“Experience Real Vision with Mish and Beyond!

Real Vision, a leading financial media platform, is home to an array of videos from top commentators, investors, and financial analysts. One of its popular series is ‘Mish’, which offers a unique way of gaining an insight into the world

Make Your Heart Skip a Beat: S&P 500 Plunging to 2200!?

The S&P 500 has made admirable gains this year, hitting a new all-time high over 3,000 points. However, some analysts fear it may be too good to be true. If the market sentiment deteriorates due to risks such as an

Let’s Discuss 6-7 Year Market Cycles – Are You Ready?

The economy experiences many ups and downs, but every 5-7 years, there is a market cycle of heightened growth and decline. This period is known as the business cycle. Every market cycle brings a different story, and understanding your business’s

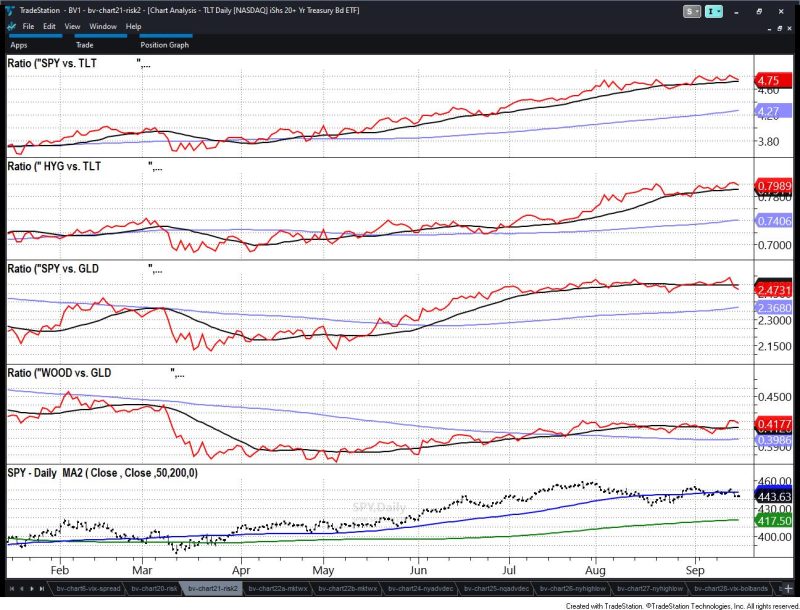

“Unlock the Power of Market Analysis: 3 Crucial Relationships

Investing in the stock market can be a tricky business. Many investors feel as though predicting the market's future direction is like trying to hit a moving target. While there is no sure-fire way to predict where the stock market

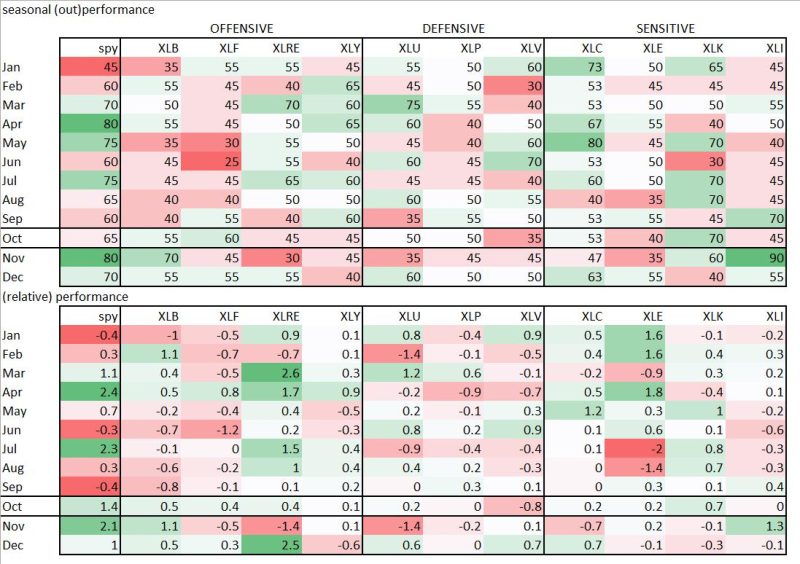

Sector Rotation: Aligning Technology to Reap Maximum Seasonal Benefits!

As investors look to increase or expand the returns of their stock portfolios, sector rotation has become a popular strategy. The purpose of sector rotation is to concentrate investments in sectors of the market that are believed to have the

“Risky Business: When Irrational Exuberance 2.0 Reverses the Stock and Bond Markets

The stock and bond markets have been on a tear for the last 10 years, reaching unprecedented highs in 2020. This has led analysts and investors to dub the situation as "Irrational Exuberance 2.0". Although the rally has been impressive,

“Don’t Get Caught Out When the Market Hits Rock Bottom: Protect Yourself Against EXTREME Cycle Lows!

The stock market is a risky and volatile place, and investors should always be aware of the risks involved. But during extreme lows in a market cycle, shorting stocks can be especially dangerous. This is because these extreme lows can

“A Fresh Start: Our Path to Better Days Ahead After the Dismal Month That Was!

The start of any new year is always an exciting time, but 2021 is proving to be especially meaningful. After a year of intense challenges, struggles, and heartache, the month of January seems to have been particularly strenuous, with countless

“Can the S&P 500 Reach & Maintain the 4300 Level?

The SP 500 is a stock market index that measures the performance of 500 large cap companies in the United States. It is one of the most widely followed and widely accepted barometers of global market sentiment. The index gained

Spin the Wheel of Energy: Chances of Profit or Loss?

The global energy sector is going through an extraordinary transition as environmental issues continue to demand more attention than ever before. Despite the current sluggish growth outlook due to the Covid-19 pandemic, there are some encouraging signs that the energy