The New Deal and Recovery, Part 24: The RFC

(In writing this series, I allowed myself to skip over some topics. But now that I'm turning the series into a book, to be published by the University of Chicago Press, I have to close those gaps. The most important

The New Deal and Recovery, Part 23: The Great Rapprochement

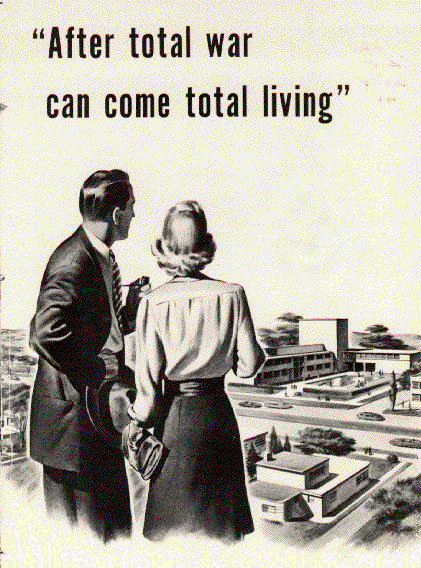

What finally brought the Great Depression to an end? We've seen that, whatever it was, it took place not during the 30s but sometime between then and the end of World War II when a remarkable postwar revival occurred instead

The New Deal and Recovery, Part 21: Postwar Monetary Policy

After an interruption due mostly to my move to Spain, I'm pleased to be back in the saddle again, wrapping up my series on the New Deal. I ended a previous installment of this series by observing that, despite many dire

