The New Deal and Recovery, Part 16: The Keynesian Myth, Continued

(The first installment of “The Keynesian Myth” is here.)

All-American Money Makers

Although conventional wisdom has it that Keynes considered government spending far more capable of ending the depression than monetary expansion, that certainly wasn’t his view in 1931: during lectures he gave then at the University of Chicago, he disappointed faculty members who themselves favored more spending on public works over monetary easing by expressing the opposite opinion.

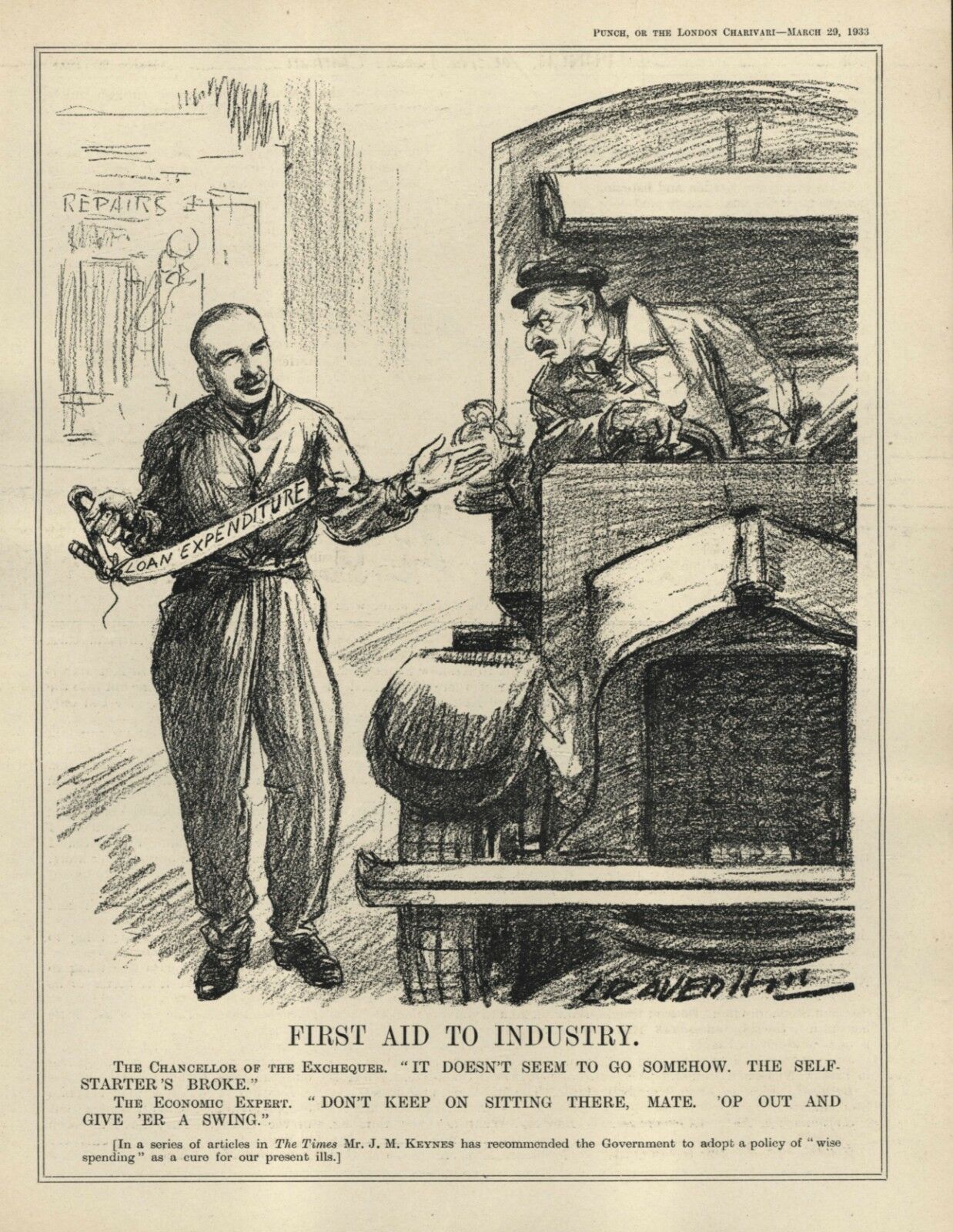

Nor had Keynes lost faith in monetary policy in March 1933, when he published a series of articles in the London Times, later republished as a pamphlet called The Means to Prosperity. In the second installment of that series, on “The Raising of Prices,” Keynes argued that boosting the public’s “aggregate spending power” called for aggressive “open-market operations to make bank credit cheap and abundant.” He then went on to accuse the Fed of having “bungled” by failing to load up on securities while it was still flush with gold.

As I showed elsewhere in this series, after Roosevelt took office the Fed kept right on bungling. Although the Thomas amendment authorized him to compel the Fed banks to buy up to $3 billion worth of government securities, he never took advantage of that authority.[1] Nor did his dismantlement of the gold standard make much difference: despite it, the Fed’s combined holdings of bills and securities remained virtually flat throughout the New Deal.

It is, nevertheless, misleading to suggest that the Fed bungled because no one there or in the administration took Keynes’s advice. As David Laidler (1999, p. 183) (among others) has observed, by the early 1930s, America had plenty of home-grown champions of expansionary monetary policy, with “vigorous and diverse” writings supporting their arguments. The government’s failure to take this American advice was far more blameworthy than its failure to heed that of a still far from famous British economist.

American economists had already started calling for a more expansionary monetary policy while Hoover was president. Fisher had long favored a dollar managed so as to keep the general price level stable. Having long tried, and failed, to get the government to adopt his “compensated dollar” plan, by 1928, when he published The Money Illusion, Fisher had instead come to regard stabilizing the price level, through discretionary open market operations and rediscount rate changes, as the Fed’s duty. Come 1932, in Booms and Depressions, he was blaming the depression on the decline in the dollar’s purchasing power, and calling for the Fed to “reflate” prices to their pre-depression level.

