers to tighten macroprudential policy tools while avoiding a broad tightening of financial conditions.

Graph 2

Source: IMF, Global Financial Stability Report (Washington, DC: IMF, April 2021).

The IMF’s compromise solution may seem a panacea, but it is not. Macroprudential policy tools are no magic bullet invented yesterday. They have been increasingly used in the aftermath of the Global Financial Crisis, as the IMF’s own report shows (graphs 3 and 4), but with little tangible result. From 2009 to 2019, a highly expansionary monetary policy more than doubled the M2 monetary aggregate, causing substantial asset price inflation. The stock market, i.e., the S&P 500 Index, increased by over 300 percent, whereas housing prices, i.e., the S&P/Case-Shiller U.S. National Home Price Index, increased by almost 60 percent, reaching levels well above their peaks prior to the Global Financial Crisis. Further tightening of macroprudential tools is not likely to solve the credit expansion problem, because as long as record-low interest rates and easy financial conditions are in place, all financial institutions—banks and nonbanks—will continue looking for ways to channel them to borrowers and boost profits.

Graphs 3 and 4

Source: IMF, Global Financial Stability Report (Washington, DC: IMF, April 2021).

Corporate Debt and Resource Misallocation

The IMF concedes that the corporate sector is emerging from the pandemic overindebted. Large companies with market access have used easy financial conditions to boost their liquidity, while smaller firms have also added debt by relying heavily on public loans and guarantees. The nonfinancial corporate debt reached a worldwide record of 91 percent of GDP at end-2019 and grew by another 12 percentage points of GDP until Q3 2020 (graph 5). Total private sector debt—corporate and household—increased from 138 percent to 152 percent of GDP during the decade leading up to 2019 and by another 17 percentage points during the pandemic, due to both higher debt levels and output declines (graphs 5 and 6).

Graphs 5 and 6

Source: IMF, Global Financial Stability Report (Washington, DC: IMF, April 2021).

This massive buildup of leverage took place despite the tightening of macroprudential measures so much advocated by the IMF. The IMF is also getting worried that so much debt accumulation combined with weaker earnings is impairing the capacity of many firms to service debt, creating zombie companies (graph 7). The concern is particularly due to the fact that the number of high-yield corporate bond defaults reached their highest level since the Global Financial Crisis last year (graph 8) and corporate bankruptcies have declined during the pandemic due to policies to protect struggling firms. The IMF’s worries seem justified, only they are long overdue. Zombie companies already proliferated during the last decades of cheap money, and their share reached 12 percent of the total companies in advanced economies in 2016, from around 2 percent in the late 1980s, while 16 percent of US public companies were already “zombies” before the pandemic.

Graphs 7 and 8

Source: IMF, Global Financial Stability Report (Washington, DC: IMF, April 2021).

But how to deal with the “zombie firms” problem without withdrawing policy support and thus increasing the number of firm bankruptcies in the short term? This is another catch-22 to which the IMF offers an unworkable compromise solution. It suggests that policymakers identify viable companies, i.e., the ones expected to be profitable within a three-year horizon, when the recovery from the covid-19 crisis should take hold. Afterward, governments are asked to provide liquidity or equity-like support for the companies deemed as “viable” instead of letting the market dissolve unprofitable businesses. Aware of the high risk of moral hazard involved, the IMF suggests that governments partner with the private sector to assess the viability of firms and to put in place adequate safeguards. However, this is merely wishful thinking, because it is pretty clear in which direction governments are likely to err and that the scheme would most likely lead to a de facto socialization of many companies and economic sectors.

Public Sector Debt and Taxation

The massive fiscal stimulus deployed together with a sharp fall in revenues caused by the economic contractions led to a surge in government deficits and debt. According to the IMF, last year’s fiscal deficits averaged almost 12 percent of GDP in advanced economies and 10 percent of GDP in emerging market economies. Global public debt climbed to 97 percent of GDP in 2020, a jump of 13 percentage points from 2019. Public debt soared to 120 percent of GDP on average in advanced economies in 2020, reaching again World War II’s peak (graph 9). With public debt at close to 130 percent of GDP, the US is now in the same ballpark as France, Spain, and Italy.

Graph 9

Source: IMF, Fiscal Monitor: A Fair Shot (Washington, DC: IMF, April 2021).

In dealing with public overindebtedness, the IMF wants again to have the cake and eat it too. It is definitely against a premature withdrawal of the fiscal support that could slow the recovery. At the same time it is asking governments to put in place credible medium-term fiscal frameworks to rebuild fiscal buffers, but “at a pace contingent on the recovery.” In other words, fiscal consolidation can be expected only when growth becomes self-sustained, which is almost impossible as long as government stimuli are not withdrawn. What is even more worrying, the IMF believes that most countries will need to mobilize additional revenues to support the second stage of the recovery, which should be “green,” “digital,” and “inclusive.” Under these buzzwords, an avalanche of socialist polices are expected to shape up the brave new post-covid-19 world.

The IMF calls on governments to invest more in green infrastructure to fight climate change, in digitalization to boost productivity, and in education and health to boost human capital. Public services and social safety nets should also be strengthened to reduce inequality. As all this comes at a cost, governments are asked to increase the progressivity of income taxation and reliance on inheritance taxes, property taxation, and wealth taxes. Covid-19 recovery contributions and “excess” corporate profits taxes could also be considered, while unrestricted global tax competition should be eliminated. One can easily imagine the significant negative impact on growth and productivity that would come from this regulatory and taxation folly, in particular for economies which already struggle with bloated social welfare systems and oppressive taxation. One should not forget that total tax revenues and social spending have both increased by about 10 percentage points of GDP on average in Organisation for Economic Co-operation and Development (OECD) countries since 1965 (graph 10) while output and productivity growth have slowed considerably.

Graph 10

Source: OECD and IMF.

Lessons from the Great Depression

The growth stimuli which failed to deliver a sustainable economic recovery from the Global Financial Crisis have been reinforced to deal with the self-created problem of covid-19 lockdowns. As expected, economic growth is not only anemic, but also riddled with mounting financial vulnerabilities that illustrate the ongoing misallocation of resources. The IMF’s confidence that better-targeted stimuli would eventually deliver a sustainable recovery seems utterly misplaced. Despite ultraexpansionary monetary policy, the interest rates on the US ten-year bonds have risen significantly, by about 120 BPS (basis points) since the summer of 2020, driven by massive public debt issuance and higher inflation expectations. And the most recent Consumer Price Index (CPI) inflation figure came in at 4.25 percent in April, the highest monthly rate in more than ten years. A market-driven rise of long-term interest rates may disable the current stimulus policies and tip the current artificial recovery into another recession.

Moreover, the experience of the Great Depression shows that not only monetary and fiscal expansion, but the whole range of government policies that interfere with the functioning of free markets can undermine a sound recovery. Under both the Hoover and the Roosevelt administrations, crippling socialist interventions such as the sharp increase in foreign trade tariffs, the tax burden, minimum wages, labor regulations, and trade union protection created an insurmountable “regime uncertainty” and delivered a heavy blow to private enterprise, prolonging the depression until World War II. Today’s calls for a plethora of socialist polices to usher in the new postpandemic world pose a similar risk for the global economic recovery.