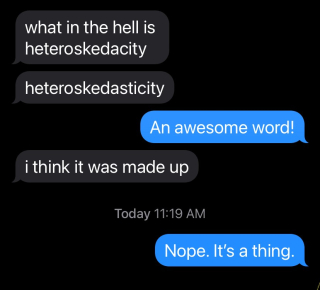

What in the hell is heteroskedasticity?

Official youngest (and only) son of Env-Econ is a junior in college. He is currently taking his first econometrics class. I got the text below on Friday:

Knowing full-well this is likely to get me in trouble, here’s my explanation of heteroskedasticity:

Somewhat Formal Definition: The standard approach to deriving the statistical properties of the ordinary least squares estimator relies on the assumption that the assumed error term has mean zero and constant variance across all observations. If the error term does not have constant variance but instead is correlated with one or more explanatory (independent) variables, then the errors are said to exhibit heteroskedasticity (hetero meaning different and skedastic meaning, um, well, skedattled?). Informal Statistical Consequences: Heteroskedastic errors screw up the estimates of the variance of the estimator. This means most of our statistical tests (and inferences from those tests) are whacked. Fortunately, heteroskedasticity only affects the variance of the estimates, so the estimator still gives us unbiased estimates of the mean of the parameters as long as the rest of the standard OLS assumptions hold. In other words, we’re still scattering darts around the bullseye, we’re just messing up our estimate of how scattered the throws land around the bullseye. My Take on Heteroskedasticity: As more and more data have become available, the variance properties of the OLS estimator have become less important. With a big enough data set, everything is statistically significant, whether we correct for heteroskedasticity or not. Undergraduate econometrics students should be familiar with the concept, in case they ever go on to graduate school, but it is far more important to make sure undergraduates know how to interpret the economic meaning of regression output rather than prove that we as professors know how to make easy ideas overly complicated.