Murray Sabrin: How Entrepreneurs Beat the Fed-Generated Boom-Bust Cycle

Entrepreneurial businesses acknowledge and understand the inevitability of boom-bust cycles in the Fed-manipulated economy. But they refuse to be defeated or even deterred. They find the profitable pathway through both the boom and the bust. Murray Sabrin has compiled a guide in his latest book, Navigating The Boom/Bust Cycle, An Entrepreneur’s Survival Guide (Mises.org/E4B_142_Book).

Key Takeaways and Actionable Insights

So long as we have central banking, entrepreneurs will experience boom-bust cycles. They adapt to this reality.

Entrepreneurship is, in its essence, focused on the generation of new value, producing betterment, growth, and improvement. While customer preferences and the nature of competitive offerings may change, and conditions such as pricing and contracts may vary, entrepreneurs work towards continuous enhancement of markets.

Their efforts are thwarted by governments, who can’t leave markets alone to function smoothly, and especially to central banks who aim overtly at manipulating markets through artificial credit creation. Austrian entrepreneurs are acutely conscious of this problem, since they understand Austrian business cycle theory. But they must nevertheless adapt to the boom-bust problems the central bankers bring about.

The first tool of adaptiveness is the recognition that there is the private economy and the public economy are different and separate.

Some economists talk of a mixed economy, but, as Mises pointed out, such middle-of-the-road thinking is socialist. The public economy is where the government trades, including trading in money, debt, and credit manipulation, and in the regulations that governments use as their management tool.

Entrepreneurs seek to establish a private economy where the government does not trade. The most important part of the market where the government is absent is the creation of customer value, especially in the form of innovation. Governments destroy value and deny innovation. When entrepreneurs can operate in the light of value generation, leaving governments in the dark, there’s room for profitable operations.

Entrepreneurs can further protect their safe haven with good anticipatory timing of the boom-bust cycle. There are signals that help.

Murray Sabrin’s book provides a long list of websites and links where relevant data is published that can help entrepreneurs watch the trend that might signal the timing of the boom-bust cycle.

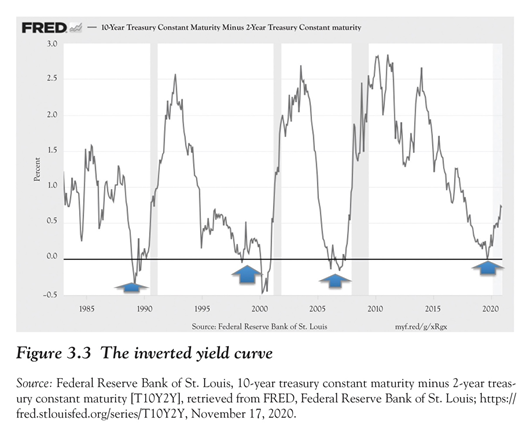

The first signal is the so-called inversion yield curve, when short term interest rates start to elevate, and even get to higher levels than longer term rates. This is unnatural, implying that there is greater uncertainty in the short term than the long term. It can only happen when markets are fearful of the short-term consequences of government policies and interventions, even though they are confident of entrepreneurially-induced growth and improvement in the long run.

As a rule of thumb, according to Murray, the beginning of a recession can be anticipated roughly one year from the inversion of the yield curve. Of course, other factors can intervene, such as the government’s idiotic shutting down of businesses over the fake COVID-19 pandemic. Nevertheless, entrepreneurs should pay attention to the yield curve signal. They can monitor it at Mises.org/E4B_142_Fred.

Another signal for entrepreneurs to monitor in the overall economy is the unemployment rate. This rate declines during the boom, and actually starts declining as the recession is ending or a few months afterwards. There are variations in the pattern by industry, which Murray describes in detail in the book. He provides a list of 12 St. Louis Fed employment data series to monitor, covering sectors such as manufacturing, durable consumer goods, finance and insurance, and construction.

He offers many more signals — such as homebuilder stock prices — to monitor boom-bust timing. There is plenty of data for the savvy entrepreneur.

Strengthening value effectiveness and value security beats managing for efficiency.

