American Dissident: The Legacy of Murray Rothbard

Murray Newton Rothbard, perhaps the greatest enemy of the state in the second half of the twentieth century, would have recently celebrated his ninety-seventh birthday had he lived. Men are not salmon, those unique creatures that swim against the current. Most

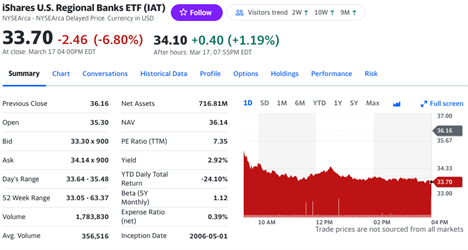

Yes, the Latest Bank Bailout Is Really a Bailout, and You Are Paying for It.

The Fed is launching a new billionaire bailout designed to keep banks afloat, and the FDIC is promising to back potentially trillions in deposits. The taxpayer will ultimately be on the hook. Original Article: "Yes, the Latest Bank Bailout Is Really

Why Governments Waste Resources: The Case of Newfoundland’s Joseph R. Smallwood

A key principle in understanding Austrian economics is seeing the inefficiency of government spending. In an era of overbearing states and reckless fiscal policy, this principle must be emphasized repeatedly. Politicians might claim the best of intentions when dishing out

Government Is as Government Does

If we have learned anything from hundreds of years of government oppression and atrocities, one thing is certain: government isn't our friend. Original Article: "Government Is as Government Does" This Audio Mises Wire is generously sponsored by Christopher Condon.

Donald Trump Is Wrong about Tariffs and Mercantilism

During the past few weeks, Donald Trump has been releasing some of his proposals if he were to win the election in 2024. While many of his positions pose great danger to personal liberty, such as his plan to “end

The Phillips Curve Is an Economic Fable

Keynesians and fellow travelers hold the Phillips curve to be sacrosanct. But because the Phillips curve cannot establish causality, it is useless as economic theory. Original Article: "The Phillips Curve Is an Economic Fable" This Audio Mises Wire is generously sponsored by

It Turns Out that Hundreds of Banks Are at Risk

It’s the weekend, but our fresh Financial Crisis does not sleep. And a recent study says we’ve only seen the tip of the iceberg. The Washington Post yesterday wrote: “If banks were suddenly forced to liquidate their bond and loan portfolios,

Socialism Isn’t about Creating Economies. It Is about Amassing Political Power

Ludwig von Mises wrote Socialism: An Economic and Sociological Analysis, a small book published in 1922, which demonstrated that economic calculation in a socialist commonwealth is impossible. Of course, Mises assumed that the purpose of an economy, even a socialist

How Easy Money Killed Silicon Valley Bank

The incredible growth and success of SVB could not have happened without negative rates, ultra-loose monetary policy, and the tech bubble that burst in 2022. Original Article: "How Easy Money Killed Silicon Valley Bank" This Audio Mises Wire is generously sponsored by Christopher

The Fed’s Huge Monetary Overhang Keeps Job Totals Up as Real Wages Fall

The current job market strength partly reflects the ongoing monetary overhang from years of breakneck growth in money-supply inflation. The $6 trillion in money that was newly created since 2020 is still very much a factor. Original Article: "The Fed's Huge Monetary Overhang