Earlier that same year, in a January, 1932 memo to Hoover, three young Harvard economists urged Hoover to support both aggressive Fed open market operations and more spending on public works. Nor were the three—Lauchlin Currie, Theodore Ellsworth, and Harry Dexter White—the only ones to do so. Their plea was soon echoed by 24 other economists, including a dozen from the University of Chicago. In short, as Laidler (n.d., p. 12) puts it, “contrary to later myths surrounding the so-called ‘Keynesian Revolution,’ support for vigorous open market operations was no novelty in the early 1930s.”

Novelty or not, so far as the Hoover administration was concerned, the American economists’ advice fell on deaf ears. The Roosevelt administration, on the other hand, looked likely to give them a hearing when Morgenthau, upon becoming Treasury Secretary in January 1934, invited one of them—the University of Chicago’s Jacob Viner—to form a “Freshman Brain Trust” to advise the government on monetary and fiscal policy. Viner in turn asked both Currie and White to join that group. It was while serving in the Freshman Brain Trust that Currie published The Supply and Control of Money in the United States, which, among other things, documented how the Fed’s failure to undertake open-market purchases large enough to keep the money stock from collapsing contributed to what Milton Friedman and Anna Schwartz, in their later and more famous account, christened the “Great Contraction.” Currie thus holds the unusual distinction of having been a forerunner of both the most celebrated Keynesian and his most famous critic!

Any of several events that followed Currie and White’s arrival at the Treasury might also have been expected to bring about a shift toward unstinting monetary expansion. First came the official denouement of FDR’s gold policy in February. Then came Marriner Eccles’ appointment, at Morgenthau’s suggestion, as Fed governor that fall, with Currie in tow as his chief advisor. Finally, there was the August, 1935, Banking Act that Eccles helped shape, transferring responsibility for setting discount rates and conducting open-market operations from the reserve banks to the newly-established Board of Governors.