The economics profession has been guilty of misguiding entrepreneurs with its focus on efficiency, i.e., managing for fewer inputs per unit of output, and eliminating “waste”. It can cause fragility, impede value generation, and slow down innovation and responsiveness to change.

One example is the management of supply chains. Managing them for maximum efficiency can also make them insecure, if, for example, there are no ready supplier replacements when one slips up. We are experiencing the impacts of supply chain fragility right now in the US. It’s for reasons extraneous to regular business operations, but the effects serve to highlight the need to keep supply chains secure under attack from government interventions. Entrepreneurial businesses that develop the strongest possible upstream supplier relationships and cultivate a richly connected value network may be able to perform better when boom-bust hits the supply chain.

Entrepreneurs fight the Fed on inflation.

The Federal Reserve insists on maintaining its 2 percent inflation target, which is economically destructive in many ways (see “Why the Fed’s 2 Percent Inflation Standard Is So Bad” by Ryan McMaken: Mises.org/E4B_142_Article). Entrepreneurs pursue deflation, always aiming to deliver better quality at lower prices. Why? Because it’s what customers want, and entrepreneurs are in business to serve customer needs. Entrepreneurs bring abundance. The Federal Reserve, taking the position that higher prices are good for the economy, promotes scarcity.

Entrepreneurs make their workforce a strong resource, rather than a source of cost-cutting in economic downturns.

The purveyors of so-called efficient management traditionally see the workforce as a cost, and urges entrepreneurs to cut costs by firing people in economic downturns. Entrepreneurs focus on effectiveness instead, and see their workforce as a resource and a source of ideas and initiatives for improvement and adaptation in all environments. A motivated frontline workforce is closest to customers and can bring back information, ideas, and new initiatives to make the business more responsive to customer needs and more capable of delivering desired customer experiences. This is the case whatever the state of the Fed-manipulated economic cycle.

Growth entrepreneurs think expansively at all times.

Entrepreneurs create new value for customers, and they don’t call a halt to their pursuit of value just because of the macro-economic data that’s being reported in the mainstream media.

They understand that customer preferences, or the order of those preferences, may well change in a boom or a bust time, and they maintain their vigilance in monitoring and responding to these changes. These are the signals to which they respond, not the economic headlines. Entrepreneurs look for the opportunity to introduce new goods and services at all times, and not just at the “right” moments in the economic cycle. They’re always looking for new ways to deliver more value. Perhaps, in a downturn, there’s a greater call for service and repairs on existing equipment than for buying new equipment. Entrepreneurs can adjust and recombine their assets to provide more repair work and thus make up for lost sales revenue.

Entrepreneurs are great cash flow managers, and tend to keep cash on hand or available for those times when this level of money can be utilized for expansion. One potential application in this book is the acquisition of assets from other businesses in a downturn, when business operators who are less savvy run out of cash and offer assets for sale at low cost. Murray calls this “picking up the pieces”.

There may also be the opportunity to expand geographically into new regions. There’s always growth somewhere.

In sum, the answer to the boom-bust cycle is value agility.

In the 4Vs business model on the Economics For Business platform, the fourth phase of the value cycle is value agility. We use this term to indicate the speed of responsiveness that successful entrepreneurs exhibit in response to customer feedback. Murray Sabrin uses the same term in his book, and defines it as “a process where entrepreneurs… adapt and adjust to continue to meet consumers’ perceptions of value your business delivers” (p. 111).

He asks, “do entrepreneurs stick it out when the economy is in a slump or wave the white flag and close the doors?” Mastering value agility means never being faced with that agonizing decision.

Additional Resources

Purchase Navigating The Boom/Bust Cycle, An Entrepreneur’s Survival Guide at Mises.org/E4B_142_Book. Use promo code BOOM20 for 20% off.

See a preview of Murray Sabrin’s book at Mises.org/E4B_142_Preview (PDF).

“The 4Vs Business Model” (Video): Mises.org/E4B_142_Video

The Economics For Business platform: Econ4Business.com

“Why the Fed’s 2 Percent Inflation Standard Is So Bad” by Ryan McMaken: Mises.org/E4B_142_Article

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity (Chart): Mises.org/E4B_142_Fred