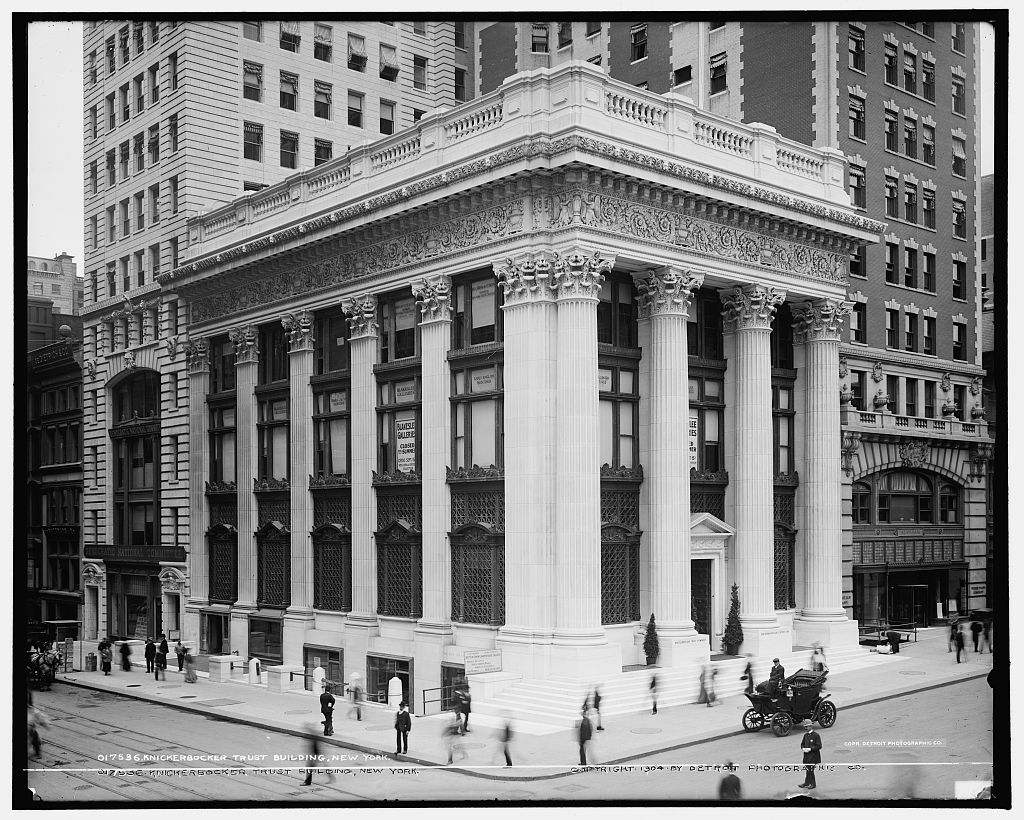

Diamond and Dybvig and the Panic of 1907

My last post argued that, despite what Diamond and Dybvig's famous theory suggests, bank runs have seldom proven fatal to otherwise sound banks. Instead, when people run on a bank, it's usually because it's already in hot water. In response to

Diamond, Dybvig, and Government Deposit Insurance

The 2022 Nobel Prize in Economics is to be shared by Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig, “for research on banks and financial crises.” Diamond and Dybvig are best known for their 1983 article, “Bank Runs, Deposit

Bank and Crypto Runs: F(ac)TX vs Fiction

On October 10th, Douglas Diamond and Philip Dybvig won the Sveriges Riksbank Prize in Economic Sciences, sharing it with Ben Bernanke "for research on banks and financial crises.” According to the prize committee, Diamond and Dybvig's research showed how the combination

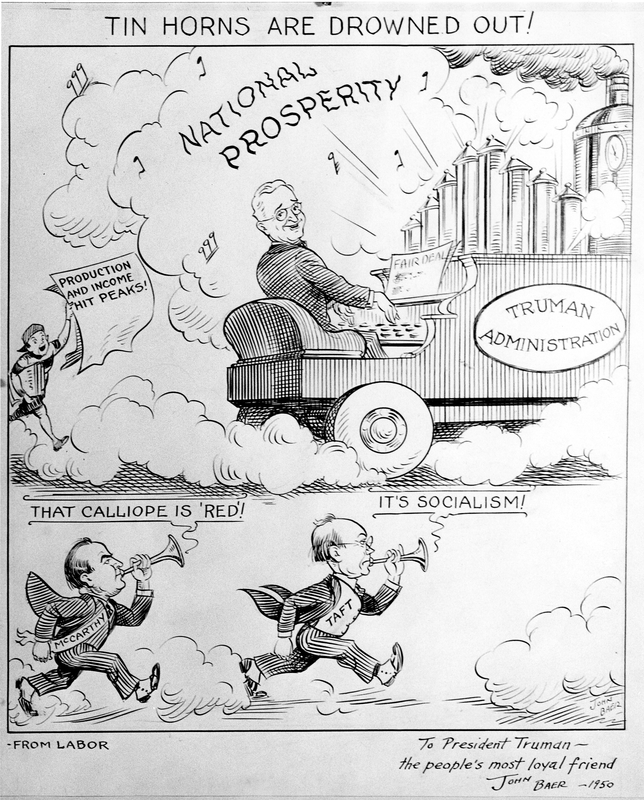

The New Deal and Recovery, Part 21: Happy Days

By the start of 1948, there could no longer be any doubt: the Great Depression wasn't coming back. Instead of collapsing at war's end, as many feared it would, combined government and private spending (as measured by nominal Gross Domestic

Stop Lionizing Paul Volcker and Villainizing Arthur Burns

In a recent Bloomberg column, former New York Fed President Bill Dudley echoes a conventional Fed narrative, contrasting Fed interest rate cycles under two supposedly distinct Chairmen. “Powell will need to find a way to persuade [markets] that he has no

How Common Has Private Currency Been?

Recently, an investment advisor and Bitcoin proponent tweeted the claim that “[f]or most of human history” the “[s]eparation of money and state was the norm, even if the state stamped their ruler's face on the coin.” Some strong disagreement (and

Is China a Threat to the Fed? A Critique of the Portman Report

Senator Rob Portman (R-OH), the ranking member of the Senate Homeland Security and Governmental Affairs Committee, released a new minority staff report on July 26 contending that, for more than a decade, China has made “a sustained effort . .