Freed from the old gold standard constraint, and equipped with more discretionary power over monetary policy than any Fed governor ever was, the Fed’s first chairman was certainly in a position to up the Fed’s game: besides bringing Currie with him from the Treasury, Eccles himself had long supported what we now think of as “Keynesian” policies for combating the depression, though he, like Currie, came to his beliefs with no help at all from Keynes. “The concepts I formulated,” Eccles says in his 1951 memoir, “were not abstracted from [Keynes’s] books, which I have never read.” When, several decades later, Milton Friedman opined that Eccles “played a far greater role in the development of what later came to be called Keynesian policies than did Keynes or any of his disciples” (Israelsen 1985, p. 362), he was only saying what most historians of American macroeconomic thought now recognize.

But for Eccles, expansionary fiscal policy was the real key to restoring full employment. “Financial fuel,” he once wrote, isn’t enough; “[t]he Government…must apply the torch” (ibid., p. 360). The task of monetary policy, as Eccles understood it, was to underwrite expansionary fiscal policy, keeping interest rates low, so the Treasury could borrow cheaply. Because interest rates were in fact low throughout the depression, this understanding was perfectly consistent with the Fed’s continuing to play a passive role. The major exception to that stance—what Charles Calomiris and David Wheelock consider the Fed’s “first major policy initiative after 1933″—was the Fed’s controversial decision to double member banks’ reserve requirements during 1936 and 1937, a step Eccles and Currie both supported and later defended, but one that was far more likely to prove contractionary than expansionary. One wonders what Keynes thought of it. But so far as I’m able to discover, he never said.

and Big Spenders

What, then, of New Deal fiscal policy? Here, too, Keynes’s influence has been greatly exaggerated, both because there were plenty of American proponents of deficit spending both before and during the New Deal, none of whom were influenced by Keynes, and because FDR himself long refused to follow either their or Keynes’s fiscal policy advice.

Eccles and Currie were only two of many advocates of deficit spending whose thinking wasn’t inspired by Keynes. There were plenty of others, many of whom had been calling for it long before FDR was elected. For example, as Julian Zelizer (2000, pp. 352-3) notes, long before Keynes began arguing for compensatory fiscal policy to make up for inadequate private investment, William Truffant Foster and Waddill Catchings had proposed it as a cure for “underconsumption.”

The depression naturally caused such proposals to multiply. In January 1932, for example, 31 economists submitted a report to Congress outlining a plan for $5 million in spending on public works, to be entirely financed by new borrowing. The report noted that economists had long favored “the construction of public works in periods of depression in order to relieve unemployment and restore purchasing power.” As J. Ronnie Davis (1968, pp. 476-7) reminds us, far from resembling the “classical” economists, with their unshakeable belief in Say’s Law, that Keynes would later portray—cleverly but very unfairly—as his sole predecessors, University of Chicago economists, including Frank H. Knight, Henry C. Simons, and Jacob Viner, were among the more outspoken advocates of substantial deficit spending to counter unemployment and deflation. “As far as I know,” wrote Knight in May 1932, “economists are completely agreed that the Government should spend as much, and tax as little as possible, at a time such as this” (Thorndike p 32; originally 75 Cong. Record 10323). Viner, as I’ve noted, went on to form the New Deal’s Freshman Brain Trust, and to include Lauchlin Currie in it.[2]

Nor were economists alone in calling for deficit spending to combat unemployment. As Joseph Thorndike (2009, pp. 97-8) notes, “[m]any political and business leaders of the 1920s believed that government had a useful role to play in fighting recessions and curbing unemployment. They placed particular faith in the efficacy of increased spending on public works [and] generally agreed that debt finance was the only plausible answer” to the question of how to pay for them. The sharp 1920-21 depression was a potent catalyst for such thinking—potent enough, even, to cause the ultra-conservative Warren Harding to convene of a Conference on Unemployment on September 26, 1921. Although Harding himself wasn’t keen on involving the Federal government in efforts to counter unemployment, his Secretary of Commerce, the event’s real instigator, was convinced that properly-timed public works, undertaken by all levels of government, could be a powerful weapon against the business cycle. His name was Herbert Hoover.

For the remainder of the 20s, Hoover (who also served as Coolidge’s Commerce Secretary) was the Federal government’s most persistent advocate of countercyclical spending on public works. But his efforts produced few results, in large part because the rapid recovery from 1920-21 took the wind out of countercyclical public work advocates’ sails. The prevailing thinking, especially among the Republican Party’s leaders, was of the same sort that could see little reason for patching a roof so long as the sun kept shining.

Once in office, Hoover first redoubled his efforts to organize countercyclical public works spending, particularly by proposing what came to be known as “the Hoover Plan” for preventing another depression, proposing (among other things) that the Federal government defer construction long enough to accumulate a public works “reserve fund” to be spent when private spending flagged. At $3 billion, the sum he proposed was almost equal to the entire 1929 Federal budget. But the Hoover Plan fared no better than Hoover’s earlier efforts, in part because the Republican Party leadership again held that a “new era” was no time to be planning for another depression (Howenstein 1946, p. 495).

It took the depression itself to call such complacency into question, and when it did the movement for compensatory public works seemed to gather steam at last. After the ’29 crash, Hoover promised to make “a special effort” to expand the construction work at all levels of government. By early 1930, he’d succeeded in getting 29 state governors to agree on a plan to undertake $1.3 billion worth of combined state and federal public works projects. Thanks to his efforts, during the first two years of the crisis overall spending on public works tripled.

But the depression proved to be a double-edged sword, because so far as fiscal conservatives were concerned, the deeper it got, the more important it was to balance the Federal budget. In December 1931, James Garland, who headed the public works committee of the President’s Organization on Unemployment Relief, dismissed calls for multimillion-dollar public works bond issues as unsound. “The problem of unemployment,” he said, “cannot be solved by any magic of appropriations from the public treasury.” The following March, Ogden Mills, Hoover’s recently-appointed Treasury Secretary, expressed the same sentiment. “The foundation upon which the structure of restoring prosperity must rest,” he said, “is the unimpaired credit of the national Government.” By then, with the election looming, Hoover was himself singing the same fiscal-conservative tune. A balanced budget, he said, was “the very keystone of recovery,” without which “the depression will be prolonged indefinitely.”[3]

Thus it fell to what William Dale Reeves calls “a determined public works faction in the Senate,” led by New York Democrat Robert Wagner and Wisconsin Republican Robert (“Fighting Bob”) LaFollette, Jr., to take up the cause of increased federal spending on public works in the teeth of the administration’s opposition. Wagner and LaFollette and other members of the coalition introduced a series of bills proposing millions of dollars in public works to be financed by bond sales, to little avail. Both Wagner and LaFollette introduced amendments that would have made a $5.5 billion public works program part of the July 21, 1932 Emergency Relief and Construction Act, though they knew perfectly well by then that such large-scale proposals didn’t stand a chance. The act ended up providing for only $322,224,000 in public works expenditures; and that was to be the only federal spending on public works authorized by the 72nd Congress.

Under Construction

The 73rd Congress ended up spending a lot more on public works than Hoover ever spent, starting with a $3.3 billion public works program—the Public Works Administration—that made its way into the National Industrial Recovery Act. But Keynes had nothing to do with this breakthrough; and although FDR didn’t veto the measure, as Hoover surely would have, he only signed off on it grudgingly: his chief interest, which was to be the New Deal’s centerpiece, was the NRA, to which the rest of the NIRA was devoted.

Far from being an integral part of the New Deal, the Public Works Administration, name and all, was LaFollette’s June, 1932 amendment, dusted off for the new Congress. Disappointed by Hoover, LaFollete and other members of Congress’s public works faction had supported FDR in the 1932 election. They knew that some New Dealers—Frances Perkins especially—were themselves keen on public works, and they expected FDR to be so as well. But as Reeves reports, the faction soon learned that the sailing might not be all that smooth. When several shared their hopes over dinner that March with Ray Moley and Rex Tugwell, the two Brain Trusters warned them not to press the President too hard, as he “was leery of the arguments for public works.”

Still the public works faction pressed on, preparing a draft bill calling for $5 billion in public works—half a million less than Wagner and LaFollette had each proposed the previous summer. Roosevelt wondered how the government could possibly spend that much if it tried. Although Frances Perkins answered with a list that the Construction League, a contractors association, had prepared with that very question in mind, FDR wasn’t convinced, and neither were Lewis Douglas, his Budget Director, Tugwell, and the other Brain Trust planners. In the end, FDR compromised by accepting a reduced PWA budget of $3.3 billion. But FDR never ceased to be “leery” of public works. What’s more, he deprived the $3.3 billion provision of much of its force, by drawing on it to finance almost all of the federal government’s ordinary construction activities, and by allowing Harold Icke’s, the PWA’s head, to husband its resources so as to avoid waste. Partly as a result of this, as Herbert Stein notes (1996, p. 207), it took the Roosevelt administration until 1937 to get annual public works spending up to just $710 million. Taking account not just of federal spending on public works but of spending by all levels of government, relative to GDP, until the outbreak of World War II, the Roosevelt administration never even managed to best the record set under Hoover in 1930.

FDR’s lack of enthusiasm for voluminous public works was, as I’ve mentioned, one of the things Keynes addressed in his December 1933 open letter, in which Keynes’s urged him to make spending, especially on projects “which can be made to mature quickly on a large scale,” his first domestic priority. “Could not the energy and enthusiasm, which launched the N.I.R.A. in its early days, be put behind a campaign for accelerating capital expenditures, as wisely chosen as the pressure of circumstances permits? You can at least feel sure that the country will be better enriched by such projects than by the involuntary idleness of millions.”

Keynes returned to the same theme in the “Agenda for the President” he published in The Times soon after his 1934 trip to the States. “For six months at least,” he wrote then, “and probably for a year, [recovery] will mainly depend on the degree of direct stimulus to production deliberately applied by the Administration. Since I have no belief in the efficacy for this purpose of the price and wage raising activities of the N.R.A., this must chiefly mean the pace and volume of the Government’s emergency expenditures.” Keynes went on to recommend monthly expenditures of $400 million, “financed out of loans, and not out of taxation,” or, according to Lauchlin Currie’s later estimates, roughly half again as much as the government’s total net “activity-creating” expenditures at the time.

(To be continued.)

Continue Reading The New Deal and Recovery:

Intro Part 1: The Record Part 2: Inventing the New Deal Part 3: The Fiscal Stimulus Myth Part 4: FDR’s Fed Part 5: The Banking Crises Part 6: The National Banking Holiday Part 7: FDR and Gold Part 8: The NRA Part 8 (Supplement): The Brookings Report Part 9: The AAA Part 10: The Roosevelt Recession Part 11: The Roosevelt Recession, Continued Part 12: Fear Itself Part 13: Fear Itself, Continued Part 14: Fear Itself, Concluded Part 15: The Keynesian Myth Part 16: The Keynesian Myth, Continued__________________________

[1] The Thomas Amendment itself “had come from outside the White House” (Renshaw, 1999, p. 341), and was treated by FDR as a bargaining chip only: a threat to hold against those who would not go along with his preferred strategies for raising prices.

[2] If any British economist deserves credit for inspiring these economists’ support for fiscal and (in several cases) monetary stimulus, that economist was not John Maynard Keynes but Ralph Hawtrey, who was to influence several of them either directly or indirectly through Allyn Young, who taught at Harvard between 1920 and 1927. For details see Laidler (1993).

[3] It should be said that there was nothing inconsistent or hypocritical about Hoover’s apparent about-face: his position all along had been that countercyclical public works spending should be provided for by limiting such spending in good times, so as to accumulate a “reserve” of unspent funds when depression threatened.

The post The New Deal and Recovery, Part 16: The Keynesian Myth, Continued appeared first on Alt-M.