The Conspiracy Theory of History Revisited

Anytime that a hard-nosed analysis is put forth of who our rulers are, of how their political and economic interests interlock, it is invariably denounced by Establishment liberals and conservatives (and even by many libertarians) as a "conspiracy theory of history," "paranoid,"

Omicron: The Lockdowners’ Last Stand

Just as President Biden’s unconstitutional vaccination mandates were being ripped up by the courts, authoritarian politicians, public health bureaucrats, and the mainstream media, announced a new Covid variant to justify another round of lockdowns and restrictions. The things that didn’t

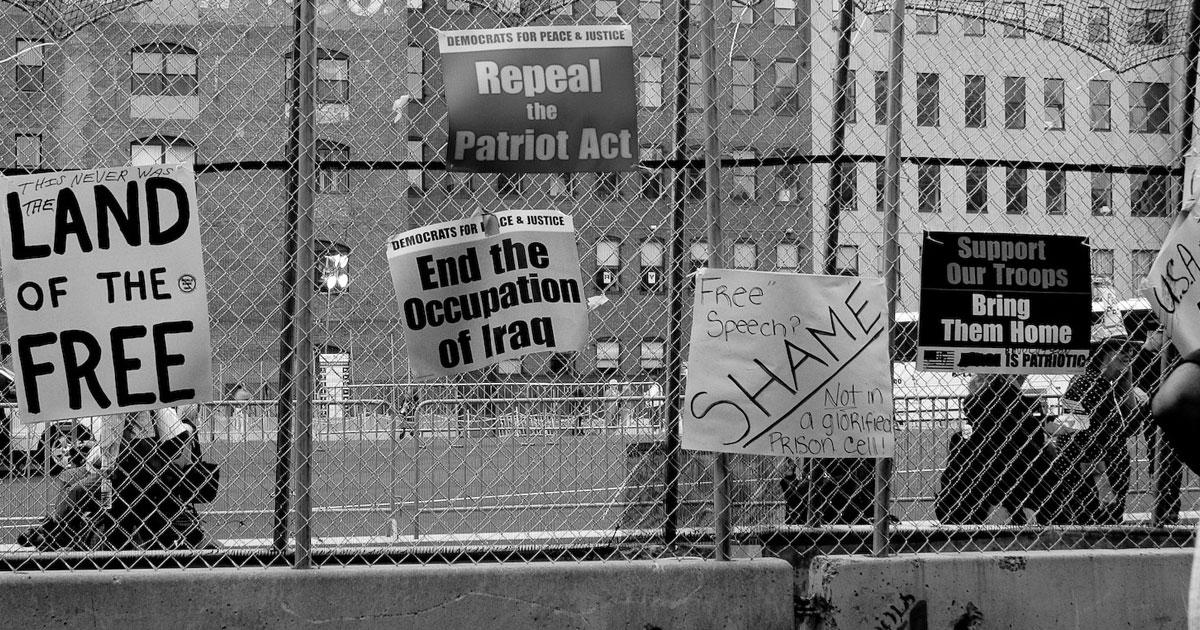

My Favorite Antiwar Protest: A Time of Mounted Park Police and “Free Speech Zones”

I’ve attended most of the major antiwar protests in Washington since 9/11. At a 2005 protest, a cop tried to whack me on the head with a wooden pole. At a 2007 protest, I snapped a picture showing George W.

End Roe v. Wade: It’s Time to Defederalize Abortion Policy

California has announced it seeks to become a "sanctuary state" for abortion should the Supreme Court overturn Roe v. Wade. That is, the situation would return much to what it was before 1973. Original Article: "End Roe v. Wade: It's Time

Victor Chor: The Journey From Flipping to Global High-Tech Brand Building

Entrepreneurship is fulfilling and exciting and inspiring. It’s fun. It’s learning. It’s a sense of achievement. It’s a journey. Economics For Business loves to spotlight individual journeys to illustrate what’s possible, provide learning about how to create and grow opportunities,

How Market Freedom Combats Economic Inequality

Joe Biden thinks that unless there's widespread government intervention in the economy, economic inequality "brews and ferments political discord and basic revolutions." Original Article: "How Market Freedom Combats Economic Inequality" This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by

Welcome to a New Chapter in the Latest Boom-Bust Cycle

What lies ahead is undoubtedly a rather sensitive chapter in the boom-and-bust-cycle drama caused by US monetary policy: the US Federal Reserve System (Fed) is about to end its ultraeasy course. The reason: after many years of exceptionally low interest

Liberty Defined

[This address was given before the Mont Pelerin Society at St. Moritz, Switzerland, on September 4, 1957.] There are times when one's humility seems to go on vacation, as it did for me when Professor Hayek proposed tackling this topic for

The Truth about Tulipmania

When the economics profession turns its attention to financial panics and crashes, the first episode mentioned is tulipmania. In fact, tulipmania has become a metaphor in the economics field. Should one look up tulipmania in The New Palgrave: A Dictionary

New York State Has Imposed New Covid Rituals. This Time There’s Some Resistance.

Friday, December 10, New York State governor Kathy Hochul reaffirmed the state’s status as the nation’s most zealous practitioner of covid cultism with the announcement of a new statewide “vax-or-mask” mandate. The mandate confronts businesses and physical institutions with a choice: